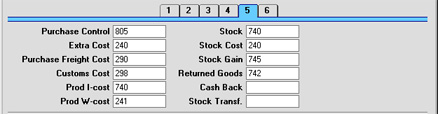

Account Usage S/L - Card 5

- Purchase Control

- The suspense Account used to book goods received before a Purchase Invoice has been received and booked. It is credited when records in the Goods Receipt register in the Stock module are approved (if the equivalent field for the appropriate Item Group is blank) and debited when Purchase Invoices created from Purchase Orders are approved (depending on the Purchase Order Item Transfer Control option chosen in the Purchase Invoice Settings setting in the Purchase Ledger).

- Please refer to the Cost Accounting page for full details of this feature.

- Extra Cost

- A special expense account to collect any "extra costs" associated with the receipt of goods (entered to the Cost field for each row of a Goods Receipt record). It is credited when records in the Goods Receipt register in the Stock module are approved.

- Purchase Freight Cost

- Used to book the cost of freight on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Customs Cost

- Used to book the customs duty cost on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Prod I-cost

- The Account specified here will be credited by the total input cost and debited by the total output cost whenever a Production record is approved, providing no Stock Accounts have been specified for the relevant Location or Item Groups. Production records (used to assemble Stocked Items from components) are fully described here.

- Prod W-cost

- The Account specified here will be credited by the total work cost whenever a Production record is approved. Usually, this will be the cost of labour required to build the assembled Items.

- Stock

- The stock control Account. Used only if the Stock module is used. If you are using maintaining stock values in the Nominal Ledger ('cost accounting'), this Account will be debited when goods are received into stock and credited upon Invoice or Delivery, if the equivalent field for the appropriate Location or Item Group is blank.

- Please refer to the Cost Accounting page for full details of this feature.

- Stock Cost

- Cost Account used when shipping goods from stock. If you are using cost accounting, this Account will be debited upon Invoice or Delivery, if the equivalent field for the appropriate Item Group is blank.

- Stock Gain

- This Account is used by the Stock Movement register to book value differences from internal stock transfers between stock Locations.

- Returned Goods

- When an Item is returned to stock by a Customer, a record is entered to the Returned Goods register. When the Returned Goods record is approved, this Account will be credited in the subsequent Nominal Ledger Transaction unless the Item belongs to an Item Group with a Cost Account and the Use Item Groups for Cost Accounts option in the Cost Accounting setting (Stock module) is on.

- Cash Back

- This Account is used when entering Cash Invoices in the Point of Sales module. When a Customer overpays using a credit card and requires the difference to be paid back in cash, this cash amount is credited to the Account specified here. For this difference to be shown in the Nominal Ledger Transaction, this Account should be different to the Cash Account used in the Cash Invoice (which comes from the Payment Mode or the Cash Account on card 1 of this setting).

- Stock Transf.

- This Account is used by the Stock Transfer register in the Internal Stock module to book value differences from internal stock transfers between stock Locations.