Create Contract Invoices

This function creates Invoices for Contracts. It finds all

approved Contracts whose last Invoice period ends in a specified time period and creates appropriate Invoices, which are saved in an unapproved state. Approved Contracts with no Start Date are not included.

You can approve all Invoices thus created in a single step, by highlighting them in the 'Invoices: Browse' window and selecting 'OK' from the Operations menu. Remember that if you wish to change any of the Invoices, you must do so before they are approved. Any such changes are NOT reported back to the Contracts module. You can also print the Invoices in a single batch, using the 'Documents' function on the File menu or the [Documents] button in the Master Control panel having first selected 'Sales Ledger' from the Modules menu. Please click for more details about printing and approving Invoices.

You can run the Invoiceable Contracts report before you use this function if you want to preview the Invoices that will be created.

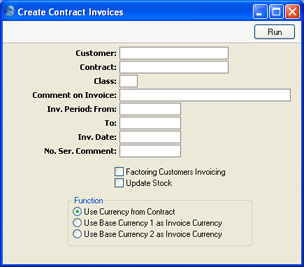

Selecting the 'Create Contract Invoices' function brings up the following dialogue box:

- Customer

- Paste Special

Customers in Customer register

- Range Reporting Alpha

- To create Invoices from Contracts of a particular Customer or range of Customers, enter their Customer Number here. Leave blank to include all Customers.

- If you are using the Factoring Customers Invoicing option below, enter an Invoice To Customer (or range of Invoice To Customers) here, not the final Customers.

- Contract

- Range Reporting

Numeric

- Enter a Contract Number or a range of Numbers to limit the selection to certain Contracts.

- Class

- Paste Special

Contract Classes setting, Contracts module

- Enter a Contract Class to limit the process to Contracts of a particular Class only.

- Comment on Invoice

- By default, Invoices generated by this function will contain a reference to the Contract period covered by the Invoice. This reference can be replaced by any text as required: if so, enter that text here.

- Inv. Period: From, To

- Paste Special Choose date

- Enter a range of dates. All Contracts that are due for invoicing during the indicated period will have an Invoice created and saved in the Invoice register.

- The beginning of the period can be left open, but the To field must contain a value for any Invoices to be raised.

- Inv. Date

- Paste Special

Choose date

- Enter a date to be used as the Invoice Date in all Invoices generated in this run. If this field is left blank, Invoice Dates will be calculated using the Invoice options on the 'Dates' card of each Contract.

- No. Srs. Comment

- Paste Special

Languages setting, System module

- You can specify that the Invoice Numbers of the Invoices created by this function are to come from a particular number sequence in the Number Series - Invoices setting. To do this, enter the Comment of the number sequence here. The field is case sensitive, so be careful when typing. If nothing is entered here, or if no matching Comment is found, the first number sequence in the setting will be used.

- Factoring Customers Invoicing

- Use this option if you need to group together on the same Invoice all Contracts that have the same Invoice To Customer specified on their 'Partners' cards. The Invoice To Customer will usually be a head office or a leasing or factoring company. Contracts that do not have an Invoice To Customer will not be invoiced.

- If you do not use this option, Contracts with an Invoice To Customer specified on their 'Partners' cards will still be invoiced to the Invoice To Customer, but they will not be grouped together on the same Invoice.

- Update Stock

- Use this option if you would like the Update Stock box in each new Invoice ('Delivery' card) to be checked. The Update Stock box ensures that stock levels of any Stocked Items in the new Invoices will be adjusted when the Invoices are approved, and that cost accounting postings (for use when maintaining stock values in the Nominal Ledger) will be included in the subsequent Nominal Ledger Transactions.

- The Invoice Update Stock option in the Account Usage S/L setting usually sets the default for the Update Stock box in new Invoices but has no influence over Contract Invoices.

- Function

- Select one option to determine the Currency to be used on any Invoices created by the function.

Click [Run] in the Button Bar to run the function. It may take a few moments, depending on the number of Invoices to be created. The appropriate Invoice Date will be copied back to the Last Inv. Date field of each Contract. When the function has finished, you will be returned to the 'Maintenance' list window.

If you click [Run] without entering a Customer or Contract Number, Invoices will be raised for all Contracts that have become due for invoicing, providing a date has been entered to the Inv. Period: To field.

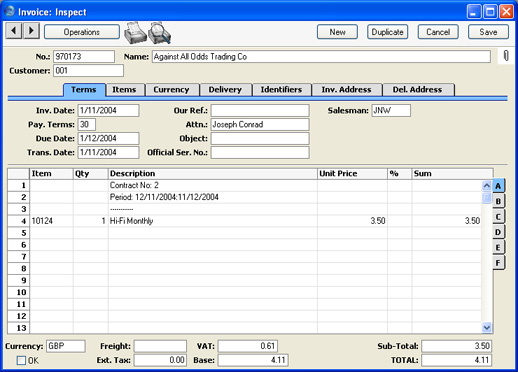

An example Invoice generated by this function is shown below. As no Comment was entered in the specification window, the example includes a reference to the Contract period covered by the Invoice.

This function creates Invoices individually as the Contract period progresses. If you would like to create an appropriate number of unapproved Invoices for the entire Contract period at one stroke, use the

'Invoice' function on the Operations menu of the Contract screen.

If an Invoice is not created when expected, the probable causes are:

- The Contract is not approved.

- The Contract is missing a Start Date.

- The Length in the Contract is zero.

- You did not enter a To date in the 'Create Contract Invoices' specification window.

- You entered a To date in the 'Create Contract Invoices' specification window that is earlier than the Last Invoice Date or later than the Cancel Date in the Contract.

- The Customer is on hold (the 'On Hold' box on the 'Terms' card of their Customer record has been checked).

- There is no valid record in the Number Series - Invoices setting (in the Sales Ledger). This might be a fault in the setting itself, or it might be because the default Invoice Number on the 'Ser Nos' card of the current user's Person record or in the Number Series Defaults setting (in the System module) is not in a valid Number Series. This problem will usually occur at the beginning of a new year. If a change is made to the 'Ser Nos' card of the Person record, you will need to quit Hansa and restart for it to take effect.