Tax Reports - Designing a Form to be used with the Tax Report Document

The Tax Report document prints the results of your formulae, using the correct formatting. Design the Form used by this document in the usual way (as described

here) with these exceptions:

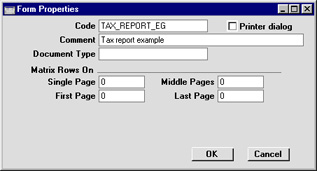

- When creating a new Form, select 'Properties' from the Operations menu. Enter an appropriate Code and Comment (name), but leave the Document Type blank:

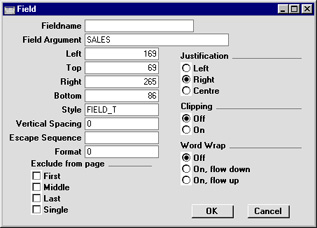

- A particular Form should be linked to a single record in the Tax Reports setting. This link will be established using the 'Define Document' function. Each field in the Form will relate to a particular row in the Tax Report record. When adding fields to the Form, leave the Fieldname blank. Instead, enter the Code of the row in the Tax Report record as the Field Argument:

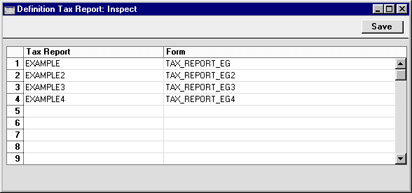

- Since a particular Form is linked to a single record in the Tax Reports setting, you should design a new Form for each record in that setting.

When the design of the Form is complete, click the [Save] button in the Button Bar to save it. Then, change to the Nominal Ledger and open the 'Documents' window using the 'Documents' item on the File menu or by clicking the [Documents] button in the Master Control panel. Highlight 'Tax Report' in the list and select 'Define Document' from the Operations menu.

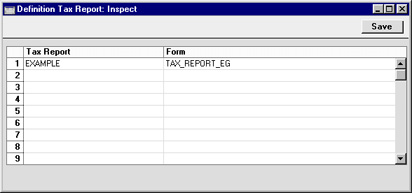

Use this window to link a record in the

Tax Reports setting to a Form. Enter the Code of a Tax Report record in the first column, and its associated Form in the second. You can use 'Paste Special' in both cases if necessary. As you create further Tax Report records and design the Forms to go with them, list them in the document definition window:

Click [Save] to save the Tax Report document definition.