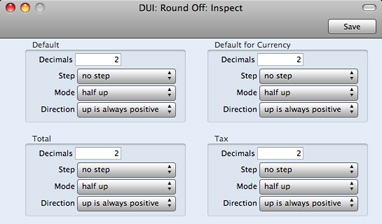

Settings in the System module - Round Off

The Round Off setting controls the way figures are rounded off.

Rounding is used throughout the system. When you enter a Sub System record such as an Invoice, the rounding process will be visible immediately. When you then approve that record (mark it as OK and save, causing a General Ledger Transaction to be created automatically), any amounts lost or gained will be posted to the Round Off Account specified in the Account Usage A/R setting. This Account will be used in Transactions generated from both Sales Invoices and Purchase Invoices.

To open the Round Off setting, ensure you are in the System module using the [Module] button in the Master Control panel and click the [Settings] button, also in the Master Control panel. The 'Settings' list opens: double-click 'Round Off'. When the 'Round Off: Inspect' window opens, enter your requirements for the rounding process as necessary. Click [Save] to save and close, or the close box to close without saving changes.

Each section contains the same set of options that control how the rounding process will operate:

- Decimals

- The number of decimal places. Example values are:

- 2

- Rounds to two decimal places.

- 1

- Rounds to one decimal place.

- 0

- Rounds to the nearest whole number.

- -1

- Rounds to the nearest 10.

- -2

- Rounds to the nearest 100.

The maximum number of decimal places is seven. However, some non-calculated fields can only contain a maximum of three decimal places. For example, the Quantity and Unit Price fields in an Invoice can only contain up to three decimal places, and therefore the maximum number of decimal places in the calculated Sum field is six.

- Step

- Use these options to specify the rounding increment, as follows:

- no step

- A rounding increment of 1 will be used. For example, if you are rounding to two decimal places, values after rounding will follow the sequence 0.00, 0.01, 0.02, 0.03 and so on. 0.023 will be rounded to 0.02 using this option.

- 5

- A rounding increment of 5 will be used. For example, if you are rounding to two decimal places, values after rounding will follow the sequence 0.00, 0.05, 0.10, 0.15 and so on. 0.023 will be rounded to 0.00 using this option.

- 2.5

- A rounding increment of 2.5 will be used. For example, if you are rounding to two decimal places, values after rounding will follow the sequence 0.00, 0.025, 0.05, 0.075 and so on. 0.023 will be rounded to 0.025 using this option. Note that this option will sometimes result in one extra decimal place than specified being used.

- Mode

- Choose an option to specify how 0.5 will be rounded. The options are:

- half up

- 0.5 will be rounded up to 1.0 when rounding to zero decimal places.

- half down

- 0.5 will be rounded down to 0.0 when rounding to zero decimal places.

- to even

- 0.5 will be rounded to the nearest even whole number. For example, when rounding to zero decimal places, 1.5 will be rounded to 2, 2.5 will be rounded to 2, 3.5 will be rounded to 4.

- to odd

- 0.5 will be rounded to the nearest odd whole number. For example, when rounding to zero decimal places, 1.5 will be rounded to 1, 2.5 will be rounded to 3, 3.5 will be rounded to 3.

- truncate

- Rounding will be carried out by removing decimals. For example, 1.999 will be rounded to 1.99 (two decimal places), to 1.9 (one decimal place) or to 1 (zero decimal places).

- Direction

- The Direction is only used if the Mode is "half up" or "half down". It specifies what "up" and "down" mean for negative numbers.

- up is always positive

- -1.5 will be rounded up to -1, +1.5 will be rounded up to 2.

- up is away from zero

- -1.5 will be rounded up to -2, +1.5 will be rounded up to 2. This option will ensure a negative record will completely cancel a positive one.

The 'Round Off: Inspect' window contains the following sections:

- Default

- The Default section has the following effects:

- It controls the number of decimals that will be displayed in Price fields and in fields with calculated values (e.g. Sum). For example, if the Default number of decimals is 4, four decimals will always be displayed. So, a value of 1 will be displayed as 1.0000, and 1.25 will be displayed as 1.2500.

- It sets the maximum number of decimals that can be used anywhere in this setting. For example, if the Default number of decimals is 4, the Row Sum will be rounded to four decimal places, even if you specified in the relevant section of this setting that it should be rounded to six.

- The Quantity field in all matrices will not follow the number of decimal places specified here. This field can support up to three decimal places. For example, if you enter "1", "1" will be displayed in the field, if you enter "1.123", "1.123" will be displayed in the field, and so on. If you enter "1.1234", then it will be rounded to three decimal places following the Default rules for Step, Mode and Direction.

- The Unit Price field in all matrices can also support up to three decimal places, and will always display a minimum of two. For example, if you enter "1", "1.00" will be displayed in the field, if you enter "1.123", "1.123" will be displayed in the field, and so on. If you enter "1.1234", then it will be rounded to three decimal places following the Default rules for Step, Mode and Direction. If the Default number of decimals is greater than three, then the appropriate number of trailing zeros will be added to the figures. For example, if the Default number of decimals is five and you enter "1.12", "1.12000" will be displayed.

- Default for Currency

- This section controls the rounding of the Tax (i.e. the Tax total) and Subtotal fields below all matrices. The number of decimals should not be more than the Default number of decimals specified above.

- Total

- This section controls the rounding of the TOTAL field below all matrices. The number of decimals should not be more than the Default number of decimals specified above.

- Tax

- This section controls the rounding of the Tax calculation in each matrix row. The number of decimals should not be more than the Default number of decimals specified above.

---

In this chapter:

Go back to:

|