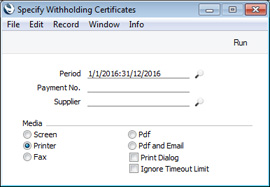

Withholding Certificates

The Withholding Certificates form is only available if the VAT Law in the

Company Info setting is set to "Argentinean", "Brazilian", "Italian", "Portuguese" or "Singaporean". You can use this function to print records from the Withholding Certificates setting.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify a period: all Withholding Certificates whose Pay. Dates fall within that period will be printed.

- Payment No.

- Range Reporting

Numeric

- If you enter a Payment Number or range of Payment Numbers here, all Withholding Certificates connected to the specified Payments will be printed.

- Supplier

- Paste Special

Suppliers in Contact register

- Enter a Supplier to print Withholding Certificates for that Supplier.

You can also print this form from an individual Withholding Certificate record by opening it and clicking the Printer icon (Windows/Mac OS X) or by selecting 'Print' from the File menu (all platforms). To print a Withholding Certificate to screen, click the Preview icon (Windows/Mac OS X only).

The Withholding Certificate is unusual in that it will not necessarily be printed using the Form Template specified in the 'Form Definition' window as described here. You can specify different Form Templates for each Withholding Tax regime in the Withholding Taxes setting. If the Withh. Tax field in a Certificate refers to a Withholding Tax regime in which you have specified a Form Template, this Form Template will be used instead.

You can use the following fields when you design the Form Template to be used by the Withholding Certificate form:

| Field in Form Template | Prints (from Withholding Certificate) |

| |

| Amount | Amount |

| Calculation Formula | Calc. Formulae |

| Comment | Comment |

| Comment 2 | Pay. Comment |

| Currency | Currency or, if blank, Base Currency 1 |

| Description | Name from the Withholding Calculation Formula |

| Description 1 | Text from the Payment row from which the Withholding Certificate was generated (only printed if the Payment Row field is not empty) |

| Number | Certificate No. |

| Payment Date | Pay. Date |

| Payment Mode | Payment Mode (not shown in the Withholding Certificate window) |

| Payment Number | Pay. No. |

| Reference | Pay. Reference |

| Row Base | Base Amounts from the rows. You should specify a Line Height for this field |

| Row Sum | Amounts from the rows. You should specify a Line Height for this field |

| Salesman | User |

| Salesman Name | User Name |

| Supplier | Supplier |

| Supplier Address | Invoice Address from the Contact record for the Supplier. This will be printed on separate lines, so you should specify a Line Height for this field |

| Supplier Invoice Number | Invoice Nos from the rows (if the Payment Row field is empty) or the Supp. Inv. No. of the Purchase Invoice being paid (otherwise). As this field can print more than one Invoice No, you should specify a Line Height |

| Supplier Name | Supplier Name |

| Supplier Registration No. 1 | Reg. No. 1 from the Contact record for the Supplier |

| Supplier Registration No. 2 | Reg. No. 2 from the Contact record for the Supplier |

| Supplier VAT Reg. Number | VAT Reg. No. from the Contact record for the Supplier |

| Total Base | Base |

| Transaction Number | No. |

| Withholding TAX Article | Final characters (up to a dash or stroke) in the Tax Code in the relevant row in the Withholding Taxes setting (usually three characters) |

| Withholding TAX Code | Initial characters (after a dash or stroke) in the Tax Code in the relevant row in the Withholding Taxes setting (usually three characters) |

| Withholding TAX Comment | Tax Comment |

| TAX % | Withholding Tax % |

Please refer

here for details of the standard fields that you can also include in the Form Template.

---

Forms in the Purchase Ledger:

Go back to: