Locations

HansaWorld Enterprise allows stocks to be kept at several different Locations. Stock balances for items are maintained both per Location and total.

If you have at least one Location, you must specify a Main Location in the Stock Settings setting. This will prevent you having stock that is not in any Location: if you forget to specify a Location in any stock transaction, that stock transaction will add stock to or remove it from the Main Location. This will be useful if you only have one Location. If you have more than one, you may also want to use the Require Location option in the same setting: this will ensure you have to specify a Location in every stock transaction. You can also specify default Locations in the Local Machine setting in the User Settings module and on the 'Bonus' card of each Person record. The first will be used by default in all stock transactions entered on the particular client machine, while the second will be used by default in all stock transactions entered by a particular user.

To open the Locations setting, ensure you are in the Stock module and click the [Settings] button in the Master Control panel or select 'Settings' from the File menu to open the 'Settings' list. Double-click 'Locations' in the list. The 'Locations: Browse' window is opened, showing existing Locations.

To enter a new Location, click the [New] button in the Button Bar. Alternatively, if one already exists that is similar to the one you are about to enter, find it in the list, highlight it and click [Duplicate].

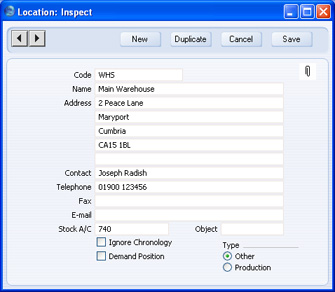

The 'Location: New' window is opened, empty if you clicked [New] or containing a duplicate of the highlighted Location.

Enter the Code and other information for each Location.

- Stock A/C

- The Stock Account specified in this field will be debited whenever stock is received into the Location and credited when stock is delivered (providing that, in the Sub Systems setting in the Nominal Ledger and in the relevant Number Series settings, you have specified that Nominal Ledger Transactions will be created when you approve Goods Receipts and Deliveries). If you do not specify a Stock Account in a Location, the Stock Account for the Item Group to which the individual Item belongs or the Stock Account in the Account Usage Stock setting will be used.

- Object

- Paste Special

Object register, Nominal Ledger/System module

- You can assign up to 20 Objects, separated by commas, to a Location. These Objects will be copied to the 'Comment' card of all Goods Receipts and the header of all Stock Depreciations with this Location created by the 'Stocktaking Comparison' Maintenance function. From those Goods Receipts, they will be assigned to the credit postings to the Stock Gain Account (and to the debit postings to the Stock Account if you are using the Supplier Object on Stock A/C option in the setting in the Purchase Ledger). From those Stock Depreciations, they will be assigned to the debit postings to the Stock Loss Account (and to the credit postings to the Stock Account if you are using the Object on Stock Account option in the Cost Accounting setting). These Objects will not be copied to other Goods Receipts and Stock Depreciations, so they will allow you to analyse in the Nominal Ledger stock gains and losses for each Location resulting from the stock checking process.

- Ignore Chronology

- HansaWorld Enterprise contains a chronology feature that you can use to help improve the accuracy of the FIFO/LIFO queue, as it will ensure you will enter stock transactions in date sequence. This feature is controlled using the Chronology in Stock options in the Stock Settings setting. If you are using this feature, you will not be able to approve a stock transaction (i.e. Goods Receipt, Delivery, Stock Movement, Returned Goods record or Stock Depreciation) if there are unapproved stock transactions (in any of those registers) with an earlier Transaction Date, or approved stock transactions with a later Transaction Date. You can switch this chronology check off for a particular Location using the Ignore Chronology check box.

- Demand Position

- If the Location is one that has Positions and you want to ensure that you always specify a Position when you use the Location, check this box.

- You must switch this option on if you are using the Warehouse Management module and the Location is your Warehouse (as specified in the Warehouse Management Settings setting).

- If you are not using the Warehouse Management module, you cannot use this option.

- Type

- These options affect the choice of Stock Gain and Stock Loss Accounts when you use the 'Stocktaking Comparison' Maintenance function for this Location.

- Other

- Choose this option for standard Locations. If the 'Stocktaking Comparison' Maintenance function creates a Goods Receipt for an Item in this Location, the Stock Gain Account will be taken from the Account Usage Stock setting. If the function creates a Stock Depreciation, the Stock Loss Account will also be taken from the Account Usage Stock setting.

- Production

- If the 'Stocktaking Comparison' Maintenance function creates a Goods Receipt for an Item in this Location, if the Item belongs to an Item Group and if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Stock Gain Account will be the Usage Variance Account in the Item Group. Otherwise, it will be taken from the Account Usage Stock setting. Similarly, if the function creates a Stock Depreciation and the same conditions are met, the Stock Loss Account will be the Usage Variance Account in the Item Group. Otherwise, it will be taken from the Account Usage Stock setting.

If you are using Locations, you may wish to switch on the Queued Cost Model per Location and Weighted Average per Location options in the

Cost Accounting setting in the Stock module. These will maintain separate FIFO/LIFO queues and Weighted Average schedules for each Location, ensuring that Items are removed from each Location in the order in which they arrived. If these options are off, single overall FIFO/LIFO queues and Weighted Average schedules will be maintained, so Items will be removed from stock in the order in which they arrived, irrespective of the Location in which they are stored. These options will also affect the calculation of stock values in the Stock List report. It is also recommended that you either switch on the Require Location option or specify a Main Location (both in the

Stock Settings setting in the Stock module). This will ensure that you will not be able to forget to specify a Location when adding or removing stock.