Supplier Categories

You can group Suppliers of a similar type can be grouped together using Supplier Categories. All Suppliers of the same Category can be given the same default Creditor Account, saving you the work of having to specify this for all Suppliers individually.

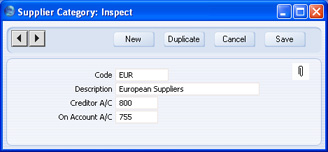

Supplier Categories are defined using the setting in the Purchase Ledger. Use the [Select Module] button in the Master Control panel to enter the Purchase Ledger and then select 'Settings' from the File menu or click the [Settings] button, also in the Master Control panel. Double-click 'Supplier Categories' in the resulting list. The 'Supplier Categories: Browse' window is displayed, showing all Categories previously entered. Click [New] to enter a new record, and [Save] to save it.

- Code

- Specify a unique code, by which the Supplier Category can be identified from the Contact screen and elsewhere in HansaWorld Enterprise.

- Description

- Enter text describing the Supplier Category here.

- Creditor A/C

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the Creditor Account that you wish to be credited by the Nominal Ledger Transactions created when you receive Purchase Invoices from Suppliers that belong to this Category.

- If you specify a Creditor Account both in a Supplier Category and in a Supplier that belongs to that Category, the Account entered in the Supplier will take precedence. If you do not specify a Creditor Account in a Category or a Supplier, the Creditor, On Account or Cash Accounts specified in the Account Usage P/L setting will be used.

- If you cannot save the Supplier Category, it may be because you are using Sub-ledger Checking in the Purchase Ledger and you have not defined the Account entered here as a Creditor Control Account. You can switch on Sub-ledger Checking using the check box on the 'Creditors' card of the Account Usage P/L setting, and you can define Control Accounts using the Sub-ledger Control Accounts setting in the System module.

- On Account A/C

- Paste Special

Account register, Nominal Ledger/System module

- This Account is used when you can buy on account from a Supplier (i.e. when they allow you to pay before they have issued you with a Purchase Invoice). To allow this, you must check the On Account check box in the Contact record for each individual Supplier affected (on the 'Terms' card). When you issue a Prepayment or On Account Payment to a Supplier belonging to this Category, it will be debited to this Account. Subsequently, when you receive the Purchase Invoice and allocate it to that Payment, the same Account will be credited in place of the default Creditor Account. Please refer to the On Account Payments and Prepayments page for full details of this process.

- If you specify a Creditor On Account A/C for an individual Supplier, it will be used in place of the one entered here. If you do not specify an On Account A/C for a Supplier or for the Category to which it belongs, the On Account A/C specified in the Account Usage P/L setting ('Creditors' card) will be used.