BuyBack Workflow

To record the purchase and sale of an Item that will qualify for BuyBack, follow these steps:

- When purchasing Items, follow the usual procedure of entering a Purchase Order, creating a Goods Receipt to receive the Items into stock and creating a Purchase Invoice.

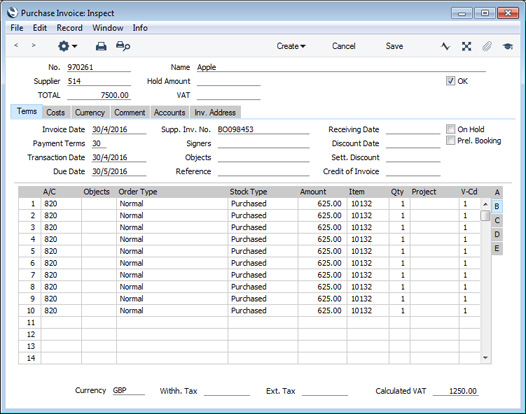

Illustrated below is a Purchase Invoice recording the purchase of 10 x Item 10132 at the standard unit Cost Price of 625.00:

- To sell an Item, create a Sales Order in the normal way. If you did not assign a BuyBack Price List to the Customer, specify one on the 'Price List' card before adding the Item(s).

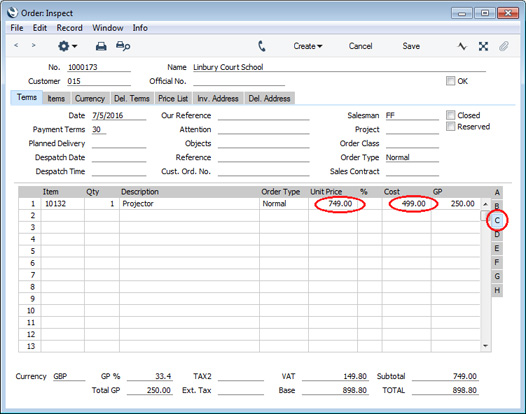

When you add Items to the Order, the Unit Price (on flip A) and Cost Price (on flip C) will be taken from the relevant record in the Price register:

If an Item is Serial Numbered at the Batch or Unit level and you are using the Cost Price for Serial Number option for that Item, you can have the appropriate Cost Price for the Serial Number brought in to the Cost field when you specify a Serial Number on flip E. If you want to use this option, tick the Use Actual Cost Price for GP Cost box in the Cost Accounting setting in the Stock module.

- Create a Delivery from the Sales Order in the usual way by choosing 'Delivery' from the Create menu (Windows/Mac OS X) or the + menu (iOS/Android).

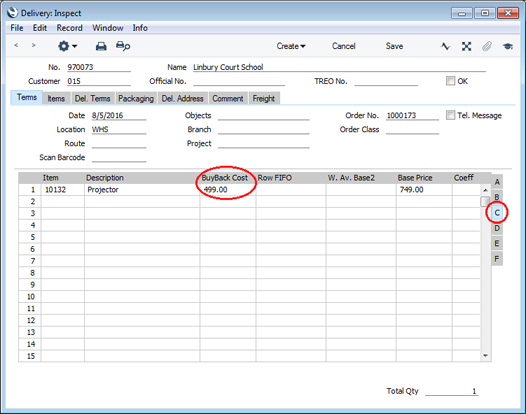

On flip C of the Delivery, the BuyBack Cost from the Price record will be entered in the BuyBack Cost field:

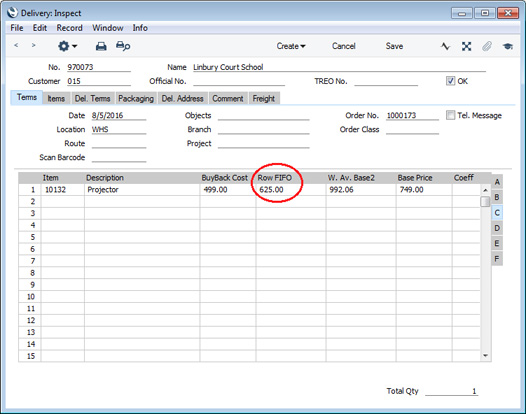

- If appropriate, enter the Serial Number of the Item(s) and then mark the Delivery as OK and save it. The cost of sales value will be entered to the Row FIFO field as normal:

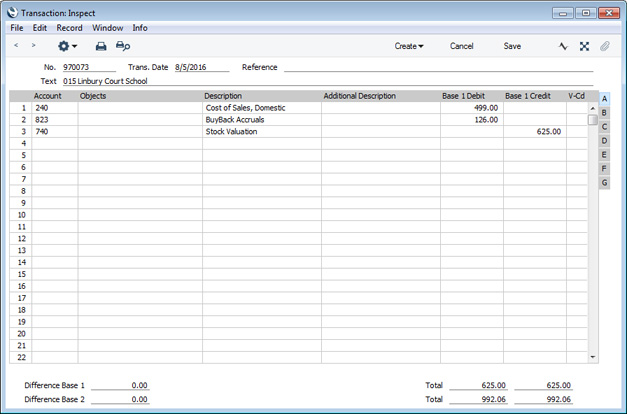

If you have determined that outgoing cost accounting postings (cost of sales postings) are to be created on the point of delivery, a Nominal Ledger Transaction will be created as usual. However, the postings in the Transaction will differ from the norm, as follows:

- The BuyBack Cost will be debited to the Cost of Sales Account.

- The difference between the BuyBack Cost and the cost of sales value will be debited to the BuyBack Accrual Account.

- The cost of sales value will be credited to the Stock Account.

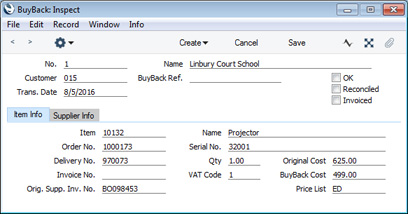

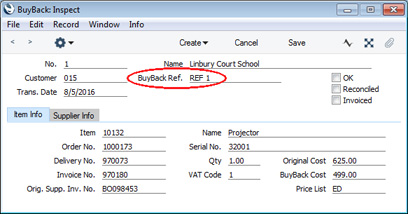

Marking the Delivery as OK and saving will also cause a record to be created automatically in the BuyBack register in the Purchase Ledger:

The fields in this record are described in detail here.

If you have determined that cost of sales postings are to be created from Invoices, the cost of sales postings and the creation of the BuyBack record will take place after the next step, when you mark the Invoice as OK and save it.

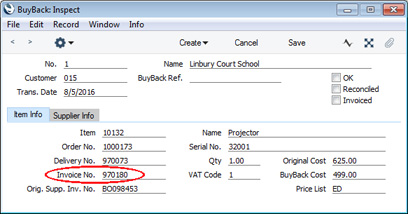

- Create a Sales Invoice from the Order in the usual way by choosing 'Invoice' from the Create or + menu. When you mark the Invoice as OK and save it, the BuyBack record will be updated with the Invoice Number:

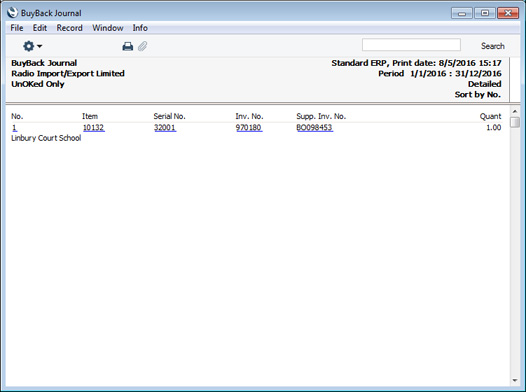

- Run the BuyBack Journal report in the Purchase Ledger module to list the BuyBack records that do not have BuyBack Reference Numbers. The Detailed version of this report is illustrated below:

- If you are an Apple Premium Reseller, log in to the relevant section of Apple's website and, working from the report produced in the previous step, register each sale. You will be given a reference number for each sale: drill down from the report to enter this reference number in the BuyBack Ref. field in each relevant BuyBack record.

