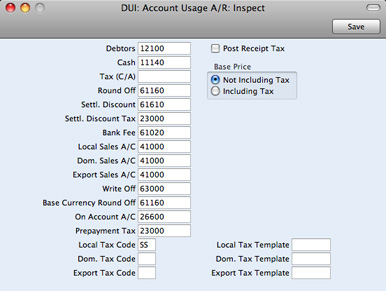

Settings in the Receivables module - Account Usage A/R

You should use the Account Usage A/R setting to choose the Accounts and Tax Codes that will be used as defaults in your Accounts Receivable transactions (i.e. Invoices and Receipts). These defaults will be used in the absence of Accounts or Tax Codes being specified elsewhere (for example, in the Items or Customers used in the transactions). The Accounts that you use here must exist in the Account register, otherwise Books by HansaWorld will not be able to create transactions.

If you created your database using the 'Start with standard chart of accounts' option as described on the Starting Books by HansaWorld - New Database page), you will find that most of the fields in the Account Usage A/R setting already contain suggested values. If you have modified this Chart of Accounts or have used your own, you must ensure that you replace these suggested values with the correct Accounts.

! | The Accounts that you use in this setting must also exist in the Chart of Accounts. Otherwise, Books by HansaWorld will not be able to create Transactions. You must either add the Accounts to the Chart of Accounts (i.e. to the Account register in the General Ledger and System module), or use Accounts that already exist in the Chart of Accounts. | |

To open this setting, first ensure you are in the Receivables module and then click the [Settings] button in the Master Control panel. Then double-click 'Account Usage A/R' in the 'Settings' list. Fill in the fields as described below. Then, to save changes and close the window, click the [Save] button. To close the window without saving changes, click the close box.

- Debtors

- Paste Special

Account register, General Ledger/System module

- When you approve an Invoice (i.e. post it to the General Ledger), its value including Tax will be debited to a Debtor Account. When you approve a Receipt, its value will be credited to the same Account. This Account therefore shows how much your company is owed at a particular time.

- Specify here the Account that you wish to be used as your main default Debtor Account. This Account will be overridden if you have specified a separate Debtor Account in the Customer Category to which a Customer belongs.

- Cash

- Paste Special

Account register, General Ledger/System module

- The Account entered here will be debited instead of the Debtor Account whenever you approve a cash sale (a "Cash Note"). Please refer to the description of the Payment Terms setting for details about Cash Notes.

- This Cash Account will be overridden if you have specified a separate Cash Account for the Payment Term used in a Cash Note.

- Tax (C/A)

- Paste Special

Account register, General Ledger/System module

- This Account is used for two purposes.

- First, the Post Receipt Tax option described below allows you to account for Tax based on Receipts. When you approve a Receipt, Tax will be moved from a temporary Tax Output Account to the final one. Usually, the final Output Account will be the O/P Account specified in the Tax Codes setting. If a particular Tax Code does not have an O/P Account, the Tax Value will be credited to this Account instead.

- Second, this Account is used if you need to reduce Tax when you give a settlement discount. Please refer to the description of the Settl. Discount Tax Account below for details.

- Round Off

- Paste Special

Account register, General Ledger/System module

- The total and Tax amounts of each Invoice will be rounded up or down according to rules set in the Round Off setting. Whenever you approve an Invoice, any amount lost or gained by this rounding process will be posted to the Account specified here.

- This Account can only be defined in the Account Usage A/R setting and is therefore used in Transactions generated from Purchase Invoices as well.

- Settl. Discount

- Paste Special

Account register, General Ledger/System module

- In the event of an Invoice attracting a settlement discount when it is paid on time, the Account specified here will be debited with the discount amount in the General Ledger Transaction resulting from the Receipt. You can define settlement discounts using the Payment Terms setting.

- Settl. Discount Tax

- Paste Special

Account register, General Ledger/System module

- This Account will be used when you enter a Receipt with a settlement discount.

- For example, you have a Payment Term with a 10% early settlement discount and you enter an Invoice worth 100 + 17.50 Tax. When you enter the Receipt, the settlement discount will be calculated to be 11.75. This 11.75 discount can be accounted for in the General Ledger in one of three ways, as follows:

- If the Settlement Discount Tax Account field is empty, 11.75 will be debited to the Settlement Discount Account (described immediately above).

- If there is a Settlement Discount Tax Account, but the Tax (C/A) Account is empty, 10.00 will be debited to the Settlement Discount Account and 1.75 will be debited to the Settlement Discount Tax Account.

- If you have specified both a Settlement Discount Tax Account and a Tax (C/A) Account, 11.75 will be debited to the Settlement Discount Account, 1.75 will be debited to the Settlement Discount Tax Account and 1.75 will be credited to the Tax (C/A) Account.

The Tax figure of 1.75 in this example will be calculated as follows:

| Settlement Discount * Invoice Tax Total | | Invoice Total (including Tax) |

- The use of this Account and the Tax (C/A) Account depends on local Tax legislation.

- Bank Fee

- Paste Special

Account register, General Ledger/System module

- Specify here the Account that you want to be credited by any bank charges that you may incur when banking Receipts.

- Local Sales A/C, Dom. Sales A/C, Export Sales A/C

- Paste Special

Account register, General Ledger/System module

- A Sales Account will be credited whenever you sell an Item, allowing you to record the levels of sales of different types of Items in the General Ledger. For each Item that you sell, the default Sales Account will be chosen in this order:

- If the Customer has a Price List and there is a record in the Price register for the Item/Price List combination, the Sales Account will be taken from that Price record.

- It will be taken from the Item record itself.

- This Sales Account in the Account Usage A/R setting will be used.

In the cases of points 2 and 3, the choice of Sales Account will depend on the Tax Zone of the Customer (specified on the ' Account' card of the Contact record for the Customer). If you leave the Domestic and Export Sales Accounts empty, the Local Sales Account will be used for all sales, irrespective of Zone.

- Write Off

- Paste Special

Account register, General Ledger/System module

- The Account specified here will be debited by bad debts written off by the 'New Write-off' Operations menu function on the Receipt screen.

- Base Currency Round Off

- Paste Special

Account register, General Ledger/System module

- This Account is not used in Books by HansaWorld, but you must specify a valid Account before you can save the Account Usage A/R setting.

- On Account A/C

- Paste Special

Account register, General Ledger/System module

- If you receive On Account Receipts from Customers without reference to specific Invoices (usually before you have raised those Invoices), you may want to use a special Account for such Receipts. Specify that Account here, and switch on the On Account check box on the 'Terms' card of the Contact records for the Customers in question. When you enter and approve an On Account Receipt, its value will be credited to this Account. On Account Receipts are described here.

- Local Tax Code, Dom. Tax Code, Export Tax Code

- Paste Special

Tax Codes setting, General Ledger

- The Tax Code will determine the Output Tax Account to be credited whenever you sell an Item and the rate at which Tax will be charged. For each Item that you sell, the default Tax Code will be chosen in this order:

- The Sales Tax Code for the Customer will be used.

- It will be taken from the Item record itself.

- This Tax Code in the Account Usage A/R setting will be used.

In the cases of points 2 and 3, the correct Tax Code for the Zone of the Customer will be used.

- You will be able to override the choice of Tax Code in an individual Invoice row if necessary.

- Note that, for Customers in the "Domestic" and "Export" Zones, Tax will not be charged on any Invoices raised, irrespective of the Tax Code specified here. If you want to charge Tax to such Customers, place them in the Domestic (Post Tax)" and "Export (Post Tax)" Zones.

- Post Receipt Tax

- This option allows you to account for Tax based on Receipts (rather than Invoices) and On Account Receipts. An On Account Receipt is a Receipt with no Invoice Number. If you need to use this option, you should enter O/P Accounts for all your Tax Codes (in the Tax Codes setting in the General Ledger), or at least a Tax (C/A) Account in the field above. Please refer to the description of flip B of the 'Receipt: New' window here for details.

- Base Price

- Use these options to specify whether the sales Prices in the Item records are to include Tax. Tax rates are defined in the Tax Codes setting in the General Ledger.

---

In this chapter:

Go back to:

|