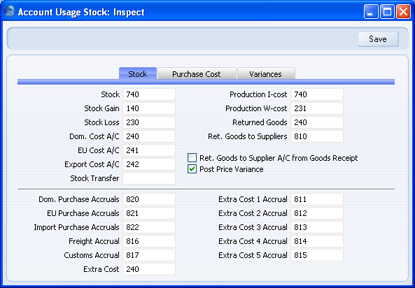

Account Usage Stock - Stock Card

- Stock

- The stock control Account. If you are using maintaining stock values in the Nominal Ledger ('cost accounting'), this Account will be debited when goods are received into stock and credited upon Invoice or Delivery, if the equivalent field for the appropriate Location or Item Group is blank.

- Please refer to the Cost Accounting page for full details of this feature.

- Stock Gain, Stock Loss

- These Accounts are used by the Stock Movement register to book value differences resulting from internal stock transfers between stock Locations. The Stock Loss Account will also be debited by default from Stock Depreciation records, while the Stock Gain Account will be credited by default from Goods Receipts created by the 'Stocktaking Comparison' Maintenance function.

- Dom, EU, Export Cost A/C

- Cost (Cost of Sales) Account used when shipping goods from stock. If you are using cost accounting, this Account will be debited upon Invoice or Delivery, if the equivalent field for the appropriate Item Group is blank. You should specify three separate Cost Accounts, one for each Zone.

- Stock Transfer

- This Account is used by the Stock Transfer register in the Internal Stock module to book value differences from internal stock transfers between stock Locations.

- Production I-cost

- The Account specified here will be credited by the total input cost and debited by the total output cost whenever a Production record is approved, providing no Stock Accounts have been specified for the relevant Location or Item Groups. Production records (used to assemble Stocked Items from components) are fully described here.

- Production W-cost

- The Account specified here will be credited by the total work cost whenever a Production record is approved. Usually, this will be the cost of labour required to build the assembled Items.

- Returned Goods

- When an Item is returned to stock by a Customer, you will record the return in the Returned Goods register. When you approve and save the Returned Goods record, this Account will be credited in the subsequent Nominal Ledger Transaction unless the Item belongs to an Item Group with a Cost Account and you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting (Stock module).

- Ret. Goods to Suppliers

- When you return an Item to its Supplier, you will record the return in the Returned Goods to Supplier register. When you approve and save the Returned Goods to Supplier record, this Account will be debited in the subsequent Nominal Ledger Transaction, if you are not using the Ret. Goods to Supplier A/C from Goods Receipt option below.

- Ret. Goods to Supplier A/C from Goods Receipt

- When you return an Item to its Supplier, you will record the return in the Returned Goods to Supplier register. Usually, you will create a Returned Goods to Supplier record from the Goods Receipt that you used to receive the Item into stock. When you approve and save the Returned Goods to Supplier record, the subsequent Nominal Ledger Transaction can debit the Returned Goods to Supplier Account specified above, or the Purchase Accruals Account credited by that original Goods Receipt. If you want to use the second option, check this box.

- You can also create Returned Goods to Supplier records from Purchase Orders. If you do this and you are using this option, the Transaction will debit the Purchase Accruals Account for the Item Group to which the Item belongs (if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting) or the Purchase Accruals Account specified on the 'Purchase Cost' card of this setting.

- Post Price Variance

- Please refer to the 'Price Variances' page for a description of this option.