Dual-Base System

The Dual Base Currency Value Pack allows you to treat an Invoice as fully paid if the amount received or sent is slightly different to that outstanding, providing that difference is within an allowable margin. This difference can be posted to any one of a number of Accounts, depending on the circumstance. Alternatively, if your requirement is for a simplified Accounts structure, you can use the same Account can be used. This Value Pack also requires you to specify a Round Off Account to be used to ensure Transactions balance when expressed in Base Currency 2.

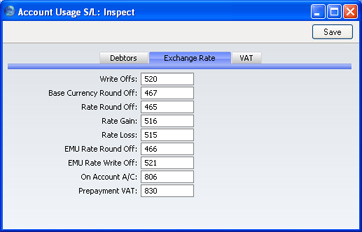

First, ensure that the Account(s) to be used have been added to the Chart of Accounts. Then, you need to specify the Account that is to be used in each circumstance. You should do this using the 'Exchange Rate' cards of the Account Usage S/L and P/L settings in the Sales and Purchase Ledgers respectively.

The Accounts on this screen that are relevant to Dual-Base users are now described. Except where stated, you can specify separate Accounts for use in a particular circumstance depending on whether the originating transaction comes from the Sales or the Purchase Ledger.

- Write Offs, Rate Round Off, EMU Rate Round Off, EMU Rate Write Off

- These Accounts are used in the situation where an Invoice is to be treated as fully paid if the amount received or sent is slightly different to that outstanding, providing that difference is within an allowable margin. The difference is posted to one of these Accounts on the following basis:

- Write Offs

- if the Received or Sent Currency is the same as the Invoice Currency, and it is not a member of the EMU;

- Rate Round Off

- if the Received or Sent Currency is different to the Invoice Currency, and the Received or Sent Currency is not a member of the EMU;

- EMU Rate Round Off

- if the Received or Sent Currency is different to the Invoice Currency, and the Received or Sent Currency is a member of the EMU;

- EMU Rate Write Off

- if the Received or Sent Currency is the same as the Invoice Currency, and it is a member of the EMU.

- Please refer to the page describing the Automatic Round Off Limit and Automatic Write Off Limit fields on the Currency screen for more details of this feature.

- Note that in the special case where the difference is caused by a change in Exchange Rate, it will not be posted to one of these Accounts, but to the Rate Gain or Loss Account (described on the Simple Conversion System page).

- In the case of Write Offs Account in the Account Usage S/L setting only, this Account is also used for bad debts that you write off using the 'New Write-off' Operations menu function of the Receipt and the 'Write off Invoices' Maintenance function.

- Base Currency Round Off

- Under the Dual-Base system, all Nominal Ledger Transactions should be expressible, and should balance, in both Base Currencies. The Account entered here will be used for postings to ensure that this is the case. Usually, it will only be used for Base Currency 2 values.

- For example, if you create and approve an Invoice or Purchase Invoice, the resulting Nominal Ledger Transaction will balance in Base Currency 1. However, due to rounding errors, it might not balance when expressed in Base Currency 2. If this is the case, a balancing posting in Base Currency 2 only will be made to the Account specified here.

- This Account can only be defined in the Account Usage S/L setting and is used for all Transactions.

If you are unsure, consult with your auditor/accounting adviser or FirstOffice representative for advice concerning correct Account usage.

! | Check that the Accounts that you use also exist in the Chart of Accounts. |

|