Withholding Taxes in the Purchase Ledger - Withholding Taxes

The Withholding Tax feature is available in the following countries (determined by the VAT Law specified in the

Company Info setting): Angola, Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Italy, Kenya, Mexico, Nicaragua, Panama, Philippines, Portugal, Paraguay, Singapore, South Africa and Uruguay. The settings and options described on this page will not be visible elsewhere.

---

Once you have defined your Withholding Calculation Formulae as described here, you should configure your Withholding Tax regime or regimes using the Withholding Taxes setting.

To work with Withholding Taxes, first ensure you are in the Purchase Ledger. Then, if you are using Windows or Mac OS X, open the settings list by clicking the [Settings] button in the Navigation Centre or using the Ctrl-S/⌘-S keyboard shortcut and then double-click 'Withholding Taxes' in the list. If you are using iOS or Android, select 'Settings' from the Tools menu (with 'wrench' icon) and tap 'Withholding Taxes' in the 'Settings' list. The 'Withholding Taxes: Inspect window will be opened, showing all Withholding Tax records previously entered. Each row in the matrix contains a separate Withholding Tax record or regime.

To edit a Withholding Tax record, simply click (Windows/Mac OS X) or tap (iOS/Android) in the field to be changed and overtype the existing entry. To add a new Withholding Tax record, scroll down to the first blank line. If you are using iOS or Android, you can add rows by tapping the + button below the matrix. Click [Save] (Windows/Mac OS X) or tap √ (iOS/Android) in the Button Bar to save changes. To close the window without saving changes, use the close box (Windows/Mac OS X) or tap < (iOS/Android).

The information required for each Withholding Tax record is as follows:

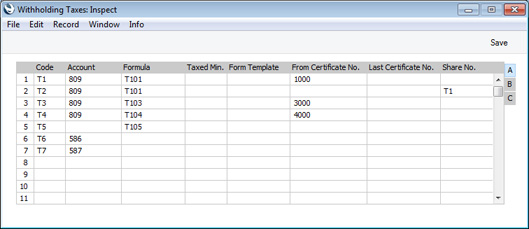

Flip A

- Code

- Enter the unique Code by which the record is to be identified from elsewhere in Standard ERP. The Code should contain two characters.

- Account

- Paste Special

Account register, Nominal Ledger/System module

- Specify the Account that will be credited with Withholding Tax amounts in Nominal Ledger Transactions created from Payments.

- This Account will also be used when you add Withholding Tax to Purchase Invoices manually. In this situation, you will use the 'Add Withholding Tax' Operations menu function to add a Withholding Tax row to the Purchase Invoice. In this row you should specify a Withholding Tax regime and an Account to be credited with Withholding Tax. The Account specified here will usually be the default. The exception is in Mexico (i.e. when the VAT Law in the Company Info setting is "Mexican"). In this case, the Tmp. Account on flip C will be the default. In Mexico, when the Purchase Invoice is paid, the Tax will be moved from the temporary Account to a final one (i.e. to the Account specified in this field) automatically.

- If you are having Withholding Tax calculated automatically in Purchase Invoices (i.e. the Tax Calculation Base in a Calculation Formula is Per Purchase Invoice and the Calculate Withholding Tax option in the Purchase Invoice Settings setting is selected), this Account will not be used. Instead, the Withholding Tax Account specified in the Account Usage P/L setting will be credited with Withholding Tax amounts.

- Formula

- Paste Special

Withholding Calculation Formulae setting, Purchase Ledger

- Specify the Withholding Calculation Formula that will be used to calculate Withholding Tax.

- Taxed Min.

- If there is a minimum Base figure before Withholding Tax can be calculated, specify that value here.

- This field is used when calculating Withholding Tax in Payments. The effect of specifying a Taxed Min. will depend on the Tax Calculation Base in a Calculation Formula, as follows:

- Monthly

- The total Base value for the Supplier for the month so far (i.e. value of all payments to the Supplier) will be compared to the Taxed Min.

- For example, if the first Purchase Invoice you pay has a Base value that is less than the Taxed Min., no Withholding Tax will be payable. If you then pay a second Purchase Invoice from the same Supplier in the same calendar month, the total Base value of both Invoices will be compared to the Taxed Min. If the total is less than the Taxed Min., again no Tax will be payable. If the total is more than the Taxed Min., Tax will be payable on that total i.e. on both Invoices.

- Yearly

- In a similar manner to the Monthly option, the total Base value for the Supplier for the calendar year so far (i.e. value of all payments to the Supplier) will be compared to the Taxed Min.

- Per Payment

- If you pay several Purchase Invoices from the same Supplier in the same Payment, the total Base value of those Purchase Invoices will be compared to the Taxed Min. If the total is less than the Taxed Min., no Tax will be payable. If the total is more than the Taxed Min., Tax will be payable on that total i.e. on all Invoices in the Payment.

- Per Invoice

- If you pay several Purchase Invoices from the same Supplier in the same Payment, the Base value of each Invoice will be compared to the Taxed Min. individually. Tax will be only be payable on the Invoices whose Base values are greater than the Taxed Min.

In all cases, if you have also specified a Non Tax. Base in the Calculation Formula, Tax will be payable if (Base amount - Non Tax. Base) > Taxed Min.

- Form Template

- Paste Special

Form Template register, System module

- Specify the Form Template that is to be used when printing Withholding Certificates created using the Withholding Tax record. This Form Template will be used instead of the standard one specified using the 'Define Form' function for the Withholding Certificate form.

- Certificate No.

- Specify the start of the numbering sequence that you want to be used for Withholding Certificates created using the Withholding Tax record.

- Last Certificate No.

- This field displays the Certificate Number of the most recently created Withholding Certificate and will be updated automatically.

- If you have used the Share No. field (below) to share a numbering sequence, this field will only be updated in the first row that uses the numbering sequence in question (for example, referring to the illustration above, this field will be updated in row 1 but not row 2).

- Share No.

- Paste Special

Withholding Taxes setting

- Use this field if you need different Withholding Tax records to share the same numbering sequence when creating Withholding Certificates.

- In the illustration above, Tax record T1 has a numbering sequence beginning at 1000. This Code T1 is entered in the Share No. field for T2, so T2 will use the same numbering sequence.

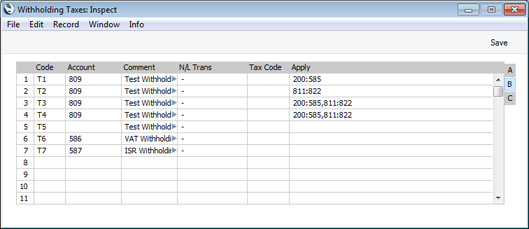

Flip B

- Comment

- Enter a descriptive name for each Withholding Tax regime. This will be shown in the 'Paste Special' list, so should be detailed enough to ensure the correct record is always chosen.

- This comment will be copied to the Tax Comment field in each Withholding Certificate.

- N/L Trans

- Paste Special

Choice of possible entries

- Use this field to choose between two options, as follows:

- -

- Use this option in the majority of situations. All methods and examples described in this manual use this option.

- Post Payment Withholding Tax

- This option can only be used in particular circumstances in Mexico. Please refer to your Standard ERP representative for details.

- Tax Code

- This field is used in Argentina, where a Tax Code will usually consist of a Tax Code (usually three characters), a dash or stroke separator and an Article or Additional Code (again, usually three characters). This Tax Code will be included in files created by the 'Withholding Certificates (Argentina)' Export function in the Purchase Ledger (and in files created by the 'P/L Withholding and Perceptions (Argentina)' Export function if there is no Tax Code in relevant record in the Supplier Withholdings setting). It will also be printed in Withholding Certificates if you have included the fields "Withholding TAX Code" (initial characters) and "Withholding TAX Article" (final characters) in the Form Template design.

- Apply

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the Accounts that are liable for Withholding Tax. If you are calculating Withholding Tax in Payments, Withholding Tax will be calculated when you pay a Purchase Invoice in which one of these Accounts has been used.

- As shown in the illustration, you can enter a range of Accounts separated by a colon (:) and/or several Accounts separated by commas.

- If you specify different Formulae on flip A, you will be able to calculate Withholding Tax at different rates, depending on the Apply Account(s).

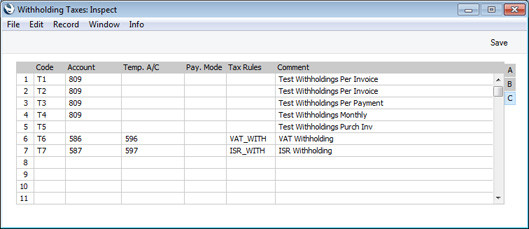

Flip C

- Tmp. Account

- Paste Special

Account register, Nominal Ledger/System module

- This field will be used in Mexico (i.e. if the VAT Law in the Company Info setting is "Mexican") when adding Withholding Tax to Purchase Invoices manually. In this situation, you will use the 'Add Withholding Tax' Operations menu function to add a Withholding Tax row to the Purchase Invoice. In this row you should specify a Withholding Tax regime and an Account to be credited with Withholding Tax. The Account specified here will be the default. This Account will be treated as a temporary Account: when the Purchase Invoice is paid, the Tax will be moved from the temporary Account to a final one (the Account specified on flip A in this setting) automatically.

- This field is also used when calculating Withholding Tax on the sales side. If you sell an Item that is subject to Withholding Tax, a Withholding Tax row will be added to the Invoice automatically. The Sales Account in this row (i.e. the Account to which the Withholding Tax will be posted) will be taken from the record in the Item Group Withholdings setting in the Sales Ledger for the Item Group to which the Item belongs (Tmp A/C field). If the Item Group Withholdings record does not have an A/C but has been connected to a row in this Withholding Taxes setting, this Tmp Account will be used. If the Invoice is a Cash Note, the Account on flip A will be used in place of this Tmp Account.

- Pay. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- If you will pay Withholding Tax using a particular Payment Mode, specify that Payment Mode here.

- When you use the 'Calculate Withholding Taxes' Operations menu function to add a row to a Payment containing the Withholding Tax amount, this Payment Mode will be copied to flip C of that row.

- In countries such as Argentina, Withholding Taxes calculated in Payments are posted separately and are not included in amounts paid to Suppliers. Entering a Payment Mode here reduces the possibility of mistakes when entering Payments with Withholding Taxes. To this end, you can make it compulsory to specify a Payment Mode in this field by selecting the Payment Mode Control for Withholding Taxes option in the Account Usage P/L setting. This option is only available in Argentina (i.e. if the VAT Law in the Company Info setting is "Argentinean").

- Tax Rules

- Paste Special

Tax Rules setting, Nominal Ledger

- This field is used in Portugal and Mexico.

- In Mexico, use this field to refer to a record in the Tax Rules setting in which the VAT Type is "Withholding" (if the Withholding Tax is a VAT Withholding) or "ISR Withholding" (if the Withholding Tax is an ISR Withholding). This controls reporting to the tax authorities.

- Please refer to your local Standard ERP representative for more information.

---

The Payment register in Standard ERP:

Go back to: