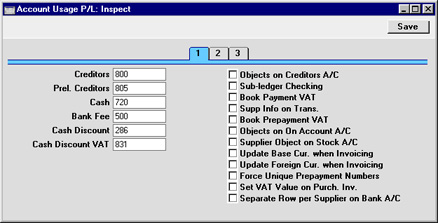

Account Usage P/L - Card 1

Account Fields

- Creditors

- When a Purchase Invoice is approved (i.e. posted to the Nominal Ledger), its value including VAT is credited to a Creditor Account. When a Payment is entered, its value is debited to the same Account. This Account therefore shows how much your company owes at a particular time.

- Enter here the Account Code of the Account that you wish to be used as your Creditor Account. It will be overridden if a separate such Account has been specified for the Supplier or its Supplier Category.

- Prel. Creditors

- It is possible to post a Purchase Invoice to a preliminary Account when it is first received and to subsequently move the posting to the normal Creditor Account when it is approved. If you wish to make use of this feature, which allows the late amendment of the Cost Accounts used, specify the preliminary Account to be credited here.

- Cash

- The Account to be credited instead of the Creditor Account whenever a cash purchase (Cash Note) is approved. Please refer to the description of the Payment Terms setting for details of Cash Notes.

- The Account specified here will be overridden if a separate such Account has been specified for the Payment Term used in the Cash Note.

- Bank Fee

- Enter here the Account Code of the Account to be debited by any bank charges you may incur when issuing Payments.

- Cash Discount

- In the event of an Invoice attracting a settlement discount when it is paid on time, the Account specified here will be credited with the discount amount. Settlement discounts are defined using the Payment Terms setting.

- Cash Discount VAT

- This field should only be used in those cases when cash discounts taken are allowed to change the VAT amount noted on the original invoice. Check with local VAT regulations.

Check Boxes

- Objects on Cred. A/C

- With this setting on, Hansa will transfer the Object(s) entered for the Supplier to the 'Other' card of all Purchase Invoices entered in their name.

- When approving Purchase Invoices, any Objects specified on the 'Other' card will be assigned to the debit posting to the Purchase Account(s) when a Nominal Ledger Transaction is generated. If this box is checked, they will be assigned to the credit posting to the Creditor Account as well.

- Sub-ledger Checking

- Check this box if you want to use the sub-ledger checking feature in the Purchase Ledger. This will mean that it will only be possible to post to specified Accounts (such as Creditor Accounts) from the sub-ledger (i.e. from Purchase Invoices or Payments in the Purchase Ledger). If you try to post to a controlled Account directly from the Nominal Ledger (using the Transaction register) you will get an alert message.

- This feature does not prevent you from entering Payments by journal in the Nominal Ledger. However, it will prevent you from using the Creditor Account accidentally and incorrectly in other Nominal Ledger Transactions, thus rendering it inaccurate. For details of this process, please refer to the description of flip E of the Transaction screen on this page.

- For this feature to work, you must specify the Accounts which are to be included in the sub-ledger checking function (i.e. the Accounts which are not to be used in the Transaction register). Do this using the Sub-ledger Control Accounts setting in the System module.

- Note that this check box is used to control whether sub-ledger checking takes place for specified Purchase Ledger Accounts only. There is a check box with the same name in the Account Usage S/L setting which performs an equivalent function for Sales Ledger Accounts.

- Book Payment VAT

- This option allows the posting of VAT from Payments, a requirement in Latvia and for users of the Cash VAT scheme in the UK. If this check box is on, I/P Accounts should be specified for all VAT Codes entered using the setting in the Nominal Ledger.

- UK Cash VAT users only should also switch on the Book Receipt VAT option on card 1 of the Account Usage S/L setting and specify O/P Accounts for all VAT Codes. The Cash VAT scheme on the VAT Codes page.

- Supp. Info. on Trans.

- When Nominal Ledger Transactions are generated automatically from Purchase Invoices and Payments, use this option if you would like to have the Invoice Number, Due Date and Supplier (in the case of Invoices) or the Payment Number, Payment Date and Supplier (in the case of Payments) shown on flip E of the Transaction. This applies to the posting to the Creditor Account only.

- The setting can be changed for an individual Purchase Invoice or Payment.

- Book Prepayment VAT

- This option allows the posting of VAT from Prepayments, a requirement for users of the Cash VAT scheme in the UK. Prepayments are Payments without a Purchase Invoice Number but with a Prepayment Number specified on flip E. If this check box is on, On Account VAT and Prepayment VAT Accounts should be specified on card 2.

- Objects on On Account A/C

- When entering a Payment, the Objects for the debit posting to the Creditor Account will be taken from the 'Other' card of the Purchase Invoice being paid. In the case of an On Account Payment or a Prepayment, there is no Purchase Invoice to supply the default Objects. Instead the default Objects can be taken from the 'Accounts' card of the Supplier: check this box if you want to use this option. If the box is not checked, no default Objects will be offered in On Account Payments and Prepayments.

- Supplier Object on Stock A/C

- When entering a Goods Receipt, the Objects on the 'Comment' card are taken from the Supplier. These will be assigned to the credit posting to the Purchase Control Account when a Nominal Ledger Transaction is generated from the Goods Receipt. Check this box if you would like them to be assigned to the debit posting to the Stock Account as well.

- Update Base Cur. when Invoicing, Update Foreign Cur. when Invoicing

- When an Invoice is created from a Purchase Order, these check boxes control the Base and Exchange Rates on the 'Currency' card of the Invoice. If these options are not used, the rates will be copied from the Order. If they are used, the latest Base and Exchange Rates will be used, although the prices in Currency will not be changed. This means you will still be charged the agreed price, but the value of the Invoice in the home Currency (and therefore in the Nominal Ledger) will be different to that of the Order.

- Force Unique Prepayment Numbers

- Check this box if you would like to ensure that unique Prepayment Numbers are always used when entering Prepayment Payments (flip E).

- Separate Row per Supplier on Bank A/C

- When you enter a Payment with several rows, the resulting Nominal Ledger Transaction will usually contain a single credit posting to the Bank Account. Check this box if you would like such Transactions to contain separate credit postings for each Payment row The Description in each credit posting will show the Purchase Invoice Number and Supplier Name, so you should use this option if you want this information to appear in the Account Reconciliation register (used for bank reconciliation).

|