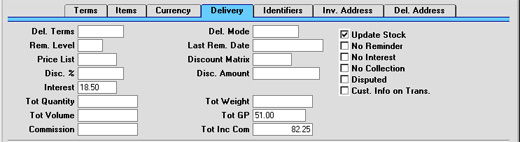

Entering an Invoice - Delivery Card

- Del. Terms

- Paste Special

Delivery Terms setting, Sales Orders module

- Default taken from Customer

- Specify the Delivery Terms for this Invoice here. You will tend to use this field for international Customers: examples might be Cost, Insurance, Freight or Free On Board.

- For each Delivery Term record you can specify an appropriate description in different Languages: the Language for the Invoice (on the 'Identifiers' card) will therefore determine the translation to be printed on any documentation produced from the Invoice.

- Del. Mode

- Paste Special

Delivery Modes setting, Sales Orders module

- Default taken from Customer

- Enter the mode of shipping for this Invoice. Examples might be Post or Courier, or might specify the name of the courier that you will use to supply the goods on the Invoice.

- For each Delivery Mode record you can specify an appropriate description in different Languages: the Language for the Invoice (on the 'Identifiers' card) will therefore determine the translation to be printed on any paperwork produced from the Invoice.

- You can also set up different versions of the Invoice document for each Delivery Mode, perhaps incorporating appropriate payment instructions. To do this, enter the Delivery Mode in the Language field when defining documents. Document definition is described here.

- Rem. Level

- This Reminder Level indicates how many Reminder documents have been printed for this Invoice. You can update this field yourself, or it can be updated automatically whenever a Reminder or a customer statement is printed.

- Reminders are printed using the Reminder document. A separate Reminder can be printed for each overdue Invoice, and it can contain one of three messages of increasing severity. These messages are defined in the Texts for Reminders setting. When you next print a Reminder for this Invoice, the message it contains will be chosen depending on this Reminder Level. For example, if the Reminder Level of the Invoice is 2, the message will be taken from the Reminder 2 field in the Texts for Reminders setting, and so on. If the Reminder Level of an Invoice is greater than 3, a Reminder document will be printed, but it will not contain a message.

- For Reminders to be printed, the No Reminder check box (above) must be switched off.

- This field may be changed even after the Invoice has been approved.

- Last Rem. Date

- The last date a reminder or statement was printed for this Invoice is recorded here. This field may be changed manually even after approving the Invoice.

- Price List

- Paste Special

Price List register, Pricing module

- Default taken from Customer, Customer Category or Payment Term

- Specify here the Price List which will determine the prices used on this Invoice. Ensure you have chosen the correct Price List before adding rows to the Invoice: if you forget, the 'Update Currency Price List Items' function is available on the Operations menu which can be used to change the prices of Items added to the Invoice before the Price List was specified (save the Invoice before using this function).

- When a row is added to the Invoice and an Item specified, Hansa searches either in the Price register or in the Quantity Dependent Prices setting for the single record representing the Item/Price List combination and brings in the Unit Price from there. If no such record is found, the Base Price of the Item is used. If a Discount Price List is specified, the Price register will be used. Otherwise, the Quantity Dependent Prices setting will be used.

- If the Price List specified is one which is Inclusive of VAT, the Unit Prices and Sums of each Invoice row will include VAT.

- When creating a new Invoice, Hansa will first look to the Customer record for an appropriate Price List. If none is specified there, the Price List for the Customer Category to which the Customer belongs will be used. If this is blank, or the Customer does not belong to a Category, Hansa will look to the Payment Term record allocated to the Customer. If the Payment Term is subsequently changed for this Invoice only, the Price List will only be changed if it is blank.

- Discount Matrix

- Default taken from

Customer or Customer Category

- If there is a Discount Matrix applying to this Invoice, it will be shown here. The field cannot be changed. Discount Matrices are used to administer quantity discounts.

- Interest

- Default taken from

Customer or Interest setting, Sales Ledger

- If payment for this Invoice is late, the 'Create Interest Invoices' Maintenance function can be used to charge interest. This is the annual rate that will be used to calculate the interest on this Invoice, if interest is to be calculated using the interest rate applicable at the Invoice Date. The figure will be brought in from the Customer or from the Interest setting but can be altered for this Invoice only. Interest Invoices will not be created if the Interest check box on the 'Terms' card of the Customer screen is switched off or if the No Interest check box (described below) is switched on. Please refer to the description of the Interest setting for details about interest rates and calculation.

- Tot Quantity

- This shows the total number of Items on the Invoice. If this figure becomes inaccurate for any reason, use the 'Recalculate Weight and Volume' function on the Operations menu to update it.

- Tot Weight

- Default taken from

Items

- This field will contain a calculated value based on the Invoice Quantity and the Weight of the Items. If the Weight of one of the Items is changed or if this figure becomes inaccurate for any other reason, use the 'Recalculate Weight and Volume' function on the Operations menu to update this field.

- Tot Volume

- Default taken from

Items

- This field will contain a calculated value based on the Invoice Quantity and the Volume of the Items. If the Volume of one of the Items is changed or if this figure becomes inaccurate for any other reason, use the 'Recalculate Weight and Volume' function on the Operations menu to update this field.

- Tot GP

- The total gross profit of the Items on the Invoice: this does not include any profit in the Freight value, as set in the Freight or Freight/Weight Calculation settings.

- Commission, Tot Inc Com

- These fields are used in Russia. Please refer to your local Hansa representatives for details.

- Update Stock

- Default taken from

Account Usage S/L setting card 1, Sales Ledger

- Use this option if you need stock levels for the Items on the Invoice to be reduced when the Invoice is approved. This only affects Items that are Stocked Items. No check of the availability of stock will be made, unless the Do Not Allow Over Delivery option in the Stock Settings setting in the Stock module is in use. This feature is used only if the Stock module is installed.

- Switching this option on will also cause cost accounting postings (for use when maintaining stock values in the Nominal Ledger) to be included in the Nominal Ledger Transaction generated when the Invoice is approved.

- Both effects of this check box will only be used in those cases where Deliveries are made at the invoicing stage, from Invoices without related Sales Orders.

- In the case of Invoices created from Orders, if you need to invoice a greater Quantity than was delivered, this must be done by adding a new row to the Invoice. Ensure that this Update Stock box is checked so that stock levels are updated accordingly and, if appropriate, to cause cost accounting transactions to be created in the Nominal Ledger for the extra quantity. In this situation, this box will only apply to Invoice rows that are not related to the Order.

- In the case of Invoices created from Projects, this check box will be switched off, and cannot be used. You should therefore not add new rows to such Invoices.

- Note that when raising a Credit Note, this check box will be switched off by default, whatever the status of the Inv Update Stock option in the Account Usage S/L setting. If you are using cost accounting (maintaining stock valuations in the Nominal Ledger), it should be left turned off because otherwise the stock value will be updated with an incorrect FIFO amount. For details about updating stock from Credit Notes, please refer to the Credit Notes and Stock page.

- No Reminder

- If the Reminders box on the 'Terms' card of the Customer is on, that Customer can be sent reminders for all outstanding Invoices. If a reminder is not to be sent for this Invoice, check this box. Reminders are sent using the Reminder document.

- Invoices marked as No Reminder can be excluded from some reports and documents such as the Open Invoice Customer Statement and the Sales Ledger report.

- No Interest

- If the Interest box on the 'Terms' card of the Customer is on, that Customer can be charged interest on all outstanding Invoices. If this Invoice is not to be included in the interest calculation, check this box. Interest is calculated using the 'Create Interest Invoices' Maintenance function.

- No Collection

- This check box is used in Finland. Please refer to your local Hansa representatives for details. Invoices marked as No Collection can be excluded from some reports and documents such as the Open Invoice Customer Statement and the Sales Ledger report.

- Disputed

- Check this box if the Invoice is subject to a dispute.

- Disputed Invoices can be in- or excluded from some reports and documents such as the Open Invoice Customer Statement and the Sales Ledger report. However, the Invoice will still be subject to Interest charges and Reminders unless the No Interest and No Reminder boxes above are checked as well. The Disputed, No Interest and No Reminder boxes can all be checked after the Invoice has been approved.

- If the Invoice is greatly overdue, the debt can be transferred from the Debtor Account to the Bad Debtor Account using the 'Transfer to Bad Debtors' Maintenance function. This function will mark the Invoice as Disputed, to prevent the debt being transferred again the next time the function is used. If you mark an Invoice as Disputed yourself, you will therefore prevent the debt being transferred.

- In multi-user systems, you can prevent certain users from marking an Invoice as Disputed using Access Groups (by denying access to the 'Allow to Dispute Invoice' Action).

- Cust. Info. on Trans.

- When a Nominal Ledger Transaction is generated automatically from this Invoice, use this option if you would like to have the Invoice Number, Due Date and Customer shown on flip E of the Transaction. This applies to the posting to the Debtor Account only.

- The check box will be on by default if you are using the Invoice Info on N/L Transaction option on card 1 of the Account Usage S/L setting.

|