Entering a Stock Revaluation Record - Example

In order to be able to revalue an Item that you hold in stock, you should first carry out the following configuration work:

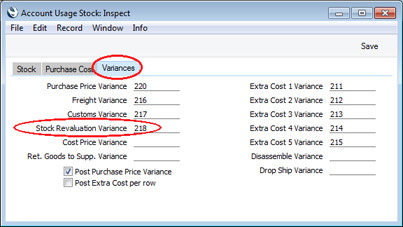

- Specify a Stock Revaluation Variance Account on the 'Variances' card in the Account Usage Stock setting.

When you reduce the value of an Item in a Stock Revaluation, this Variance Account will be debited with the value of the reduction. If you increase the value of an Item in a Stock Revaluation, the Variance Account will be credited with the value of the increase.

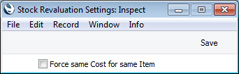

- If you hold stock in more than one Location (or you hold stock of Serial Numbered Items), you may want to be able to assign different values to Items in different Locations (or different values to Items with different Serial Numbers). On the other hand, you may need to ensure that every Item is revalued with the same value. If you need the latter option, select the Force same Cost for same Item option in the Stock Revaluation Settings setting:

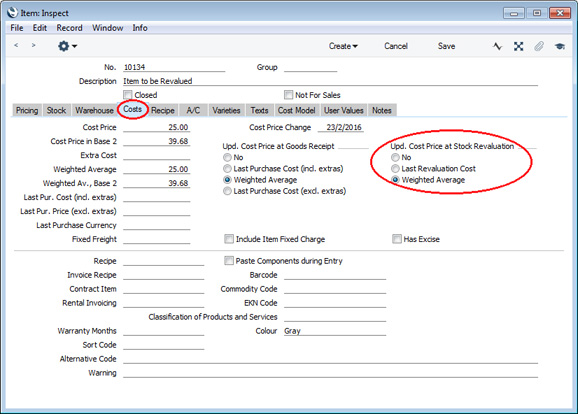

- If you would like the Cost Price of an Item to be updated from Revaluations, select one of the Upd. Cost Price at Stock Revaluation options on the 'Costs' card of each Item record:

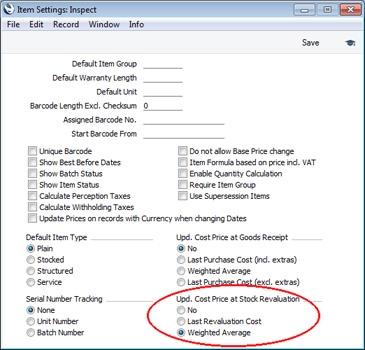

If you would like one of the Upd. Cost Price at Stock Revaluation options to be selected by default in new Item records, you can specify this in the Item Settings setting in the Sales Ledger:

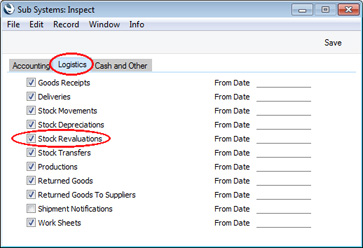

- If you need Stock Revaluations to update the stock valuation in the Nominal Ledger, select the Stock Revaluations option on the 'Logistics' card in the Sub Systems setting:

Having carried out the configuration work as described above, you can now revalue an Item. Follow these steps:

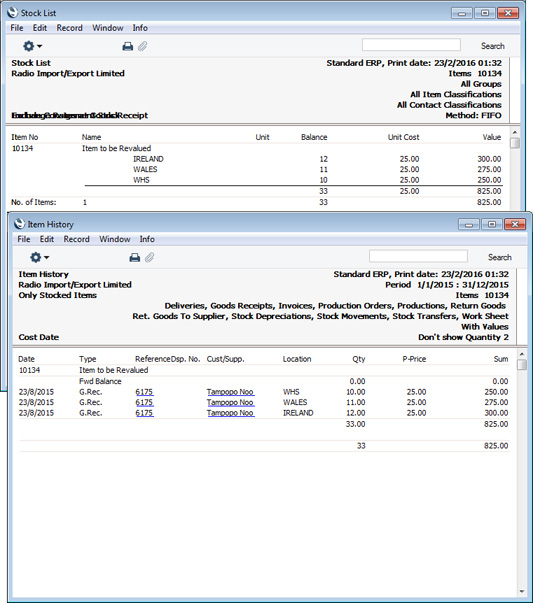

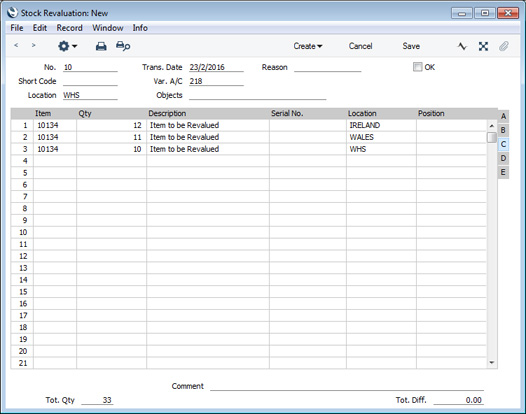

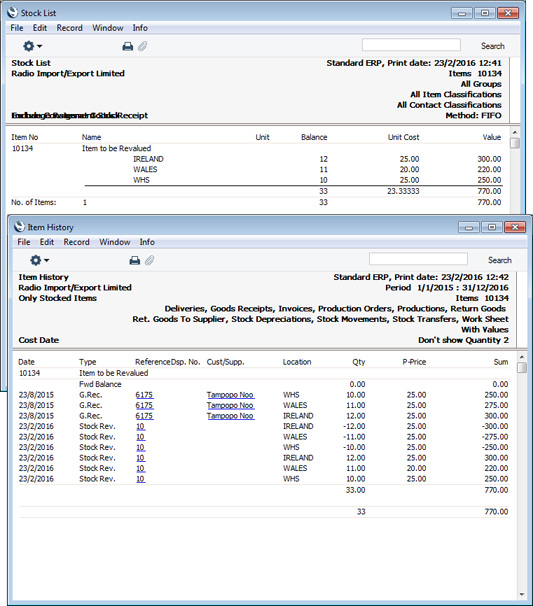

- In this example, we will revalue our stock of Item 10134. The Item History and Stock List reports show that we have 33 x 10134 in stock in three Locations, valued at 25.00 each:

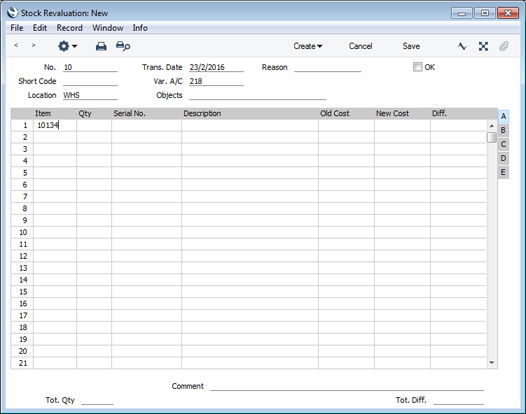

- To begin the revaluation process, create a new record in the Stock Revaluation register and enter Item 10134 in the first row:

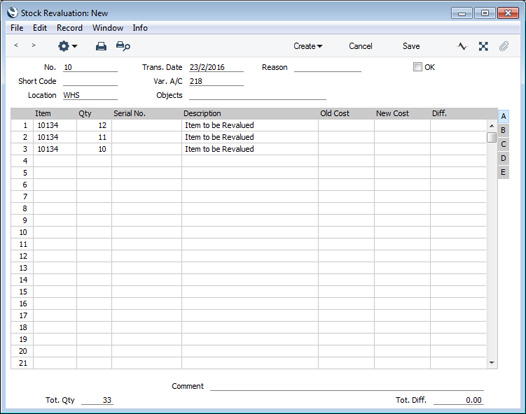

- When you move the insertion point to the next field, the quantity that you currently hold in stock will be placed in the Qty field. In this example, as we are holding stock in different Locations, a separate row for each Location will be added to the matrix automatically.

The Location will be shown on flip C:

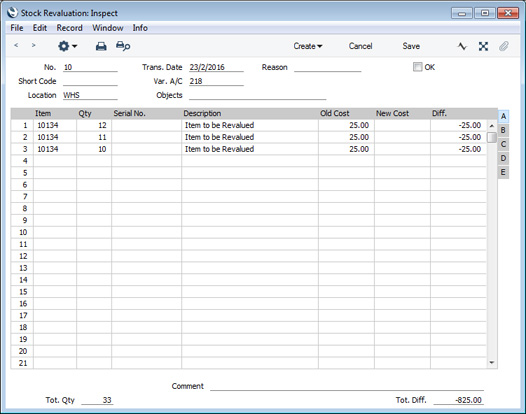

- If you know the new value per unit of the Item, you can enter it in the New Cost field on flip A immediately. But if you need to use the existing value per unit as a guide, save the Stock Revaluation. The existing value per unit will be brought in to the Old Cost field:

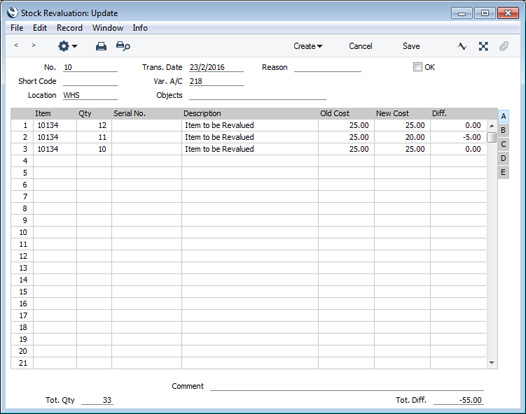

- In this example, we are not using the Force same Cost for same Item option in the Stock Revaluation Settings setting (step 2 above). This allows us to revalue the Items differently depending on the Location. For the purposes of illustration, we will only revalue the Items in the WALES Location. Here we have entered the new unit value for that Location in the New Cost field in row 2:

As the Item is not Serial Numbered, we have to include the full stock quantity of the Item to be revalued in the Stock Revaluation record. This means that we cannot remove the rows representing the Locations where we will not revalue the Item, and we cannot set the Qty in those rows to zero. So, for those Locations, we have entered New Costs (in rows 1 and 3) that are the same as the Old Costs.

If we were using the Force same Cost for same Item option in the Stock Revaluation Settings setting, the New Cost would need to be the same in each row.

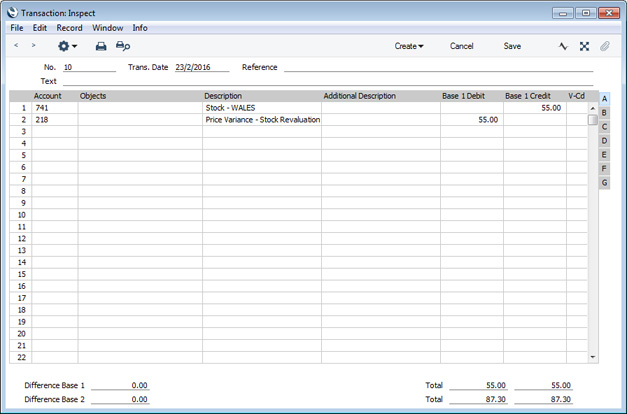

- When we mark the Stock Revaluation as OK and save it, a Nominal Ledger Transaction will be created, to update the stock valuation in the Nominal Ledger. The creation of this Transaction depends on the options that you are using in the Sub Systems setting in the Nominal Ledger and in the Number Series - Stock Revaluations setting. As we reduced the value of Item 10134 in Location WALES, the value of the reduction will be credited to the Stock Account and debited to the Stock Revaluation Variance Account:

- The new value of Item 10134 will now be shown in the Stock List and Item History reports:

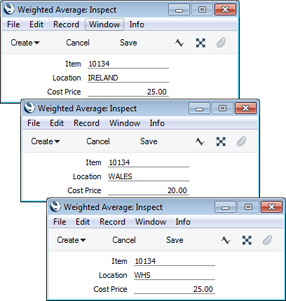

- The Weighted Average setting (which stores the Weighted Average figure for each Location) will be updated as well:

---

The Stock Revaluation register in Standard ERP:

Go back to: