The Depreciation Model Register

This page describes the Depreciation Model register in the Assets module.

---

Depreciation Models are the formulae that you will use to calculate the depreciation of your Assets. You can use up to two Models in each Asset.

To enter a Depreciation Model, first ensure you are in the Assets module. Then, if you are using Windows or macOS, click the [Registers] button in the Navigation Centre and double-click 'Depreciation Models' in the resulting list. If you are using iOS or Android, tap the [Registers] button in the Navigation Centre and then tap 'Depreciation Models' in the 'Registers' list.

The 'Depreciation Models: Browse' window will be opened, showing the Depreciation Models that you have already entered. To enter a new Depreciation Model, select 'New' from the Create menu (Windows/macOS) or the + menu (iOS/Android). You can also use the Ctrl-N (Windows) or ⌘-N (macOS) keyboard shortcuts. Alternatively, highlight a Depreciation Model similar to the one you want to enter and select 'Duplicate' from the same menu. In both cases, the 'Depreciation Model: New' window will be opened.

Complete the Depreciation Model record as appropriate and as described below, then save it using the [Save] button (Windows/macOS) or by tapping √ (iOS/Android) and close the window by clicking the close box (Windows/macOS) or by tapping < (iOS/Android). Then, close the browse window using the close box or < again.

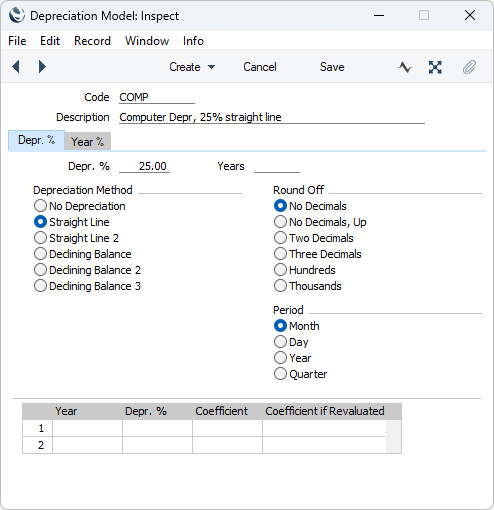

Header

- Code

- Enter a unique code by which the Model can be identified. You can use a maximum of ten alpha-numeric characters.

- Description

- Enter the complete name for the Depreciation Model, to be shown in the 'Depreciation Models: Browse' window and the 'Paste Special' list.

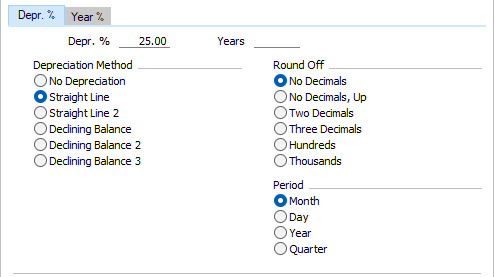

Depr. % Card

- Depr. %, Year

- You can enter the annual depreciation percentage using one of two methods:

- You can enter a percentage in the Depr. % field.

- You can enter the depreciation life as a number of years in the Years field.

- If you enter both a Depr. % and a number of Years, the number of Years will be given priority and the Depr. % will be ignored.

- You can only use the Years field with one of the Straight Line Depreciation Models. No depreciation will be calculated if you use it with one of the Declining Balance Models.

- Using the Years field can help avoid the round-off issues that can occur with some Asset lifespans. For example, if the depreciation life is three years and an Asset will be depreciated on a monthly or yearly basis, entering 33.33 as the Depr. % will mean that the Asset will not be fully depreciated at the end of the third year as it will have been depreciated by 99.99%. Entering 3 as the number of years will mean that the Asset will be depreciated by 33.33% in the first two years and by 33.34% in the in the final depreciation period, at the end of which it will therefore be fully depreciated.

- Depending on the options that you select when calculating depreciation, the calculation will apply the depreciation percentage to the Purchase Value of the Asset (entered on the 'Purchase' card in the Asset record) or its Fiscal Value, or to the Starting Value in the latest Revaluation record, if one exists.

- Depreciation of an Asset will begin on its Start. Date 1 (if depreciation will be calculated using Depreciation Model 1) or on its Start. Date 2 (using Depreciation Model 2). If you are using the Years field in a Depreciation Model, this will still be the case but depreciation will be calculated to be zero if both the Used From and Purchase dates in the Asset record are empty. You should therefore ensure that you have specified a Start Date and either a Used From or a Purchase date or both in each Asset record, otherwise the depreciation calculation will not be correct.

- If you need to specify different depreciation percentages for each year in the life of an Asset, use the 'Year %' card described below.

- Note that if you have selected Quarter as the Period (below), you should enter the quarterly depreciation percentage in the Depr. % field. In all other cases, enter the annual depreciation percentage. Do not use the Years field if the Period is Quarter.

- Depreciation Method

- The Depreciation Method determines how the depreciation will be calculated. Check with local legislation as to which method is appropriate for your country of operation. The following options are available:

- No Depreciation

- No depreciation is calculated.

- Straight Line

- This method means that the Asset is written down by the same amount each year. It uses the Purchase Value or Fiscal Value as the basis for the calculation, unless the Asset has been revalued. If so, the Starting Value in the latest Revaluation will be the basis for the calculation.

- For example, if an Asset cost 100,000 and is to be depreciated by 20% p.a. using the Straight Line method, it will depreciate by 20,000 each year and will be written off after 5 years.

- Straight Line 2

- This method is used in Lithuania and is identical to the Straight Line method described above if you are calculating depreciation for Assets for which there are no Revaluations.

- If there is a Revaluation, then depreciation will be calculated using this formula:

- (Value on date of Revaluation + Change in Value) * Depreciation %

- For example, an Asset was purchased for 2400 on 31/12/2022. Its Residual Value is 1. It will be depreciated by 25% p.a. using the Straight Line 2 method. To start with, depreciation will be identical to that calculated using the Straight Line method, so the value on 31/12/2024 will be 2400 - (600 x 2) = 1200.

- The Asset is revalued on 1/1/2025. The Start. Value in the Revaluation is 3000. So, for 2025, depreciation will be (1200 + (3000 - 2400)) x 25% = 450.00, and it will be fully depreciated on 31/12/2028.

- If you were using the Straight Line method, annual depreciation after the Revaluation would be 3000 x 25% = 750.00.

- Declining Balance

- This method causes the base value of the Asset to decline by the depreciation amount each year.

- For example, an Asset which cost 100,000 which is to be depreciated by 20% p.a. using the Declining Balance method will be depreciated by 1,666.67 in the first month, by 1,638.89 in the second month (20% of (100,000-1,666.67) x 1/12) and so on. Such an Asset will never be completely written off. In some countries such as Portugal there may be special rules about writing off such an Asset at the end of its useful life. Please refer to your local HansaWorld representative and your auditor for advice.

- If you are using a Declining Balance Model, you should select Month or Quarter as the Period (below).

- Declining Balance 2

- This method is identical to Declining Balance described above if you are calculating depreciation annually.

- If you are calculating depreciation monthly, this method is half-way between Straight Line and Declining Balance. It uses the Straight Line method to calculate figures for each month in a calendar year, but the base value will be reduced for the next year on a Declining Balance basis. For example, depreciation in the first month of an Asset which cost 100,000 and which is to be depreciated by 20% p.a. using this method will be 100,000 x 20% x 1/12 = 1666.66. In the second month, the depreciation will again be 1666.66, and so on. Every January, the base value will be re-calculated (to 100,000 - (12 x 1666.66) = 80,000 in the example, assuming it was purchased the previous January). Monthly depreciation in the next year will be 80,000 x 20% x 1/12 = 1333.33. The recalculation of the base value will always take place in January, irrespective of when the Asset was purchased, although the result will depend on the purchase date. For example, if the sample Asset was purchased in July, the base value will change to 100,000 - (6 x 1666.66) = 90,000 the following January.

- Depending on advice from your auditor or other financial adviser, this may be the preferred Declining Balance method for use in the UK.

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function here for some example depreciation calculations.

- Period

- These options are mostly only relevant to Straight Line Depreciation Models. In a Declining Balance Model, you should select Month or Quarter: if you select Day or Year, depreciation will be calculated as if you had selected the Month option. The option that you choose here will be used in the Asset Status report, the Depreciations Report, the two Portuguese Fiscal reports and the Subsidy Assets report. In all other circumstances, you will be able to choose a period when calculating depreciation or producing a report, as one of the available options will be According to Model which, if selected, will mean that the option selected here in the Depreciation Model will be used.

- Month

- This option will divide the yearly depreciation percentage by 12 to obtain a monthly percentage. For example, an Asset worth 50,000 being depreciated by 5% p.a. will be depreciated by 208.33 per month (50,000 x 0.05 / 12). This figure will always be the same, irrespective of the number of days in the month. The minimum period for the depreciation calculation in reports will be one month, starting from the first day of the month. The Start Date of an Asset will also be treated as the first day of a month: e.g. if you enter March 15 as an Asset's Start Date, depreciation will be calculated as if the Start Date were March 1.

- Day

- This option will divide the yearly depreciation percentage by 365 and multiply it by the number of days in the month to obtain a monthly percentage. For example, an Asset worth 50,000 being depreciated by 5% p.a. will be depreciated by 212.33 per 31 day month (50,000 x 0.05 / 365 x 31). This figure will change, depending on the number of days in the month. The number of days is calculated from the depreciation period entered in the specification window of the report or Maintenance function. There is no minimum period for the depreciation calculation. The Start Date of an Asset can be any day within a month, depreciation will be calculated from the specified date.

- Year

- This option is similar to the Month option described above, and everything in the description of that option applies to this one.

- Where Month and Year differ is in the calculation of the depreciation prior to the period entered in the specification window of the report or Maintenance function. For example, if you are calculating depreciation for the seventh month in the life of an Asset, the Month option will calculate prior depreciation as the sum of the depreciation amounts for each of the previous six months (month 1 depreciation + month 2 depreciation, etc). The Year option will calculate prior depreciation by multiplying monthly depreciation by the number of prior months (annual depreciation * 6 / 12). This difference may cause a divergence in the value of the Asset at the end of the calculation period (at the end of the seventh period in the example) due to rounding.

- If you have selected this option in a Straight Line Depreciation Model and have specified a number of Years instead of a Depr %, the minimum period for the depreciation calculation will be one year starting from the first day of the calendar year, and subsequent depreciation periods should be the following calendar years. In many cases this will not be practical, so it is usually recommended that you specify a Depr % not a number of Years.

- Quarter

- If you need to calculate depreciation on a quarterly basis, select this option and enter the quarterly depreciation percentage in the Depr. % field above. Do not enter the annual depreciation percentage that is required by the other Period options, and do not use the Years field.

- With a Straight Line Depreciation Model, you can use monthly periods for the depreciation calculation in reports and Maintenance functions, starting from the first day of the month (the quarterly depreciation value will be divided by three) as well as quarterly or annual periods. With a Declining Balance Depreciation Model, you must use quarterly or yearly periods (or multiples thereof) i.e. do not use monthly periods. It is recommended that you separate Assets bought in different months by Inventory Number or Department so that you can report on them separately (e.g. when the report period is April-June, it should include Assets bought in January and April but not those bought in February or March, when the report period is May-July, it should include Assets bought in February and May but not those bought in January, March or April, etc).

- The Start Date of an Asset will be treated as the first day of a month: e.g. if you enter March 15 as an Asset's Start Date, depreciation will be calculated as if the Start Date were March 1.

- Round Off

- Select one of these options to specify the rounding method to be used in depreciation calculations.

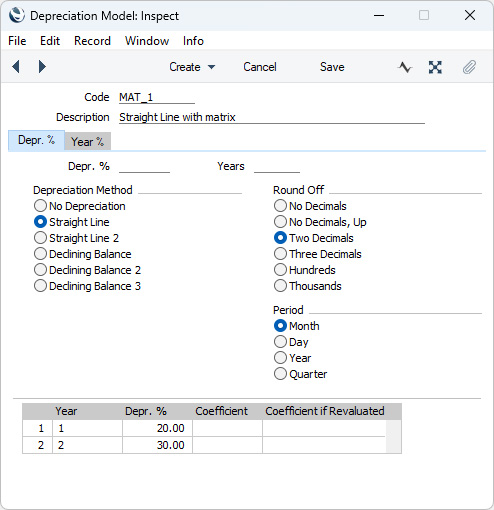

Year % Card

The 'Year %' card allows you to configure a complex depreciation structure with different percentages in each year.

Adding at least one row in the matrix on the 'Year %' card will mean that the Depr. % and Years fields on the 'Depr. %' card will be ignored. You should therefore enter a separate row in the matrix for each year in the life of an Asset. If you need the specifications in a particular row to be repeated for a second year, add the row twice. If an Asset is not fully depreciated after depreciation has been calculated using the specifications in the last row, that row will be repeated in subsequent years until the Asset is fully depreciated.

The illustration above is of a Straight Line Depreciation Model that will result in 20% depreciation in the first year, 30% depreciation in the second year and 50% depreciation in the third year. When using the Depr. % column as in this example, you should fill in the fields in the Year column.

Applied to an Asset with Purchase Value 10000 and Start Date in January, the results of this Depreciation Model are as follows:

| Calendar Year 1 | Depreciation = Purchase Value 10000 * Depr. % 20 = 2000 |

| Calendar Year 2 | Depreciation = Purchase Value 10000 * Depr. % 30 = 3000 |

| Calendar Year 3 | Depreciation = Purchase Value 10000 * Depr. % 50 = 5000 |

If the Asset were to be purchased in July, the calculation will be as follows:

| Calendar Year 1 | Depreciation = (Purchase Value 10000 * Depr. % 20) * (months in use 6 / months in year 12) = 1000 |

| Calendar Year 2 | Depreciation = ((Purchase Value 10000 * Depr. % 20) * (months in use 6 / months in year 12)) + ((Purchase Value 10000 * Depr. % 30) * (months in use 6 / months in year 12)) = 2500 |

| Calendar Year 3 | Depreciation = ((Purchase Value 10000 * Depr. % 30) * (months in use 6 / months in year 12)) + ((Purchase Value 10000 * Depr. % 50)) = 4000 |

| Calendar Year 4 | Depreciation = (Purchase Value 10000 * Depr. % 50) = 2500 |

In a Straight Line Depreciation Model you will usually need the sum of the depreciation percentages in the rows to be 100, but not in Declining Balance Depreciation Models, because the base value for the depreciation calculation will gradually be reduced.

An alternative to using the Depr.% column is to use the Coefficient column, which was designed for use in Slovakia in Declining Balance 2 Depreciation Models. Leave the Depr. % column empty if you need to use the Coefficient column, because the Depr. % if specified will be given priority. The Coefficient will be used as follows:

| First year depreciation | (Purchase Value/Coefficient) |

| Second and subsequent years | (2 * End Value from previous year)/(Coefficient - Number of Years already depreciated) |

| Final year | the remainder |

(the End Value from previous year will be calculated as though the previous year was a full year i.e. as if the Asset Start Date is in January).

For example, Coefficients are entered as follows:

Applied to an Asset with Purchase Value 10000 and Start Date in January, the results of a Declining Balance 2 calculation are as follows:

| Calendar Year 1 | Depreciation = Purchase Value 10000 / Coefficient 4 = 2500

End Value = 10000 - 2500 = 7500 |

| Calendar Year 2 | Depreciation = (2 * End Value 7500) / (Coefficient 5 - No. of Previous Years 1) = 3750

End Value = 7500 - 3750 = 3750 |

| Calendar Year 3 | Depreciation = (2 * End Value 3750) / (Coefficient 5 - No. of Previous Years 2) = 2500

End Value = 3750 - 2500 = 1250 |

| Calendar Year 4 | Depreciation = (2 * End Value 1250) / (Coefficient 5 - No. of Previous Years 3) = 1250

End Value = 1250 - 1250 = 0 |

If the Asset were to be purchased in July, the calculation will be as follows:

| Calendar Year 1 | Depreciation = (Purchase Value 10000 / Coefficient 4 = 2500) * (months in use 6 / months in year 12) = 1250

End Value = 10000 - (Purchase Value 10000 / Coefficient 4 = 2500) = 7500 (i.e. calculated as though the Asset was purchased in January) |

| Calendar Year 2 | Depreciation = (2 * End Value 7500) / (Coefficient 5 - No. of Previous Years 1) = 3750

End Value = 7500 - 3750 = 3750 |

| Calendar Year 3 | Depreciation = (2 * End Value 3750) / (Coefficient 5 - No. of Previous Years 2) = 2500

End Value = 3750 - 2500 = 1250 |

| Calendar Year 4 | Depreciation = (2 * End Value 1250) / (Coefficient 5 - No. of Previous Years 3) = 1250

End Value = 1250 - 1250 = 0 |

If there is a Revaluation, the Coefficient will be applied to the value in the Revaluation record less previous depreciation. For example if the Asset in the previous example were to be revalued to 15000 in January in Calendar Year 3, the calculation will be as follows:

| Calendar Year 1 | Depreciation = (Purchase Value 10000 / Coefficient 4 = 2500) * (months in use 6 / months in year 12) = 1250

End Value = 10000 - (Purchase Value 10000 / Coefficient 4 = 2500) = 7500 (i.e. calculated as though the Asset was purchased in January) |

| Calendar Year 2 | Depreciation = (2 * End Value 7500) / (Coefficient 5 - No. of Previous Years 1) = 3750

End Value = 7500 - 3750 = 3750 |

| Calendar Year 3 | Depreciation = (2 * Revalued Value 15000 - Year 1 Depreciation 2500 - Year 2 Depreciation 3750) / (Coefficient 5 - No. of Previous Years 2) = 5834 (the first year's depreciation is calculated as though the Asset was purchased in January)

End Value = Revalued Value 15000 - 2500 - 3750 - 5834 = 2916 |

| Calendar Year 4 | Depreciation = (2 * End Value 2916) / (Coefficient 5 - No. of Previous Years 3) = 2916

End Value = 2916 - 2916 = 0 |

If you need to use a different Coefficient after the Revaluation (i.e. in Years 3 and 4 in the example), enter that Coefficient in the Coefficient if Revaluated column and change the Depreciation Method from Declining Balance 2 to Declining Balance 3.

---

Go back to: