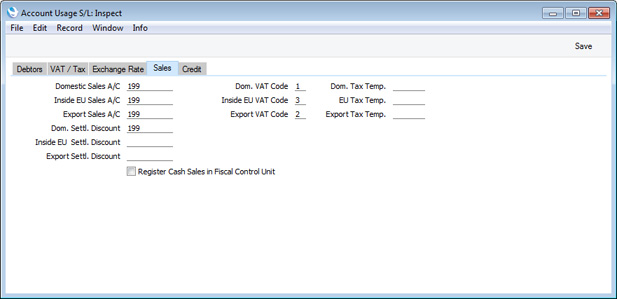

Account Usage S/L - Sales Card

This page describes the 'Sales' card of the Account Usage S/L setting. Please click the following links for descriptions of the other cards:

---

- Domestic Sales A/C, Inside EU Sales A/C, Export Sales A/C

- Paste Special

Account register, Nominal Ledger/System module

- A Sales Account will be credited whenever you sell an Item, allowing you to record the levels of sales of different types of Items in the Nominal Ledger.

- When you sell an Item (i.e. whenever you specify an Item in a row in an Invoice, Order, Quotation or other sales transaction), the default Sales Account will be chosen in this order:

- If you are using the Use always option in the Payment Term Sales A/C setting, the Sales Account will be taken from the Payment Term.

- If the Customer has a Price List and there is a record in the Price register for the Item/Price List combination or in the Quantity Dependent Prices setting for the Item/Price List combination (depending on the Type of the Price List), the Sales Account will be taken from that Price or Quantity Dependent Price record.

- If you have specified a Sales Account for the Location in the Location Accounts setting in the Stock module, that Sales Account will be used.

- The Sales Account will be taken from the Item record itself.

- If you are using the Use if no Account on Item option in the Payment Term Sales A/C setting, the Sales Account will be taken from the Payment Term.

- The Sales Account will be taken from the Item Group to which the Item belongs.

- This Sales Account in the Account Usage S/L setting will be used.

In the cases of points 3, 4, 6 and 7, the choice of Sales Account will depend on the VAT Zone of the Customer concerned (set on the 'Company' card of the Contact record for the Customer). If you leave the EU and Export Sales Accounts empty, the Domestic Sales Account will be used for all sales, irrespective of Zone.

- The Accounts specified here will usually be used in both Invoices and Credit Notes. If you would like to use different Accounts in Credit Notes, specify them on the 'Credit' card of this setting. You should also select the Use Credit Sales Accounts option on the 'Debtors' card.

- If you would like to use the same VAT Codes in Credit Notes but have them post to different Output VAT Accounts, you can specify those Output VAT Accounts on flip D in the VAT Codes setting. There is no need to select the Use Credit Sales Accounts option in this case.

- You can change the name of the Inside EU Sales A/C field if it is not suitable. Using the VAT Zone Label setting in the Sales Ledger, you can replace the string "EU" with your own string (for example "SACU" in South Africa).

- Dom. Settl. Discount, Inside EU Settl. Discount, Export Settl. Discount

- Paste Special

Account register, Nominal Ledger/System module

- In the event of an Invoice attracting a settlement discount when it is paid on time, the Account specified here will be debited with the discount amount in the Nominal Ledger Transaction resulting from the Receipt.

- The appropriate Settlement Discount Account for the Zone of the Invoice being paid will be used.

- Use the Payment Terms setting to configure settlement discounts.

- Dom. VAT Code, EU VAT Code, Export VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- The VAT Code will determine the Output VAT Account that will be credited whenever you sell an Item and the rate at which VAT will be charged.

- Whenever you sell an Item (i.e. whenever you specify an Item in a row in an Invoice, Order, Quotation or other sales transaction), the default VAT Code will be chosen in this order:

- The VAT Code in the Delivery Address specified in the sales transaction (on the 'Del. Address' card) will be used.

- The Sales VAT Code for the Customer will be used.

- It will be taken from the appropriate row for the Item or Item Group in the Customer's Price List.

- It will be taken from the Item record itself.

- It will be taken from the Item Group to which the Item belongs.

- This VAT Code in the Account Usage S/L setting will be used.

In the cases of points 4-6, the correct VAT Code for the Zone of the Customer concerned (set on the 'Company' card of the Contact record for the Customer) will be used.

- You will be able to override the choice of VAT Code in an individual Invoice row if necessary, subject to the VAT Code Control option on the 'VAT / Tax' card of this setting.

- Note that, for Customers in the "Inside EU" and "Outside EU" Zones, VAT will not be charged on any Invoices raised, irrespective of the VAT Code specified here. If you want to charge VAT to such Customers, place them in the Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

- The VAT Codes specified here will usually be used in both Invoices and Credit Notes. If you would like to use different VAT Codes in Credit Notes, specify them on the 'Credit' card of this setting. You should also select the Use Credit Sales Accounts option on the 'Debtors' card.

- You can change the name of the Inside EU VAT Code field if it is not suitable. Using the VAT Zone Label setting in the Sales Ledger, you can replace the string "EU" with your own string (for example "SACU" in South Africa).

- Dom. Tax Temp., EU Tax Temp., Export Tax Temp.

- Paste Special Tax Templates setting, Nominal Ledger

- In some countries, Tax Templates are used instead of VAT Codes. VAT Codes should be used where each sales and purchase transaction is taxed at a single rate, while Tax Templates should be used where different taxes and/or several tax rates are applied to one transaction.

- If you need to use Tax Templates, you should first select the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in the Nominal Ledger. Wherever a VAT Code field would appear, this option will cause a Tax Template field to appear instead. Having done so and having entered your Tax Templates in the Tax Templates setting also in the Nominal Ledger, you should specify the Tax Templates that are to be used as defaults in Invoices here.

- You can change this default in a particular Invoice row if necessary.

- You can change the names of two of these fields if they are not suitable. Using the VAT Zone Label setting in the Sales Ledger, you can replace the string "EU" with your own string (for example "SACU" in South Africa).

- Register Cash Sales in Fiscal Control Unit

- This option should only be used in Sweden, where it is a legal requirement that all cash or credit card payments in shops should be made through a certified Point of Sale (POS) solution that contains a fiscal control unit. The control unit will record these payments, which can later be read by tax authorities to ensure that a shop's sales have been registered and reported correctly.

- The fiscal control unit supported by Standard ERP is the CleanCash Type A from RetailInnovation. Each client or Till likely to receive cash or credit card payments should be connected to a CleanCash Type A unit via an RS232 serial cable. Standard ERP does not currently support the CleanCash Types B and C units.

- Select this option if you need cash and credit card payments to be recorded in CleanCash Type A fiscal control units. This option applies to Sales Ledger Invoices with a “Cash” Type Payment Term (i.e. Sales Ledger Cash Notes), while a similarly named option in the POS Settings setting applies to POS Invoices. Please refer to your local HansaWorld representative for more details. If you are using this option, you will not be able to change Item Descriptions and Unit Prices in Invoices.

- If you use this option without connecting a fiscal control unit (e.g. you are outside Sweden), you will be shown the message "Serial Port Device not defined" when you try to save an Invoice with a "Cash" Type Payment Term (Payment Terms are described here).

---

Settings in the Sales Ledger:

Go back to:

|