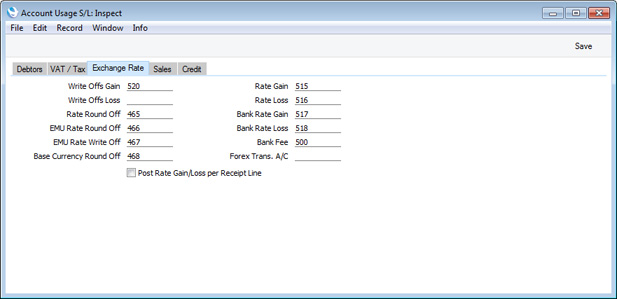

Account Usage S/L - Exchange Rate Card

This page describes the 'Exchange Rate' card of the Account Usage S/L setting. Please click the following links for descriptions of the other cards:

---

Many of the Accounts on the 'Exchange Rate' card are used when the process of creating Nominal Ledger Transactions from Sales Invoices and Receipts involves a currency conversion. Please refer to

this page for full details.

Each of the fields on this card requires you to enter an Account Number. In each case, you can use the 'Paste Special' function (Ctrl-Return or ⌘-Return) to help you choose the correct Account.

- Write Offs Gain. Write Offs Loss, Rate Round Off, EMU Rate Round Off, EMU Rate Write Off

- These Accounts will be used in the situation where an Invoice is to be treated as fully paid if the amount received is slightly different to that outstanding, providing that difference is within an allowable margin. The difference will be posted to one of these Accounts on the following basis:

- Write Offs Gain, Write Offs Loss

- if the Received Currency is the same as the Invoice Currency, and it is not a member of the EMU;

- Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is not a member of the EMU;

- EMU Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is a member of the EMU;

- EMU Rate Write Off

- if the Received Currency is the same as the Invoice Currency, and it is a member of the EMU.

- If you need to use this feature, you should set an allowable margin for each Currency, using the Automatic Round Off Limit and Automatic Write Off Limit fields on the 'Round Off' card of each Currency record. If you do this in the record representing your home Currency, you can also use this feature as an easy way of automatically writing off small outstanding amounts in domestic Invoices (i.e. those in your home Currency), reducing the need to use the 'Write off Invoices' Maintenance function.

- Please refer to the pages describing the 'EMU' and 'Round Off' cards of the Currency record for more details about using this feature.

- If the difference between the amount received and the outstanding amount is caused by a change in Exchange Rate, it will not be posted to one of these Accounts, but to the Rate Gain or Loss Accounts described below.

- A more common use of the Write Offs Account will be for bad debts written off by the 'Add Write-off' Row menu function of the Receipt and by the 'Write off Invoices' Maintenance function. You only need specify a Write Offs Loss Account or a Write Offs Gain Account: amounts written off by these functions will be debited from whichever one you specify. If you specify both, they will be debited from the Write Offs Loss Account.

- Rate Gain, Rate Loss

- These Accounts will be used when you issue a Currency Invoice and the Exchange Rate changes before it is paid. When this happens, the amount paid, when converted to your home Currency, will no longer be the same as the outstanding amount. Any difference will be posted from the Receipt to one of these Accounts, depending on whether a gain or loss is involved.

- Bank Rate Gain, Bank Rate Loss

- These Accounts will be used when the amount received at the bank against an Invoice is not the same as the outstanding amount, because the exchange rate levied by the bank is different to the rate offered to the Receipt (i.e. because you change the Bank Amount in a Receipt). Any difference will be posted from the Receipt to one of these Accounts, depending on whether a gain or loss is involved.

- Bank Fee

- Specify here the Account that you want to be credited by any bank charges that you may incur when banking Receipts. Please refer here for details about including Bank Fees in Receipts.

- Forex Trans A/C

- If you will use the Forex Transaction register to buy and sell foreign exchange, specify here the Account to which amounts in your home Currency will be posted. This Account will be credited with the transaction value in your home Currency when you buy foreign exchange, and debited when you sell.

- Post Rate Gain/Loss per Receipt Line

- When you enter a Receipt in which more than one row will post an exchange rate difference, the resulting Nominal Ledger Transaction will usually contain a single posting to the relevant Account (i.e. to the Rate Gain or Loss Accounts and/or the Bank Rate Gain or Loss Accounts described immediately above). Use this option if you would like such Transactions to contain separate exchange rate difference postings for each Receipt row. The Description in each posting will include the Invoice Number.

---

Settings in the Sales Ledger:

Go back to: