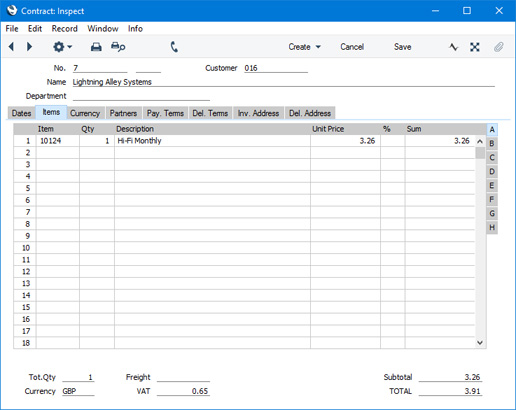

Entering a Contract - Items Card

This page describes the fields on the 'Items' card of the Contract record. Please follow the links below for descriptions of the other cards:

---

Use the grid on the 'Items' card to list the Contract Items. These Items will be included whenever you raise an Invoice for the Contract using the 'Create Contract Invoices' function.

The Contract row matrix is divided into seven horizontal flips, each showing additional fields for the Contract rows. When you click(Windows/Mac OS X) or tap (iOS/Android) on a flip tab (marked A-G), the two or three right-hand columns will be replaced.

Before adding any rows to a Contract, ensure that the Price List, Currency and Exchange Rate specified are correct. As you add Items to the Contract, the correct prices will be brought in automatically, converted into Currency if necessary. If you change the Currency or Exchange Rate after you have added Items to the Invoice, the prices of those Items will not usually be recalculated automatically. If you need to change the Currency in an existing Contract, use the 'Change Contract Currency' Maintenance function. This will change the Currency and Exchange Rate and convert all prices in the Contract to the new Currency.

If you are using Windows or Mac OS X, you can add rows to a Contract by clicking in any field in the first blank row and entering appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

If you are using iOS or Android, you can add rows by tapping the + button below the matrix. To remove a row, long tap on the row number on the left of the row and select 'Delete Row' from the resulting menu. To insert a row, long tap on the row number where the insertion is to be made and select 'Insert Row' from the resulting menu.

Flip A - Item

- Paste Special

Item register

- With the cursor in this field, enter the Item Number, Alternative Code or Bar Code for each Item included on the Contract. Usually, this will be an Item supplied on a regular basis (e.g. a magazine subscription) or a maintenance charge. Pricing, descriptive and other information will be brought in from the Item record. If you leave this field blank, you can enter a short piece of text in the Description field, perhaps using the row for additional comments to be printed on Contract documentation.

- If the Contract is for maintenance and the Item under contract is Serial Numbered and was originally sold by your business, it is recommended that you do not enter the Item Number first, but that you enter the Serial Number on flip E instead. Please refer to the description of the Original Serial No. field on flip E for details.

- Qty

- Enter the number of units offered.

- If you have specified a Factor for the Contract (on the 'Dates' card), the Quantity of every Item will be multiplied by that Factor in every Invoice raised from the Contract.

- Description

- Default taken from

Item

- This field shows the name of the Item, brought in from the Item register. Usually, it will be the Item's Description that is brought in but, if you have entered various translations of the Description on the 'Texts' card of the Item record, the correct translation for the Language of the Invoice (specified on the 'Del. Terms' card will be brought in instead.

- If you want to add an extra description, you can do so: there is room for up to 100 characters of text. If you need more space, you can continue on the following line.

- Unit Price

- The Unit Price of the Item according to the Customer's Price List when you specify the Item Number. If the Customer does not have a Price List, or the Item is not on the Price List in question, the Base Price from the Item screen will be brought in instead. If there is a Price List applying to a Contract, it will be shown on the 'Del Terms' card.

- The maximum number of decimal places that you can use in a Unit Price is three. If you need more decimal places, use the Unit Price in combination with the Price Factor on flip C.

- This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

- If the Item is an annual Contract and you will be invoicing in instalments, you could enter the appropriate fraction of the Contract value here, or you could leave the full value here and enter a multiplier in the Factor field on the 'Dates' card. For example, if the annual Contract Value is 120.00, this will be the Base Price in the Item register and will therefore be the default value that is brought in to this field when you enter the Item Number. If the Contract is to be invoiced monthly, you could change this figure to 10.00, or you could leave it at 120.00 and enter a Factor of 0.083 (1/12).

- If the Contract has a Currency and Exchange Rated, the figure shown will be in the Currency concerned (i.e. having undergone currency conversion).

- %

- If you need to offer the Customer a discount on an Item, enter the discount percentage in this field.

- A discount percentage will be brought in to this field automatically if you are using Discount Matrices and if there is a Discount Matrix that includes the Item applying to the Contract. Discount Matrices allow you to offer quantity discounts based on the value, quantity, weight or volume of each Item sold, so the discount percentage (quantity discount) will be recalculated whenever you change the Quantity.

- The Discount Calculation options in the Round Off setting in the System module allow you to determine whether the discount is to be applied to the Unit Price before it has been multiplied by the Quantity, or to the Sum. In certain circumstances (where there is a very small unit price and a large quantity) this choice can cause the calculated discount to vary, due to the rounding system used in Standard ERP. Please refer here for details and an example.

- The percentage entered here can act as a discount, margin factor or markup. This is controlled using the Discount Options setting in the System module.

- Sum

- The total for the row: Quantity multiplied by Unit Price less Discount. Changing this figure will cause the Discount Percentage to be recalculated. This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

Flip B- A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Sales Account specified here will be credited with the Sum in the Nominal Ledger Transactions generated from the Invoices that you will eventually create from the Contract. Sales Accounts are used to record the levels of sales of different types of Items in the Nominal Ledger.

- Please refer here for details about how the default Sales Account in each row will be chosen.

- Tag/Object

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Default taken from Item or Item Group

- You can assign up to 20 Tags/Objects, separated by commas, to a Contract Item. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports. Usually the Objects specified here will represent the Item.

- The Tags/Objects that you specify here will be transferred to the Nominal Ledger Transactions that will be generated from the Invoices created from the Contract. In those Transactions, these Tags/Objects will be assigned to the credit posting to the Sales Account and, if the Invoice will update the stock valuation in the Nominal Ledger, to the cost of sales posting. This assignment will merge these Tags/Objects will be merged with those of the parent Contract (shown on the 'Del Terms' card).

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- When you create an Invoice from a Contract, the VAT Code entered here determine the rate at which VAT will be charged on the Item and the VAT Account that will be credited with the VAT value.

- Please refer here for details about how the VAT Code in each row will be chosen.

- T-Cd

- Paste Special

Tax Templates setting, Nominal Ledger

- In some countries, Tax Templates are used instead of VAT Codes to determine the rate at which VAT or sales tax will be charged on the Item and the Output VAT Account that will be credited with the VAT or sales tax value. VAT Codes should be used where each sales and purchase transaction (e.g. each row in an Invoice) is taxed at a single rate, while Tax Templates should be used where different taxes and/or several tax rates are applied to one transaction (e.g. to one row).

- If you need to use Tax Templates, you should choose the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in the Nominal Ledger. This option will cause a Tax Template field ("T-Cd") to appear here instead of the VAT Code field ("V-Cd"). Having done so and having entered your Tax Templates in the Tax Templates setting also in the Nominal Ledger, you should specify the Tax Templates that are to be used in each Contract row here.

- Please refer here for details about how the Tax Template in each row will be chosen.

- Price Factor

- Default taken from

Item

- The Price Factor is the quantity of the Item that can be bought by the Unit Price. For example, if the Unit Price of an Item refers to a box of 24 units, its Price Factor will be 24. Specifying a Price Factor for such an Item is only necessary if it will be sold in individual units (e.g. if you will break into the box of 24 to sell a single unit). The Price Factor will be used to calculate the price of a single unit (in this example, the Price Factor will be 24).

- When you use an Item with a Price Factor in a Contract row, the Quantity that you specify on flip A should be the quantity of individual units, not the quantity of boxes. When you enter a Quantity, the Sum will be calculated using the formula (Quantity/Price Factor) * Unit Price.

- The Unit Price field on flip A (and the Base Price field in the Item record) can only support three decimal places. Using a Price Factor can be useful if you need to use more. For example, if the price per unit is 0.0001, you can enter 0.01 as the Unit Price and 100 as the Price Factor. This will result in a Sum of 0.0001 when the quantity is one.

- Accrual

- Paste Special

N/L Accruals setting, Nominal Ledger

- In normal circumstances, when you create an Invoice from a Contract, the whole Sum for each Invoice row will be posted to the Sales Account when the Nominal Ledger Transaction is generated. However, this might not be appropriate if the Contract Period covered by the Invoice is a long one. In this case, it might be appropriate for the Sum to be posted to the Sales Account gradually during the Contract Period.

- For example, a Contract is for one year and is to the value of 1200. You decide to issue a single Invoice for the whole year, not twelve monthly Invoices. In this situation, you might not want the Sales Account to be credited with the 1200 at once: it might be more appropriate if it is credited with 100 per month over the year (the contract period), especially if the contract period crosses over into a new fiscal year.

- Enter here the Code of a record in the N/L Accruals setting in the Nominal Ledger. This will be used to define the formula by which the Sum is gradually credited to the Sales Account (in this example, at 100 (or 8.33%) per month). When you mark the Invoice as OK and save, the Sum (i.e. excluding VAT) of the Invoice row will not be posted to the Sales Account in the normal way. Instead, it will be posted to an Accrual Account, specified in the N/L Accrual record. The postings to the VAT and Debtor Accounts will not be affected. A record will also be created in the Simulation register. This will contain twelve sets of balancing debit and credit postings, debiting the Accrual Account and crediting the Sales Account. This will allow the Sum to be moved from the Accrual Account to the Sales Account at the rate of 8.33% per month, through the use of the 'Generate N/L Accrual Transactions' Maintenance function in the Nominal Ledger.

- Please refer to the Sales Ledger Accruals page for more details and an illustrated example.

- Item Type

- Paste Special

Item Description Types setting, Contracts module

- You can use this field to categorise the Items supplied, referring to the list entered in the Item Description Types setting.

- Contact

- Enter a Contact Name for each Item.

Flip E- Original Item

- Paste Special

Item register

- If the Contract is for maintenance and the Item being maintained is one that is sold by your business, record its Item Number here. In a Contract that you created from an Invoice, the Item Number will have been copied here from the Invoice automatically.

- Original Serial No.

- Paste Special

Serial Numbers of sold Items and of Repair Items (Known Serial Numberregister)

- If the Contract is for maintenance, record the Serial Number of the Item being maintained here. In a Contract that you created from an Invoice using the 'Contract' function on the Create menu of the Invoice screen, the Serial Number will have been copied here from the Invoice automatically.

- If the Item under contract is one originally sold by your business, the Serial Number should be the first thing that you enter in a new Contract. This will cause the Customer Number and Name and Item Number to be brought in from the Known Serial Number register automatically. The Item Number will be placed in the Original Item field to the left, and sometimes in the Item Number field on flip A. The exception is when the Item has a Contract Item specified on its 'Recipe' card: in this case, the Contract Item Number will be placed in the field on flip A. You can then change the Customer information if the Item has been sold on. Note that the Serial No field is case-sensitive, so be sure to enter the correct combination of upper- and lower-case letters. If the Customer and Item does not appear, this is one probable cause. The other probable cause is that the Known Serial Number register does not contain Customer information about the Items you have sold because you are not using the Update Known Serial Number Register option in the Stock Settings setting.

- The 'Paste Special' list shows the contents of the Known Serial Number register. This contains Serial Numbers previously used in the Service Stock Transaction register in the Service Orders module and, optionally, Serial Numbers of Items originally sold by your company.

Flip FPlease refer to the description of the Service Agreement register for details about these fields.

Flip G- Row Type

- Paste Special

Choices of possible entries

- Set this field to "Repetitive" if this row is to be included on every Invoice raised from the Contract. Set it to "Invoice Once" if the row can only be invoiced once. This can be useful if you need to include an initial charge or termination fee in your Contracts.

- Invoice After

- Paste Special

Choose date

- If the Row Type above is "Invoice Once", you can enter here the earliest date when the row can be included in an Invoice. If you leave this field empty, the row will be included in the next Invoice created from the Contract.

- Invoice No.

- If the Row Type above is "Invoice Once", when an Invoice is raised for this Contract row, the Invoice Number will be shown here. This will prevent it being invoiced again.

Flip H- Length, Start, End, Last Inv. Date

- Use these fields if you need a row to have a different Start Date. End Date and/or Length to those specified on the 'Dates' card.

- You must fill in all three fields, even if you only need one value to be different, otherwise Invoices will not be created.

- The Start Date cannot be earlier than the Start Date specified on the ‘Dates’ card, and the End Date cannot be later than the End Date specified on the ‘Dates’ card.

- When an Invoice is created from the row, the Last Inv. Date field will be updated automatically, as described for the Last Inv. Date field on the ‘Dates’ card.

- Invoiced

- The Invoiced field is a counter that records the number of Invoices that have been created from a row and that have been marked as OK. Whenever you mark an Invoice as OK and save, this field will be updated.

FooterIn addition to the Currency, the Contract Footer contains various running totals. Whenever you add or change a Contract row, these totals will be updated. All totals shown assume a Factor ( 'Dates' card) of 1.

- Tot.Qty

- The total number of Items covered by the Contract is shown here and is updated automatically. This figure can be printed on Contract Labels.

- Currency

- Paste Special

Currency register, System module

- Default taken from Contact record for the Customer (Sales Currency) or Default Base Currency

- The Currency of the Contract: the Exchange Rate is shown on the 'Currency' card where you can change it for a particular Contract if necessary. Leave the field blank to use your home Currency (unless you have set a Default Base Currency, in which case this will be offered as a default and should be treated as your home Currency).

- If you need to change the Currency after adding Items to the Contract, use the 'Change Contract Currency' Maintenance function. This will change the Currency and Exchange Rate and convert all prices in the Contract to the new Currency. If you change the Currency in a Contract yourself, the prices of the Items already in the Contract will not be converted.

- Freight

- The Freight setting in the Sales Ledger allows a fixed amount for Freight to be applied automatically to each Contract. If you are using this setting, the appropriate amount will be placed in this field when you enter a Customer Number. You can change the figure if necessary. The VAT Code and the Sales Account for the freight charge will be taken from the Item entered in the Freight setting.

- If you are not using the Freight setting, enter a freight amount if applicable. In this case, VAT will not be charged and, in the eventual Invoice, the amount will be posted to the appropriate Sales Account for the Zone of the Customer, set on the 'Sales' card of the Account Usage S/L setting.

- The Freight figure is absolute: it is not multiplied by the Factor when raising Invoices.

- VAT, Tax

- The VAT total for the Contract (or tax total if you are using the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in Nominal Ledger).

- Subtotal

- The total for the Contract, excluding VAT.

- TOTAL

- The total for the Contract, including VAT.

---

The Contract register in Standard ERP:

Go back to:

|