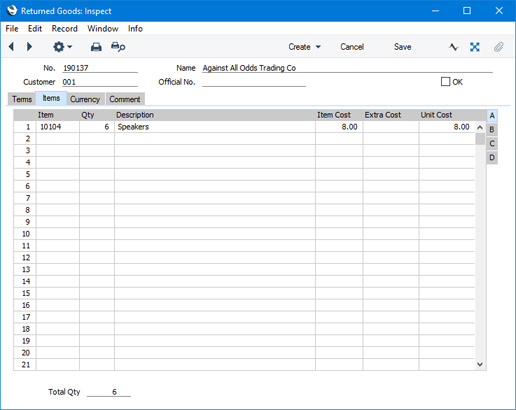

Entering a Return - Items Card

This page describes the fields on the 'Items' card in the Returned Goods record window. Please follow the links below for descriptions of the other cards:

---

Use the grid on the 'Items' card to list the Items being returned.

A new Return will contain the following Items:

- A Return created from an Order will contain every Item in the Order that has been delivered i.e. included in Deliveries connected to the Order that have been marked as OK.

- A Return created from a Delivery will contain the Items in that Delivery.

- A Return created from a Service Order will contain every Item included in Work Sheets connected to the Service Order that have been marked as OK.

- A Return created from a Work Sheet will contain the Items in that Work Sheet.

Enter the returned Quantity for each Item and remove any Items not returned by clicking on the row number to the left and pressing the Backspace key (if you are using iOS or Android, long tap on the row number on the left of the row and select 'Delete Row' from the resulting menu). If you are not using the Original Cost on Returned Goods option in the Cost Accounting setting and/or you are not using the option to insert Returned Goods at their original position in the FIFO/LIFO cost queue in the same setting, you can change the Item Cost of a Returned Item, although this is not recommended. If you have incurred any costs in receiving an Item back into stock, it is recommended that you do not change the Item Cost but instead enter an Extra Cost.

By default, you cannot enter a Quantity that is greater than the quantity delivered, and you cannot add rows to a Return. Both will be possible if you are using the Allow Returned Goods Not Linked to Orders option in the Returned Goods Settings setting. Using this option therefore means that the Quantity in a Return will not be checked against the quantity that was delivered.

If you are using the Allow Returned Goods Not Linked to Orders option, you can use Access Groups to prevent individual users from adding rows to Returns, by denying them access to the 'Add Items to Returned Goods' Action. In effect, these users will also not be able to enter Returns directly to the Returned Goods register.

Flip A - Item

- The Item Number from the Order or Delivery.

- If an Item being returned is a Structured Item, you should list its components in the Return, not the Structured Item itself. Structured Items are built the moment the Delivery is made and are not kept in stock themselves. Therefore, they should not be included on a Return. Only the components should be listed on the Return: this will ensure they are correctly received back into stock.

- Qty

- Enter the quantity returned (the default is that delivered, less any that have already been returned). You can reduce this figure, but not increase it.

- Description

- The Item Name from the Order or Delivery.

- Item Cost

- The unit Cost Price of the Item being returned, in the Currency of the Return. This figure will be updated each time you save the Return.

- In a Return created from a Delivery and if you are using the Original Cost on Returned Goods option in the Cost Accounting setting, the default will be a unit price calculated from the Row FIFO figure on flip C of the originating Delivery. If you are not using this option, the default Item Cost will be the Cost Price from the Item record.

- In a Return created from an Order, the default will be the Weighted Average or the Cost Price from the Order row, depending on the Cost Model. If the Item uses a Queued Cost Model (FIFO or LIFO), you will not be able to create the Return from the Order, because Queued values are not stored in Orders.

- In a Return created from a Project or Work Sheet and if you are using the Original Cost on Returned Goods option, the default will be a unit price calculated from the Row FIFO figure on flip D of the originating Work Sheet. If you are not using this option, the default Item Cost will be the Cost Price from the Item record.

- In a Return that you enter directly to the Returned Goods register, the default will be the Cost Price from the Item record. You can change this figure to the true unit value of the returned Item which you can find by referring to flip C of the original Invoice.

- If you are not using the Original Cost on Returned Goods option in the Cost Accounting setting and/or you are not using the option to insert Returned Goods at their original position in the FIFO/LIFO cost queue in the same setting you can change the Item Cost, although this is not recommended. Instead, if you have incurred any costs in receiving the Item back into stock, it is recommended that you enter an Extra Cost.

- If the Item is one that has its Cost Price updated on Goods Receipt using the Weighted Average option (set on the 'Costs' card of the Item record) and if you are using the Update Weighted Average from Return Goods and Credit Notes option in the Cost Accounting setting, any change in Price here will be fed back to that Cost Price automatically. The FIFO/LIFO and Weighted Average values of the Item will be adjusted accordingly.

- If you have selected the Price Incl. VAT option on the 'Terms' card, this figure should include VAT.

- Extra Cost

- Use this field to record any additional cost (per unit) incurred by your company in having the item returned. It will be shown added to the Item Cost in the Cost Price field to the right.

- You can either enter an amount (in your home Currency), or a percentage followed by the % character.

- You can only add an Extra Cost if you are not using the Original Cost on Returned Goods option in the Cost Accounting setting and/or you are not using the option to insert Returned Goods at their original position in the FIFO/LIFO cost queue in the same setting.

- In the Nominal Ledger Transaction generated from a Return, any costs in this field will be credited to the Extra Costs Account specified in the Account Usage Stock setting and included in the debit posting to the Stock Account.

- The FIFO/LIFO value of the Item will not be affected by the Extra Cost but, if you are using the Update Weighted Average from Return Goods and Credit Notes option in the Cost Accounting setting, the Extra Cost will be included in the Weighted Average calculation for the Item. The Extra Cost will therefore be fed back to the Cost Price of the Item if you are using this option and if the Item is one that has its Cost Price updated on Goods Receipt using the Weighted Average option (set on the 'Costs' card of the Item record).

- Unit Cost

- The Unit Cost of the Item in your home Currency, including any Extra Costs.

Flip B- Tags/Objects

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Default taken from Order, Delivery or Work Sheet row

- You can assign up to 20 Tags/Objects, separated by commas, to a row in a Return, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports. Usually the Tags/Objects specified here will represent the Item.

- By default, the Tags/Objects entered here will be taken from the Order, Delivery or Work Sheet row to which the Return row corresponds, but you can change them if necessary.

- In the Nominal Ledger Transaction generated from a row in a Return, the Tags/Objects specified here will be assigned to the credit posting to the Cost of Sales or Returned Goods Account. This assignment will merge these Tags/Objects with those of the parent Return (shown on the 'Terms' card). They will also be assigned to the debit posting to the Stock Account if you are using the Tag/Object for Stock Account option in the Cost Accounting setting.

- Location

- Paste Special

Locations setting, Stock module

- You can enter a separate stock Location for each row of the Return.

- If you have specified a Default Return Location in the Local Machine setting in the User Settings module, that Location will be copied both here and to the Location field on the 'Terms' card as defaults. This option is useful if you only have a single Location into which you receive Returned Items. Note that the Local Machine setting is specific to the client machine you are working on and therefore if you need to use the Default Return Location feature you should specify it in the Local Machine setting separately on each client machine. If you have not specified a Default Return Location, then the Location in the originating Order, Delivery or Work Sheet row will be copied here.

- Cost A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Cost Account specified here will be credited with the value of the Item (i.e. with the Unit Cost * Quantity) in the Nominal Ledger Transaction that will result from the Returned Goods record.

- If you have not specified a Default Return Location in the Local Machine setting, the Cost Account in a Returned Goods record that you create from a Delivery or a Work Sheet will be copied from the corresponding Delivery or Work Sheet row.

- If you have specified a Default Return Location and in a Returned Goods record that you enter directly to the Returned Goods register, the default Cost Account in each row will be chosen as follows:

- If you have specified a Cost Account for the Location in the Location Accounts setting in the Stock module, that Cost Account will be used. The Location is the one specified on flip B or, if blank, on the 'Terms' card.

- If you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Cost Account for the Item Group to which the Item belongs will be used. If that is blank or the Item does not belong to an Item Group, the Cost Account for the Item will be used.

However, if you are not using the Use Item Groups for Cost Accounts option, the Cost Account for the Item will be used. If that is blank, the Cost Account for the Item Group to which the Item belongs will be used.

- In all other cases, the Cost Account specified in the Account Usage Stock setting will be used.

You can only enter records directly to the Returned Goods register if you are using the Allow Returned Goods Not Linked to Orders option in the Returned Goods Settings setting.

- If the Cost Account field in any row is empty (i.e. if you remove the Account that is offered), the Returned Goods Account specified in the Account Usage Stock setting will be credited in the Nominal Ledger Transaction generated from the Returned Goods record.

- Serial No.

- Paste Special

Serial Numbers of Items in stock

- If the Item uses Serial Numbers at the unit or batch level, you must enter a valid Serial Number here.

- In a Return that you create from a Delivery or Work Sheet, this field will contain a default, taken from the Items that have already been delivered. In a Return that you create from an Order, there will be no default, because the Serial Numbers of delivered Items are not all stored in Orders if the Order Quantity is greater than one.

- If you are using the No Serial No. on Goods Receipts option in the Stock Settings setting, it will not be compulsory to enter Serial Numbers, and a Quantity greater than 1 will be allowed.

- If you are using the Generate Bulk Serial Numbers automatically option in the Serial Number Tracking setting, you will be able to enter a range of Serial Numbers in this field for Serial Numbered Items in a Return that you enter directly to the Returned Goods register. If you have already entered a Qty and then enter the first Serial Number in this field, it will be overwritten by a range of Serial Numbers, separated by a colon (:).

- Best Before

- In the case of perishable goods, enter a Best Before date here. The default will be taken from the Items that have already been delivered from the Order.

Flip C- BuyBack Cost

- In a Return that you create from a Delivery, the BuyBack Cost from the Delivery row will be copied here. Otherwise this field will remain empty. Please refer here for details about the BuyBack feature

- Position

- Paste Special

Position register, Warehouse Management module

- If the Location specified in the header is a large one that has been sub-divided into Positions, enter here the Position where the Item is to be stored. You must specify a Position if you have selected the Demand Position option in the Location in question. The Position must be in the correct Location. The 'Paste Special' list only lists Free Positions (Positions that are empty). When you mark the Return as OK and save, the Status of the Position specified here will be changed to "Used" automatically. If you created the Returned Goods record from a Delivery, Service Order or Work Sheet, a default Position will be taken from the relevant Delivery or Work Sheet row.

- Recipe

- The Recipe for Structured Items will be entered here. This field cannot be changed.

- Width, Height, Depth

- Default taken from

Item

- These fields contain the dimensions of the Item.

- If the Item is one that is sold by area or volume, you can have the Quantity calculated by multiplying the dimensions together. Follow these steps if you would like to use this feature:

- Select the Enable Quantity Calculation option in the Item Settings setting in the Sales Ledger.

- Select the Calculate Quantity option for the Unit that has been assigned to the Item. If the Item is sold by area, choose the Two Dimensions option in the Unit record. If the Item is sold by volume, choose the Three Dimensions option.

- In the Return, enter the Width and Height (if the Item is sold by area) or the Width, Height and Depth (if the Item is sold by volume). The Quantity will be calculated automatically.

Please refer to the page describing the Units setting for details and an example.

Footer- Total Qty

- This field shows the total number of Items returned. Whenever you add or change a row in the Return, this figure will be updated automatically.

---

The Returned Goods register in Standard ERP:

Go back to:

|