- Apple will issue a Credit Note crediting the full cost and a Debit Note or new Invoice for the discounted cost amount.

- When you receive the Credit and Debit Notes, you need to distribute the correct amounts to the BuyBack records.

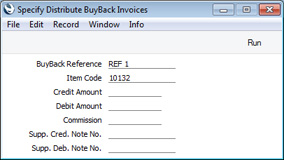

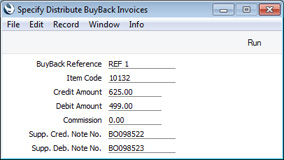

To do this, open the 'BuyBacks: Browse' window and select 'Distribute BuyBack Invoices' function from the Operations menu. The 'Specify Distribute BuyBack Invoices' window will open:

If you highlight a BuyBack record in the 'BuyBacks: Browse' window before selecting the 'Distribute BuyBack Invoices' function, the BuyBack Reference and Item in that BuyBack record will be copied to the 'Specify Distribute BuyBack Invoices' window. Fill in all the other fields (you will need to enter "0.00" as the Commission if necessary) and run the function.

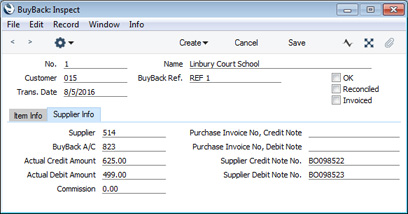

The function will update the 'Supplier Info' card of all the relevant BuyBack records in one go: the Credit and Debit Notes might cover several Invoices for the same Customer:

- The 'Distribute BuyBack Invoices' function does not mark BuyBack records as OK. This means that if any record contains a mistake you can still fix it. Check the BuyBack records, mark them as OK and save them.

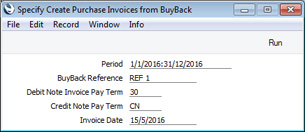

- Run the 'Create Purchase Invoices from BuyBack' Maintenance function in the Purchase Ledger.

This function will look for uninvoiced BuyBack records that have been marked as OK and from them will create records in the Purchase Invoice register for the Credit and Debit Notes.

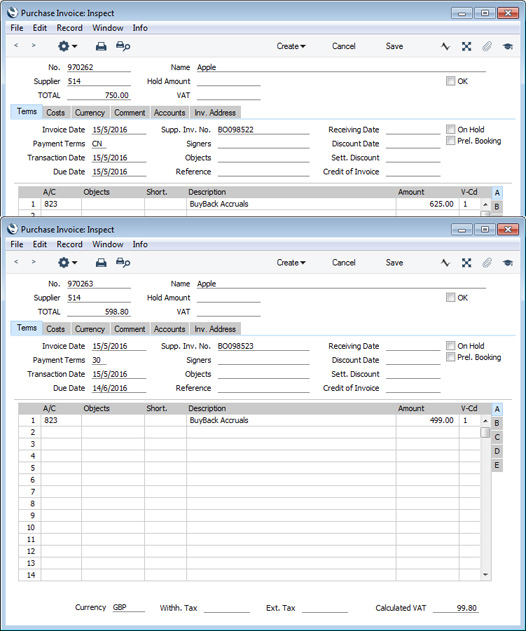

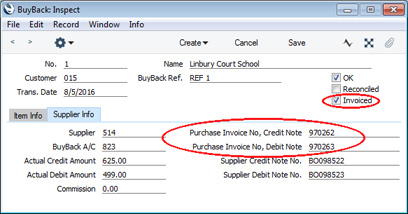

The function will also update the Buyback records with the Purchase Invoice Numbers of the Credit and Debit Notes and mark them as Invoiced:

- Check the Purchase Invoices created in step 10. Note that in the case of the Credit Note, the Credit of Invoice field will not be filled in. Some time may have passed between the purchase of the Item and its sale, so you may already have issued a Payment against the Purchase Invoice. If this is not the case, enter the Invoice Number of the original Purchase Invoice (from step 1) so that it will be removed from your Purchase Ledger. Otherwise, you can use this field to allocate the Credit Note to a different Invoice.

When the Invoices are correct, mark them as OK and save them.

---

In this chapter:

Go back to: