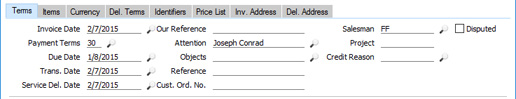

Entering an Invoice - Terms Card

This page describes the fields on the 'Terms' card of the Invoice record. Please follow the links below for descriptions of the other cards:

---

- Invoice Date

- Paste Special

Choose Date

- The date you issued the Invoice. The current date according to the computer's clock will be entered as a default.

- This date, together with the Payment Term, will determine when the Invoice will become due for payment.

- Changing the Invoice Date will usually cause the Transaction Date (below) to change as well. If you are using the Allow Trans. Date Changing option in the Transaction Settings setting in the Nominal Ledger, you will be able to change the Transaction Date if necessary. If you are not using this option, the two Dates must be the same and you will only be able to change the Invoice Date, not the Transaction Date.

- If you are using the Force Chronology for Invoice option in the Account Usage S/L setting, you will not be able to change this date.

- In multi-user systems, you can prevent certain users from changing the date in an Invoice using Access Groups, by denying them access to the 'Change Invoice Date' Action.

- Payment Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Default taken from Contact record for the Customer (Sales Pay. Terms)

- The Payment Term that you specify here will determine the Due Date (below). It will also ensure that the correct Payment Terms will be printed on Invoice documentation (in the Language of the Customer if necessary). You can also use Payment Terms to configure a system of early settlement discounts.

- Payment Terms are also the means by which Cash Notes and Credit Notes are distinguished from ordinary Invoices. To change an ordinary Invoice into a Cash Note or Credit Note, use 'Paste Special' to select a Payment Term whose Type is "Cash" or "Credit Note" respectively. When you then mark the record as OK and save, the appropriate Nominal Ledger Transaction will be created. From a Cash Note, the Transaction will debit the Cash Account (as specified in the Payment Term record) rather than the Debtor Account. From a Credit Note, the Transaction will be a reversal of the original Invoice Transaction.

- Cash Notes will immediately be treated as paid and so will not appear in your debtor reports. There is no need to enter payments against them in the Receipt register. If you need to reverse a Cash Note, create a Credit Note from the Cash Note and ensure you enter the number of the Cash Note in the first row of the grid area, as described in the next paragraph.

- When you enter a Payment Term of the "Credit Note" type, a crediting message will be entered in the first row of the grid area. In this row, you can optionally enter the number of the Invoice to be credited, using 'Paste Special' if necessary to bring up a list of open (unpaid) Invoices. If you need it to be mandatory to enter the number of the Invoice to be credited, use the Do not allow Credit Invoices without No. option in the Account Usage S/L setting.

- In a Credit Note, different Credit Sales Accounts and VAT Codes will be used in place of the standard ones if you are using the Use Credit Sales Accounts option on the 'Debtors' card of the Account Usage S/L setting. These will taken from the 'Credit A/C' card of the appropriate Item Group record or from the 'Credit' card of the Account Usage S/L setting. If you created the Credit Note by copying an Invoice, changing the Payment Term to one of the "Credit Note" type will cause the Sales Accounts and VAT Codes of the existing Items to be changed automatically.

- You can also decide that a different Location will be used by default in Credit Notes, by specifying a Default Return Location in the Local Machine setting in the User Settings module. This option is useful if you only have a single Location into which you receive Returned Items. Note that the Local Machine setting is specific to the client machine you are working on and therefore if you need to use the Default Return Location feature you should specify it in the Local Machine setting separately on each client machine.

- If an Invoice has a "Cash", "Credit Note" or "Manual Interest Inv." Payment Term, the Invoice will be printed using the Cash Note, Credit Note or Interest Invoice (respectively) Form Template instead of the standard Invoice Form Template. Please refer to the Printing Invoices page for more details.

- Due Date

- Paste Special

Choose Date

- The date when the Invoice will become due for payment, calculated from the Invoice Date and the Payment Term.

- If you are using the Calculate Due Date From Service Delivery Date option in the Account Usage S/L setting, then the Due Date will be calculated from the Service Delivery Date (below), not from the Invoice Date. In this case, the Due Date will be calculated when you save the Invoice for the first time.

- If the Payment Term is one with instalments, the Due Date of the final instalment will be shown here.

- You can change the Due Date after you have marked the Invoice as OK. This will be useful if you agree with the Customer that they will pay the Invoice on a particular date. Changing the Due Date will ensure cash flow forecast reports such as the Liquidity Forecast will use the agreed date.

- You can generate Activities from an Invoice using the 'Workflow Activity' function on the Create menu (Windows/Mac OS X) or + menu (iOS/Android): the Due Date of the Invoice will be copied to the Start Date of such Activities, thus ensuring that follow-up calls are correctly scheduled. These Activities will appear in the Salesman's Task Manager.

- Trans. Date

- This date will be used as the Transaction Date in the Nominal Ledger Transaction that will result from the Invoice.

- If you change the Invoice Date (above), the change will usually be copied to this field. If you are not using the Allow Trans. Date Changing option in the Transaction Settings setting in the Nominal Ledger, you will not be able to change this date in any other way. This effectively means that this date will always be the same as the Invoice Date. If you are using the Allow Trans. Date Changing option, you will be able to change this date, allowing the Invoice and Transaction Dates to be different.

- If you are using the Set Invoice Trans. Date to Service Delivery Date option in the Order Settings setting in the Sales Orders module and the you created created the Invoice from an Order or a Delivery, the Service Delivery Date (i.e. the date of the latest Delivery issued from the Order that has been marked as OK or the date of the Delivery respectively) will appear both here and in the Service Delivery Date field. This may result in the Invoice and Transaction Dates being different, so you should only use this option in countries where such a difference is allowed. The Set Invoice Trans. Date to Service Delivery Date option will also mean that a change to the Invoice Date will not be copied to the Transaction Date in an Invoice created from an Order or a Delivery.

- Service Del. Date

- Paste Special

Choose date

- Use this field to record the date when you delivered the goods or services listed in the Invoice.

- If you created the Invoice from an Order, the date of the latest Delivery issued from the Order that has been marked as OK will appear here. If you created the Invoice from a Delivery, the date of the Delivery will appear here. If you entered the Invoice directly to the Invoice register without reference to a Sales Order, the Invoice Date will be placed here when you save the Invoice for the first time. In both cases, you can change the date if necessary.

- If you are using the Calculate Due Date From Service Delivery Date option in the Account Usage S/L setting, then the Due Date will be calculated from this Service Delivery Date, not from the Invoice Date. Again, if you entered the Invoice directly to the Invoice register without reference to a Sales Order, the Due Date will be calculated when you save the Invoice for the first time.

- If you are using the Set Invoice Trans. Date to Service Delivery Date option in the $MAILINK(HW0301SETTINGS_Order_Settings,Order Settings) setting in the Sales Orders module and the Invoice was created from an Order or a Delivery, this Service Delivery Date will also be the Invoice Transaction Date. This may result in the Invoice and Transaction Dates being different, so you should only use this option in countries where such a difference is allowed.

- Our Reference

- Use this field if you need to identify the Invoice by means other than the Invoice Number. A default will be taken from the Our Ref field on the 'Sales' card of the Person record of the current user.

- Attention

- Paste Special

Contact Persons in the Contact register

- Default taken from Contact record for the Customer

- Record here the person for whose attention the Invoice is to be marked. The 'Paste Special' will list the Contact Persons belonging to the Customer.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- You can assign up to 20 Objects, separated by commas, to an Invoice, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports. Usually the Objects specified here will represent the Customer and the Salesman.

- In the Nominal Ledger Transaction generated from an Invoice, the Objects specified here will be assigned as follows:

- By default, they will be assigned to the credit posting(s) to the Sales Account(s) and, if the Invoice will update the stock valuation in the Nominal Ledger, to the Cost of Sales postings.

These assignments will not occur if you are using the Skip Header A/C Objects on Sales and COS A/C option in the Account Usage S/L setting.

- If you are using the Objects on Debtors Account option in the same setting, they will be assigned to the debit posting to the Debtor Account.

- If you are using the Objects on VAT Account option in the same setting ('VAT / Tax' card), they will be assigned to the credit posting(s) to the Output VAT Account(s).

- Default Objects in new Invoices will be chosen as follows:

- Objects representing the Customer will be copied from the Sales Objects field in the Contact record for the Customer.

- Objects representing the Salesman will be taken from the Person record for the Salesman.

- Objects representing the client machine being used to enter an Invoice will be taken from the Tab Item Group register in the User Settings module.

- Objects representing the Branch in which the client machine is located will be taken from the Sales Objects field in the Contact record for the Branch. The Branch itself will be copied from the Local Machine setting in the User Settings module and will be visible on the 'Del. Terms' card of the Invoice.

When an Invoice is paid, the Objects on Debtors Account option in the Account Usage S/L setting will cause the Objects in this field to be copied to the Objects field on flip F of the Receipt row. From there, they will be assigned to the credit posting to the Debtor Account.

- Reference

- Record here any additional code by which the Invoice can be identified. This Reference will be copied to the Reference field in the Nominal Ledger Transaction that results from the Invoice. When you receive payment against the Invoice, the Reference will be copied to the Reference Number field on flip G of the relevant Receipt row.

- Cust. Ord. No.

- Record the Customer's Purchase Order Number here. in an Invoice created from an Order or a Delivery, the Customer's Order Number will be brought in from the Order automatically.

- Salesman

- Paste Special

Person register, System module and Global User register, Technics module

- Default taken from Contact record for the Customer or current user

- Enter the Signature of the Salesman responsible for the sale here. You can enter more than one Signature, separated by commas.

- There are many reports in the Sales Ledger that can be broken down by Salesman. One is the Bonus, Salesman report, which you can use to calculate commission on Items sold, using the Bonus setting, the Bonus % field on the 'Pricing' card of each Item record or the Bonus field on the 'Sales' card of the Person record. If you specified more than one Salesman, the commission will be divided between them.

- Generating an Activity from the Invoice using the 'Workflow Activity' function on the Create menu (Windows/Mac OS X) or + menu (iOS/Android) will place a reminder in the Salesman's Task Manager to call the Customer on the Due Date.

- You can use Access Groups to specify which users will be able to change this field. By default, all users will be able to change the Salesman in Invoices that have not been marked as OK. If you want to prevent this for particular users, grant them Full access to the 'Disallow Changing Salesman on non OKed Sales Invoice' Action. After an Invoice has been marked as OK and saved, it will usually not be possible to change the Salesman. If you want to allow this, grant Full access to the 'Change Salesman on OKed Sales Invoice' Action.

- This field is also used by the Limited Access feature: please refer to the description of the Sales Group field (on the 'Price List' card) for details.

- You can also specify a Salesman or Salesmen in an individual Invoice row (on flip D). The Bonus, Salesman report will assign any commission for the row in question to the Salesman specified in the row only (i.e. not to the Salesman specified in this field in the header). However, the 'Workflow Activity' function will not create Activities for the row Salesman, and the Invoice will not be recognised as belonging to the row Salesman by the Limited Access feature.

- Project

- When you create an Invoice from a Project using the 'Create Project Invoices' Maintenance function in the Job Costing module, the Project Number of the Project will be placed in this field. This field cannot be changed (unless the Invoice is a Credit Note).

- If this field contains a value, the Invoice will be printed using the Project Invoice Form Template instead of the standard Invoice Form Template. Please refer to the Printing Invoices page for more details.

- The Update Stock box on the 'Del. Terms' card will not be ticked in Invoices created from Projects, and cannot be used. You should therefore not add new rows to such Invoices. A consequence of this is that if you will be creating Invoices from Projects, you cannot choose to have Cost of Sales postings made from Invoices. You must have them made from Deliveries, or from Invoices with Accruals from Deliveries.

- If you need to credit a Project Down Payment Invoice, you can do so by opening the original Invoice and choosing 'Credit Note' from the Create menu (Windows/Mac OS X) or + menu (iOS/Android), or you can do so by creating a new Invoice. In a Credit Note, as already mentioned, you will be able to specify a Project in this field using 'Paste Special'. You cannot credit a Project Down Payment Invoice by duplicating the original Invoice.

- Credit Reason

- Paste Special

Standard Problems setting, Sales Ledger/Service Orders module

- If the Invoice is a Credit Note, specify here a Standard Problem to describe the reason it was issued.

- If you need it to be mandatory to specify a Credit Reason in every Credit Note, select the Require Credit Note Reason option in the Account Usage S/L setting.

- If you create a Credit Note from a Returned Goods record, the Reason in that Returned Goods record will be copied to this field automatically.

- Disputed

- Check this box if the Invoice is subject to a dispute.

- You will be able to choose whether to include Disputed Invoices in some reports and forms such as the Open Invoice Customer Statement and the Sales Ledger report. However, the Invoice will still be subject to Interest charges and Reminders unless the No Interest and No Reminder boxes on the 'Identifiers' card are ticked. You can change the Disputed, No Interest and No Reminder boxes after the Invoice has been marked as OK.

- If the Invoice is greatly overdue, you can transfer the debt from the Debtor Account to the Bad Debtor Account using the 'Transfer to Bad Debtors' Maintenance function. This function will mark the Invoice as Disputed, to prevent the debt being transferred again the next time you use the function. If you mark an Invoice as Disputed yourself, you will therefore prevent the debt being transferred.

- In multi-user systems, you can prevent certain users from marking an Invoice as Disputed using Access Groups, by denying them access to the 'Dispute Invoices' Action.

- If you would like Credit Notes to be marked as Disputed automatically, use the Automatically set Disputed Flag on Credit Notes option on the 'Credit' card of the Account Usage S/L setting.

---

The Invoice register in Standard ERP:

Go back to:

|