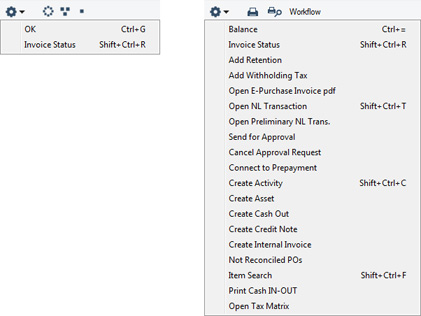

Operations Menu - Purchase Invoices

The Operations menus for Purchase Invoices are shown above. On the left is the Operations menu for the 'Purchase Invoices: Browse' window: highlight one or more Purchase Invoices (hold down the Shift key while clicking) in the list before selecting the function that you need. On the right is the Operations menu for the 'Purchase Invoice: New' and 'Purchase Invoice: Inspect' windows.

---

In this chapter:

Download:

Go back to: