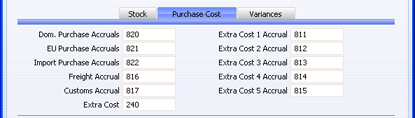

Account Usage Stock - Purchase Cost Card

- Dom, EU, Import Purchase Accruals

- The accrual Account used to book goods received before a Purchase Invoice has been received and booked. It is credited when records in the Goods Receipt register in the Stock module are approved (if the equivalent field for the appropriate Item Group is blank) and debited when Purchase Invoices created from Purchase Orders are approved (depending on the Purchase Order Item Transfer Control option chosen in the Purchase Invoice Settings setting in the Purchase Ledger). You should specify three separate Purchase Accruals Accounts, one for each Zone.

- Please refer to the Cost Accounting page for full details of this feature.

- Freight Accrual

- Used to book the cost of freight on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Customs Accrual

- Used to book the customs duty cost on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Extra Cost

- A special expense Account to collect any extra costs associated with the receipt of goods (entered to the Extra Cost field on flip C of each row of a Goods Receipt record and to the Extra Cost field in a Returned Goods record). It is credited when Goods Receipts and Returned Goods records are approved.

- Extra Cost Accruals

- These Accounts will collect any extra costs associated with the receipt of goods (entered to the five fields on the 'Extra Costs' card of a Goods Receipt record, and on flip H of a Goods Receipt row). They are credited when Goods Receipts in the Stock module are approved. If you want to give a name to each of the Extra Cost Accounts, use the User Defined Field Labels - Extra Costs setting in the Stock module.