The End of a Financial Year

At the end of the financial year, the books are closed and a new year is started. The final accounts are produced, the auditors will produce their report, and management will produce their report to the owners' annual meeting. After approval, in the case of limited companies, the annual report is filed with the relevant authority.

To end a financial year and start a new one in Books by HansaWorld, follow these steps. Companies will have their own methods for recording profit/loss at the end of a financial year. A typical method is described in steps 4-9 below: this method may not be suitable for every company in every country. Please refer to your financial adviser for more advice on this subject.

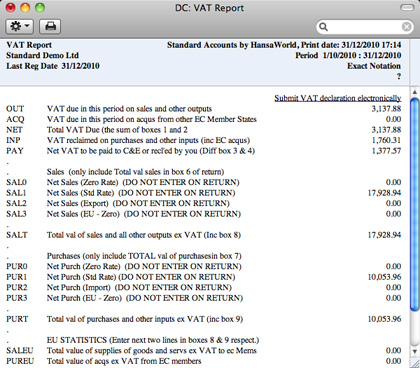

- If you are registered for VAT, the first step should be to print a VAT Report for the final quarter of the year (and separately for earlier quarters if this has not already been done).

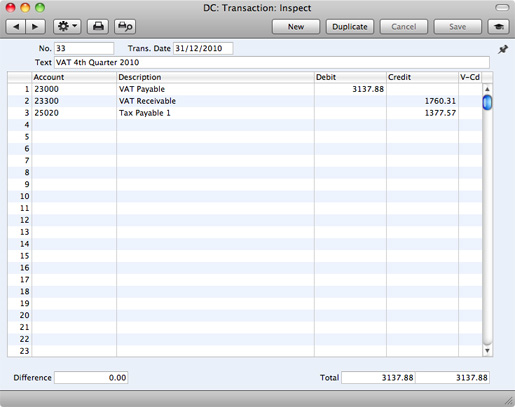

- For each quarter, you should then enter a Transaction in the Transaction register transferring the VAT amount payable/receivable into the VAT Payments Account (if you are using the sample Chart of Accounts supplied with Standard Accounts, you can use Account 25020). This Transaction would debit the VAT Outputs Payable Account (23000) and credit the VAT Inputs Receivable Account (23300), with a balancing posting to the VAT Payments Account. You must enter this Transaction in the quarter to which it belongs, preferably as the last Transaction of the period.

You can transfer the amount payable/receivable from/to your bank account using a further Transaction when payment is made/received.

- Print out the following Nominal Ledger reports, using the whole year as the report period in each case. These will provide both a hard copy record of the year's business and the basis for the end-of-year work that will now be carried out by your auditors.

- Nominal Ledger

- The Nominal Ledger report is an important part of the final accounts of a business. It is a list of every Transaction, classified by Account and listed in the order in which they were entered.

- Transaction Journal

- The Transaction Journal is a list of every Transaction, in transaction number order.

- Profit & Loss

- The Profit and Loss report summarises the income and expenditure (and therefore the operating profit or loss) of the business during the fiscal year. The result shown on the Profit & Loss report should agree with ('balance') the result on the Balance Sheet.

- Balance Sheet

- The Balance Sheet shows the financial status - at a particular point in time - of the company showing Assets, Liabilities and Equity capital.

- Chart of Accounts

- Printing the Chart of Accounts allows an outsider to understand how you have arrived at the final accounts.

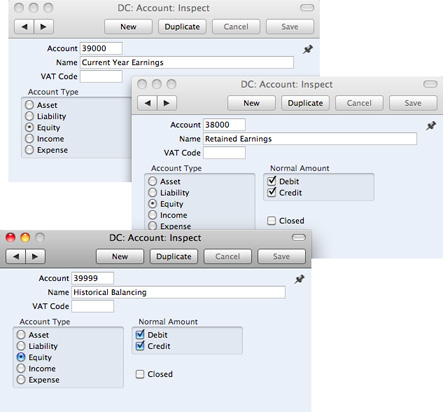

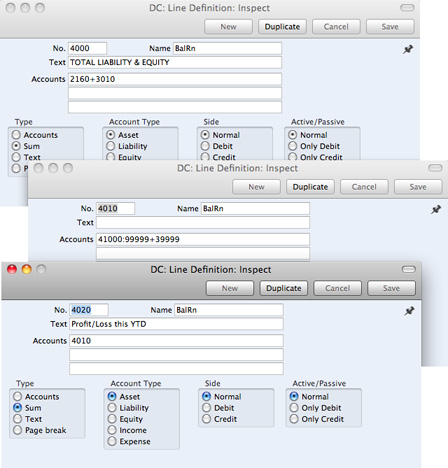

- Ensure your Chart of Accounts (i.e. Account register) includes Accounts defined as shown in the illustration:

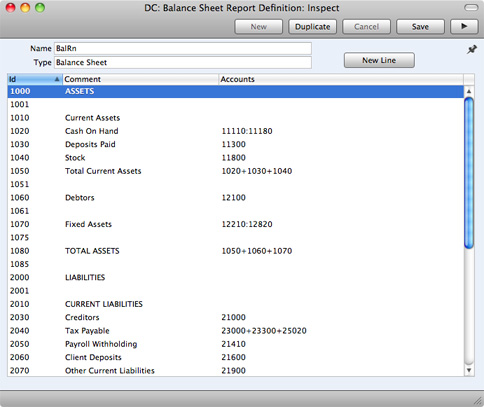

- The Accounts defined in step 4 above should not appear in the Definition of your Profit & Loss report, but should be part of the profit calculation in the Balance Sheet. In the sample Chart of Accounts supplied with Books by HansaWorld, these are lines 4000, 4010 and 4020 of the Balance Sheet Definition. To check this, ensure you are in the Nominal Ledger and click the [Settings] button in the Master Control panel or use the ⌘-S keyboard shortcut. Then, double-click 'Report Settings' in the subsequent list. Then, highlight 'Balance Sheet' in the list on the left-hand side of the 'Report Settings' window and click the [Definition] button. The following window opens:

Double-click in turn on lines 4000, 4010 and 4020 (or the equivalents if you are not using the sample Chart of Accounts and/or Balance Sheet report definition supplied with Standard Accounts) and ensure they are defined as shown:

Line 4000 in the sample Balance Sheet Definition is the equity calculation. It causes a total figure for equity to be printed in the report.

Line 4010 in the sample Balance Sheet Definition is the profit calculation. This line does not have any Text and therefore it will not be printed in the report.

In line 4020 the Type is "Sum" and so it will print the result of the calculation in line 4010.

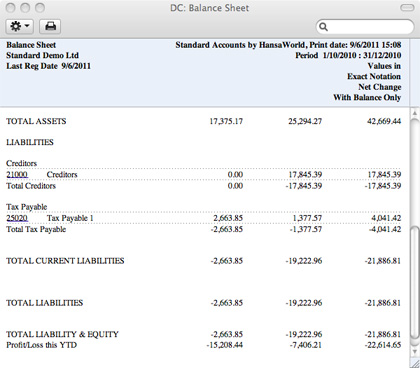

- Once your auditors have concluded their work and any consequent Transactions have been entered, refer to step 3 above and print out the reports again, as final records of the year just ended. These will be the basis for the end-of-year accounts presented to the owners or directors. The Net Profit in the Profit & Loss Report should be the same as the Profit/Loss this YTD shown in the Balance Sheet (in the Balance Sheet, a profit will be shown as a negative figure). Make a note of this figure.

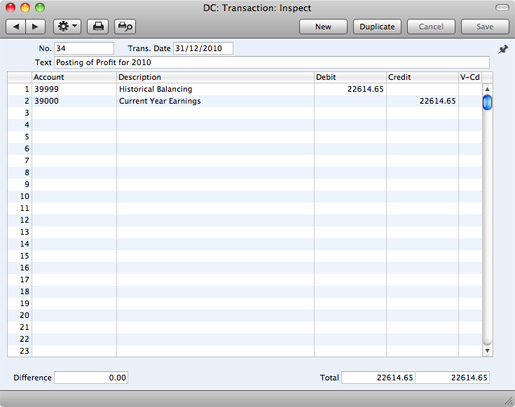

- You should now post the profit or loss for the year just ended to the Result of Current Fiscal Year Account (Account 39000 in the sample Chart of Accounts and in step 4 above). Do this by entering a new record to the Transaction register dated the last day of the year just ended. If your company made a profit, this Transaction should debit the Special Account for Y/E profit Postings (Account 39999 in step 4 above) and credit the Result of Current Fiscal Year Account with the value noted in step 6. If your company made a loss, the debits and credits should be reversed.

- Save the Transaction and print the Balance Sheet and Trial Balance to screen. You should now find that the YTD Profit figure on the Balance Sheet is zero, and the Balance Sheet should balance. Finally, check that your Trial Balance report for the last year still balances.

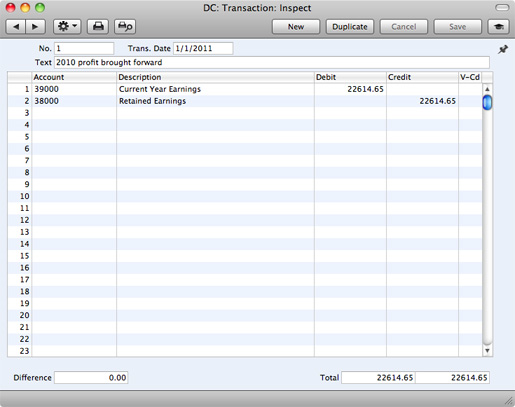

- You should now bring the profit/loss figure forward to the next year. Do this by entering a new record to the Transaction register dated the first day of the new year. You will need to update the Fiscal Years and, if you are using it, the Number Series - Transactions settings as described in steps 10 and 12 below before you can do this. If your company made a profit, this Transaction should debit the Result of Current Fiscal Year Account and credit the Retained Earnings Account (Account 38000 in step 4 above) with the value noted in step 6. If your company made a loss, the debits and credits should be reversed.

The result of the two Transactions in steps 7 and 9 is that the forward balance for Account 39000 will be the result of the previous year in the Balance Sheet for the next year. The final balance for Account 38000 will be the accumulated results of all previous years in the Balance Sheet for the next year.

You should now ensure you are ready for the new year. Follow these steps:

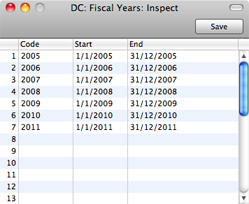

- Using the Fiscal Years setting in the System module, register the new financial year on the first blank line. Do not insert the new year at the top of the list because Fiscal Years must be listed in chronological order. Do not remove past Fiscal Years. It is recommended that you only add Fiscal Years one at a time as you need them. This will help prevent accidentally saving transactions in future years. Click [Save] to save.

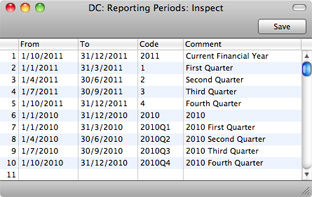

- You should now define the periods that you will commonly use when producing reports. This is done using the Reporting Periods setting, again in the System module. In this case, you should insert the new periods at the top of the list because the first period in the list is offered as a default whenever you produce a report. To insert a new period at the top of the list, click on row number 1 and press the Enter or Return key. Enter the Reporting Periods that you need and click [Save] to save.

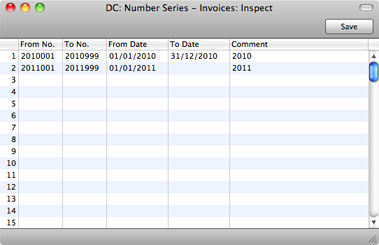

- If you are using Number Series that are date dependent, you should update them to take account of the new year. There are many Number Series settings in various modules in Standard Accounts: be sure to change every one that you have used.

- Finally, you can use the Locking setting in the System module to "lock" the previous year, preventing the accidental posting of transactions to that year.

---

Go back to: