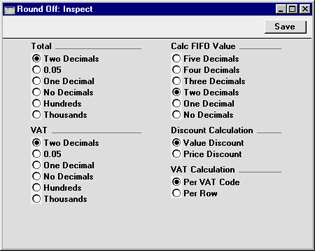

Round Off

In this setting you control the way calculations are rounded off. The setting is used by Quotations, Sales and Purchase Orders and Sales and Purchase Invoices. Any amounts lost or gained from the rounding off process are posted to the Round Off Account specified in the

Account Usage S/L setting. This Account is used in Transactions generated both from the Sales Ledger and from the Purchase Ledger.

- Total

- This set of options is used to set the rule for rounding off Total figures (i.e. including VAT) in Invoices, Orders, Purchase Orders and Quotations whose Currency field is blank and for those whose Currency is not entered in the Currency Round Off setting.

- VAT

- This set of options allows you to use a different rounding off rule for taxes. This rule applies to Quotations, Orders, Invoices, Purchase Orders and Purchase Invoices whose Currency field is blank and for those whose Currency is not entered in the Currency Round Off setting.

- FIFO

- This set of options allows you to determine the rounding options used when calculating FIFO values in the Stock List report.

- Discount Calculation

- This set of options allows you to determine how discounts are calculated throughout Hansa (i.e. in Quotations, Sales and Purchase Orders, Invoices, Contracts, Work Sheets and Project Budgets). In certain circumstances (where there is a very small unit price and a large quantity), the two alternatives can produce different results due to rounding. If the Value Discount option is chosen, the discount will be calculated after the multiplication of the unit price and the quantity. If the Price Discount option is chosen, the discount will be applied to the unit price before it is multiplied by the quantity.

- For example, you receive an Order for 20,000 items priced at 0.05 with a 25% discount. With the Value Discount option selected, the calculated discount is 250:

- 20000 x 0.05 = 1000. 25% of 1000 = 250

- With the Price Discount option selected, the calculated discount is 200:

- 25% of 0.05 rounded to two decimal places is 0.01. 0.01 x 20000 is 200

- VAT Calculation

- Specify here how VAT is to be rounded off.

- Per VAT Code

- A VAT subtotal is calculated for each VAT Code used in the transaction. These subtotals are then rounded as determined in the Currency Round Off setting or using the option chosen above (whichever is appropriate). The subtotals are then added together to produce the overall VAT total.

- Per Row

- The VAT amount for each individual transaction row is rounded as determined in the Currency Round Off setting or using the option chosen above (whichever is appropriate). These amounts are then added together to produce the overall VAT total.

- Note that the transaction row sum is rounded as determined in the Currency Round Off setting or to two decimal places (whichever is appropriate) before the VAT calculation is carried out.

Click [Save] to save any changes and close, or the close box to close without saving changes.