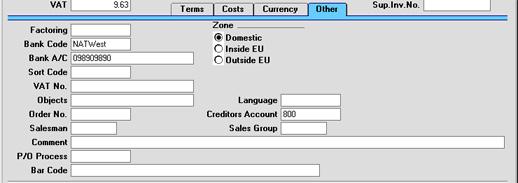

Entering a Purchase Invoice - Other Card

- Factoring

- Paste Special

Supplier register

- Default taken from Supplier

- If the Supplier is one that uses a factoring company (to which Payments are to be sent), enter the Supplier Number of that company here (that company must also be in the Supplier register).

- Zone

- Default taken from

Supplier

- This information is fetched from the Supplier record, and indicates the origin of the Supplier. The selection of a VAT Code for each row depends on the Zone of the Supplier. The Zone cannot be changed for an individual Invoice: any change should be made in the Supplier register before entering Invoices.

- VAT is calculated as follows:

- Domestic

- VAT is calculated using the VAT Code of each row. In any Nominal Ledger Transaction resulting from the Invoice, VAT is debited to the Input Account from the VAT Code and credited to the Creditor Account.

- Inside EU

- Invoices received from other countries in the EU do not carry VAT. However, depending on the nature of the Invoice, VAT can be payable.

- VAT is calculated using the VAT Code of each row. In any Nominal Ledger Transaction resulting from the Invoice, VAT is debited to the Input Account from the VAT Code and credited to the Output Account from the VAT Code. Therefore, it is recommended that a dedicated VAT Code be used for VAT on EU Acquisitions, with an Output Account that is not used in any other VAT Code.

- It is usually recommended that you leave the VAT field in the header empty when entering Purchase Invoices from inside the EU.

- Outside EU

- VAT is not calculated. Any Nominal Ledger Transaction resulting from the Invoice will not include a VAT element.

- Bank Code

- Paste Special

Banks setting, Purchase Ledger

- The Bank where the Supplier's bank account is held. This is brought in from the Supplier or the Factoring Supplier. It may be used in relation with foreign bank transactions.

- Bank A/C

- The Supplier's bank account number is brought in from the 'Accounts' card of the Supplier record or, if appropriate, from the record of the Supplier's factoring company. When a Payment is issued against the Invoice, it will be shown on flip H of the Payment record. If necessary, it can be changed to allow payment to be sent to a different account.

- Sort Code

- The Sort Code (branch number) of the bank where the Supplier's account is held is also brought in from the Supplier or the Factoring Supplier. When a Payment is issued against the Invoice, it will be shown on flip H of the Payment record.

- VAT No.

- Default taken from

Supplier

- The Supplier's VAT registration number. It is important that this field contains a value if the Supplier is in the "Within EU" Zone as this information is then required for EU VAT reporting purposes.

- Hansa contains a feature whereby it will check that the VAT Number entered here is in the correct format for the Supplier's Country. The correct format should be defined in the VAT Number Masks setting in the System module. If the Supplier's Country is blank, the Country from the Company Info setting will be used. If that is blank, no validation check will be made.

- Objects

- Paste Special

Object register, System module

- Up to 20 Objects, separated by commas, can be assigned to this Purchase Invoice and all transactions generated from it. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In any Nominal Ledger Transactions generated from this Invoice, any Objects specified here will be assigned to the debit posting to the Purchase Account(s) and, if the Objects on Creditor Account option in the Account Usage P/L setting is being used, to the credit posting to the Creditor Account.

- If the Objects on Creditor Account option is being used, any Objects specified for the Supplier will be copied here as a default.

- Language

- Paste Special

Languages setting, System module

- Default taken from Supplier

- The Language Code determines the text to be transferred from various registers and settings, for example the Account Name, text for Payment Terms and Payment Mode, the selection of document forms etc. Leave the field blank to use the base Language.

- Order No.

- In the case of Purchase Invoices created from Purchase Orders, the Purchase Order Number will be shown here. This field cannot be changed.

- Creditors Account

- Paste Special

Account register, Nominal Ledger/System module

- The Creditor Account which will be used in any Nominal Ledger Transaction generated from this Purchase Invoice is shown here. Please click here for details of how the Account offered as a default is determined.

- Salesman

- Paste Special

Person register, System module

- Default taken from Supplier or Purchase Order

- Enter the initials of the Person responsible for this Purchase Invoice.

- This field is also used by the Limited Access module: please refer to the description of the Sales Group field (below) for details.

- Sales Group

- Paste Special

Sales Groups setting, System, module

- Default taken from Salesman

- The Sales Group is brought in from the Person record after you have entered a Salesman. If the Limited Access module is present, this field can be used to prevent a user from seeing all Purchase Invoices in the 'Purchase Invoices: Browse' window by restricting their view to their own Purchase Invoices or to those of their Sales Group.

- Please click here for full details of the Limited Access module.

- Comment

- Default taken from

Supplier

- Record here any comment about this Purchase Invoice.

- P/O Process

- Paste Special

Purchase Order Process register, Purchase Orders module

- In the case of a Purchase Invoice created from a Purchase Order that has an associated Purchase Order Process, the Process Number will be shown here. This field cannot be changed.

- Bar Code

- This field is used in Finland, where Purchase Invoices have bar codes containing information such as the Supplier's bank account number, the Invoice Currency and amount, and a unique reference number. Please refer to your local Hansa representative for more details, including enabling entry to this field using a barcode reader.

|