Entering an Item Group - A/C Card

This page describes the fields on the 'A/C' card of the Item Group record. Please follow the links below for descriptions of the other cards:

---

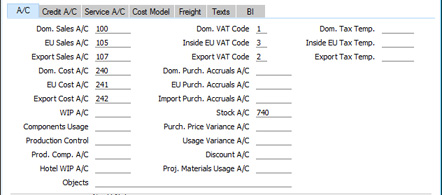

- Dom. Sales A/C, EU Sales A/C, Export Sales A/C

- Paste Special

Account register, Nominal Ledger/System module

- A Sales Account will be credited whenever you sell an Item, allowing you to record the levels of sales of different types of Items in the Nominal Ledger.

- Use these fields to specify Sales Accounts for each VAT Zone, to be used when you sell Items belonging to the Item Group when you have not specified Sales Accounts at the Item level. Please refer here for more details about how a Sales Account will be chosen when you sell an Item (i.e. when you specify an Item in a row in an Invoice, Order, Quotation or other sales transaction).

- If you need to use a dedicated Sales Account in the special case where an Invoice was created from a Service Order, specify that Account using the Service Invoiceable Sales Account field on the 'Service A/C' card.

- You can change the name of the EU Sales A/C field if it is not suitable. Using the VAT Zone Label setting in the Sales Ledger, you can replace the string "EU" with your own string (for example "SACU" in South Africa).

- Domestic VAT Code, EU VAT Code, Export VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- On the sales side, the VAT Code will determine the Output VAT Account to be credited whenever you sell an Item and the rate at which VAT will be charged.

- On the purchase side, if you will be creating Purchase Invoices from Purchase Orders or Goods Receipts, the VAT Code will determine the Input VAT Account to be debited whenever you buy an Item and the rate at which VAT will be charged.

- Use these fields to specify VAT Codes for each VAT Zone, to be used when you sell and buy Items belonging to the Item Group when you have not specified VAT Codes at the Item level. Please refer here for more details about how a VAT Code will be chosen when you sell an Item (i.e. when you specify an Item in a row in an Invoice, Order, Quotation or other sales transaction) and here for more details about how a VAT Code will be chosen when you purchase an Item (i.e. when you specify an Item in a row in a Purchase Order or Goods Receipt).

- Dom. Tax Temp., Inside EU Tax Temp., Export Tax Temp.

- Paste Special

Tax Templates setting, Nominal Ledger

- In some countries, Tax Templates are used instead of VAT Codes to determine the rate at which VAT or sales tax will be charged whenever you sell an Item and the Output VAT Account(s) that will be credited with the VAT or sales tax value. VAT Codes should be used where each sales and purchase transaction (e.g. each row in an Invoice) is taxed at a single rate, while Tax Templates should be used where different taxes and/or several tax rates are applied to one transaction (e.g. to one row.

- If you need to use Tax Templates, you should select the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in the Nominal Ledger. Wherever a VAT Code field would appear, this option will cause a Tax Template field to appear instead.

- On the purchase side, if you will be creating Purchase Invoices from Purchase Orders or Goods Receipts, the Tax Template will determine the Input VAT Account(s) to be debited whenever you buy an Item and the rate at which VAT or other tax will be charged.

- Use these fields to specify Tax Templates for each VAT Zone, to be used when you purchase Items belonging to the Item Group when you have not specified Tax Templates at the Item level. Please refer here for more details about how a Tax Template will be chosen when you sell an Item (i.e. when you specify an Item in a row in an Invoice, Order, Quotation or other sales transaction) and here for more details about how a Tax Template will be chosen when you purchase an Item (i.e. when you specify an Item in a row in a Purchase Order or Goods Receipt).

- Dom. Cost A/C, EU Cost A/C, Export Cost A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, a Cost of Sales Account will be debited with the calculated cost of goods whenever you sell a Stocked Item.

- Please refer here for full details about how the Cost of Sales Account will be chosen in an individual transaction.

- If you need Cost Accounts to be taken from Item Groups, select the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module. If you select this option, it is recommended that you assign every Stocked Item to an Item Group and that you specify Cost, Purchase Accruals and Stock Accounts in every Item Group.

- In all cases, the correct Cost Account for the VAT Zone of the Customer will be used, so be sure to specify a Cost Account for each Zone.

- If you need to use dedicated Cost Accounts in the special case where the Cost of Sales postings are being made from Work Sheets, specify them using the Service Invoiceable Cost, Service Warranty Cost, Service Contract Cost and Service Goodwill Cost Account fields on the 'Service A/C' card.

- Similarly, if you need to use a dedicated Cost Account in Cost of Sales postings made from Deliveries that have been connected to Projects, specify that Account using the Proj. Materials Usage A/C field (described towards the end of this page).

- The cost of goods will be calculated using the Cost Model chosen on the 'Cost Model' card or in the Cost Accounting setting.

- As with all Accounts on this screen, make sure that the Account you want to use exists in the Account register (available in the Nominal Ledger and the System module) to ensure that Nominal Ledger Transactions will be generated without difficulty: no attempt will be made to post to non-existent Accounts.

- Dom. Purch. Accruals A/C, EU Purch. Accruals A/C, Import Purch. Accruals A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, a Purchase Accruals Account will be credited whenever you receive a Stocked Item into stock and debited when you receive the Purchase Invoice for that Item.

- Please refer here for full details about how the Purchase Accruals Account will be chosen in each Purchase Order and Goods Receipt row.

- If you need Purchase Accruals Accounts to be taken from Item Groups, select the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module. If you select this option, it is recommended that you assign every Stocked Item to an Item Group and that you specify Cost, Purchase Accruals and Stock Accounts in every Item Group.

- In all cases, the appropriate Purchase Accruals Account for the VAT Zone of the Supplier will be used, so be sure to specify a Purchase Accruals Account for each Zone.

- When you create a Purchase Invoice from a Purchase Order, the Purchase Accruals Accounts in the Purchase Order will be copied to the Purchase Invoice for debiting, providing you are using the Transfer Each Row Separately option in the Purchase Invoice Settings setting in the Purchase Ledger. But if you are using the Consolidate By Items And Project option, the Purchase Accruals Accounts in the Purchase Order will not be copied to the Purchase Invoice and instead they will be taken from these fields in the relevant Item Groups (if you are using the Use Item Groups for Cost Accounts option) or from the Account Usage Stock setting.

- WIP A/C

- Paste Special

Account register, Nominal Ledger/System module

- Production Operations allow you to carry out Productions in stages. You will be able to remove components from stock at any stage, and add the final Item to stock when the final stage is completed. Apart from the final stage, you will not be adding to stock, but you will need to account for the work carried out so far. The Work in Progress Account is used for this purpose. This Account will be debited with the value of each intermediate Production Operation, and credited with the value of the final Production Operation. Work in Progress postings will only be made if you are using the Per Production Operation option in the Account Usage Production setting in the Production module.

- In Transactions created from intermediate Production Operations, the Work In Progress Account will be taken from the Item Groups to which the component Items belong (if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module) or from the Account Usage Production setting. In the Transaction created from the final Production Operation, the Work In Progress Account will be taken from the Item Group to which the Output Item belongs (if you are using the Use Item Groups for Cost Accounts option) or from the Account Usage Production setting.

- Stock A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, a Stock Account will be credited with the calculated cost of goods whenever you sell a Stocked Item or otherwise remove it from stock. A Stock Account will also be debited whenever you receive a Stocked Item into stock. This Stock Account will be chosen in this order:

- It will be taken from the Location.

- It will be taken from these fields in the Item Group (only if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module).

- The Stock Account in the Account Usage Stock setting will be used.

- If you are using the Use Item Groups for Cost Accounts option as mentioned in point 2 above, it is recommended that you assign every Stocked Item to an Item Group and that you specify Cost, Purchase Accruals and Stock Accounts in every Item Group.

- When you remove an Item from stock, the cost of goods will be calculated using the Cost Model chosen on the 'Cost Model' card or in the Cost Accounting setting in the Stock module.

- Components Usage, Production Control

- Paste Special

Account register, Nominal Ledger/System module

- The standard Nominal Ledger Transaction from a Production or Production Operation will credit the value of the components to a Stock Account, credit the Work Cost to a Production Components Account, and debit the value of the final Item to a Stock Account.

- This Transaction therefore simply removes the value of the components from stock and adds the value of the final Item to stock. It will therefore not be possible to distinguish the value of Items removed from stock to be used in Productions from the value of Items removed from stock for other purposes (e.g. delivered Items, depreciated Items). If you need to make such a distinction, specify Components Usage and Production Control Accounts in the Production Settings setting in the Production module, in the Item records for the components and/or in the Item Groups to which the components belong. If you do so, the Transaction will contain additional postings, debiting the value of the components to the Components Usage Account and crediting that value to the Production Control Account.

- The Components Usage and Production Control Accounts will both be taken from the Item Group to which the component Item belongs (if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module), from the component Item (in the case of the Components Usage Account only) or from the Production Settings setting.

- Purch. Price Variance A/C

- Paste Special

Account register, Nominal Ledger/System module

- Please refer to the 'Price Variances' page for details about this Account.

- Usage Variance A/C

- Paste Special

Account register, Nominal Ledger/System module

- In normal circumstances, when you create a Goods Receipt or Stock Depreciation using the 'Stocktaking Comparison' Maintenance function, the result will be a credit to the Stock Gain Account (from the Goods Receipt) or a debit to the Stock Loss Account (from the Stock Depreciation). These Accounts will be taken from the Account Usage Stock setting.

- However, if the Type of the Location is "Production", if the Item belongs to an Item Group and if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Account specified here will be used in place of the Stock Gain and Stock Loss Accounts. In the case of Stock Depreciations, this Account will record wastage incurred during the Production process.

- Prod. Comp. A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Production Components Account specified in the Account Usage Stock setting in the Stock module will usually be credited with the total Work Cost whenever you mark a Production record as Finished and save it. Usually, this will be the cost of labour required to build the assembled Items. However, if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting and you enter the Work Cost in a row in the Production with an Item belonging to an Item Group in which you have specified a Prod. Comp. (Production Components) Account, then that Account will be used instead.

- Discount A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you sell an Item for a discounted price, the discounted price will usually be credited to the Sales Account.

- If you would like the full sales price of the Item to be credited to the Sales Account and the value of the discount to be debited to a separate Account, specify that separate Account here. You must also select the Post Discount option in the Account Usage S/L setting in the Sales Ledger (for most Invoices) or in the Hotel Settings setting in the Hotel module (for Invoices created from Hotel Reservations).

- If you do not specify a Discount Account in an Item Group, the Invoice Discount Account specified in the Account Usage S/L setting will be used.

- Hotel WIP A/C

- Paste Special

Account register, Nominal Ledger/System module

- In the Hotel module, the 'Nightly Maintenance' Maintenance function has a Work in Progress Transaction option. This option will create a Nominal Ledger Transaction recording uninvoiced room occupation and extras, together with a second Transaction dated a day later that reverses the first Transaction. The value of the uninvoiced room occupation and extras will be posted to a WIP Account taken from the relevant Item records or from the Item Groups to which those Items belong. If no WIP Account is found, the WIP N/L Control A/C specified in the Hotel Settings setting will be used. The VAT element in these Transactions will be posted to the Hotel WIP A/C specified for the relevant VAT Codes. If a VAT Code does not have a Hotel WIP A/C, the VAT element will be posted to the standard Output A/C.

- Proj. Materials Usage A/C

- Paste Special

Account register, Nominal Ledger/System module

- This field allows you to specify a dedicated Account that will be debited with the calculated cost of Stocked Items when you remove them from stock using Deliveries that are connected to Projects.

- This can be useful when carrying out long-term Projects (e.g. building or construction Projects) where the Invoices will not be detailed and will not individually list the Items and materials that were used. In this circumstance, it can be desirable to post the costs of the materials to an Account dedicated to materials used for Projects rather than a Cost of Sales Account.

- The Project Materials Usage Account will be chosen as follows:

- It will be taken from the Item record.

- If you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module, it will be taken from this field in the Item Group to which the Item belongs.

- It will be taken from the Account Usage Stock setting.

If you have not specified any Project Materials Usage Accounts, then Cost Accounts for Items removed from stock using Deliveries that are connected to Projects will be chosen in the same way as in other removals from stock (e.g. normal Deliveries and Invoices) i.e. they will be chosen as described here.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- You can assign up to 20 Objects to each Item Group, separated by commas. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- If you need the same Objects to be used with every Item belonging to an Item Group, you can specify them in this field in the Item Group instead of in each Item individually.

- When you specify the Item in any transaction (e.g. in a Quotation, Order or Invoice), the Objects that you specify here will be copied in automatically if the Objects field in the Item record is empty.

---

The Item Group register in Standard ERP:

Go back to:

|