Returned Goods to Supplier Variance

When you return an Item to a Supplier, the calculation of the cost value of that Item should ideally satisfy two requirements:

- The cost should be the same as the original purchase cost. This will be the value of any Credit Note that the Supplier sends you, and is the value that will allow the Purchase Accruals Account to balance,

- Returning an Item to its Supplier is one way of removing that Item from stock. The value of all removals from stock should be calculated using the usual Cost Model.

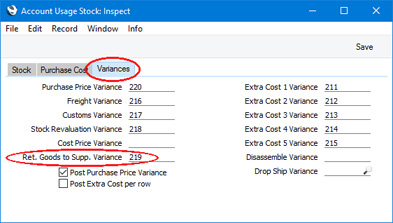

These two requirements can result in two different valuations for the Item being returned. The difference between the two valuations is a variance. That variance will be posted to the Returned Goods to Supplier Variance Account specified on the

'Variances' card in the Account Usage Stock setting:

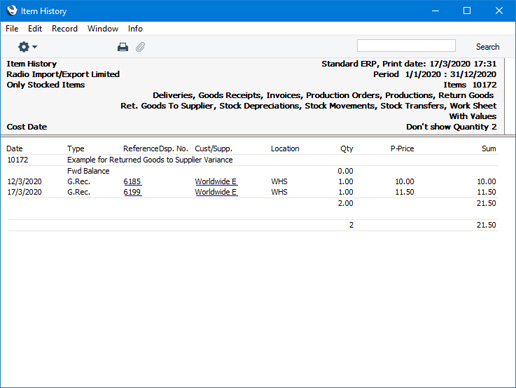

In this example, we have purchased an Item on two different occasions at two different prices, 10.00 and 11.50:

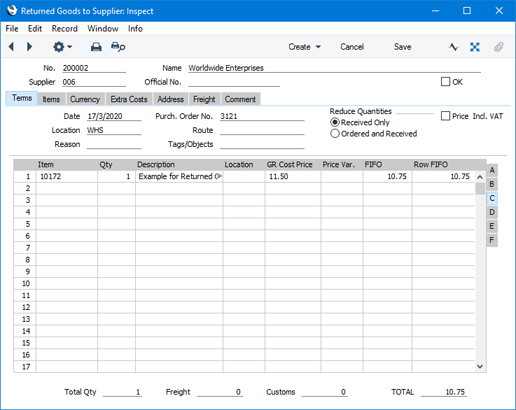

If we need to return the second one, we will create a Returned Goods to Supplier record from the second Goods Receipt. The original purchase cost of that unit will be 11.50 (shown in the GR Cost Price field on flip C) but using the Weighted Average Cost Model the stock value will be 10.75 (shown in the FIFO field, after saving). (If we were using the FIFO Cost Model the value to be removed from stock would be 11.50):

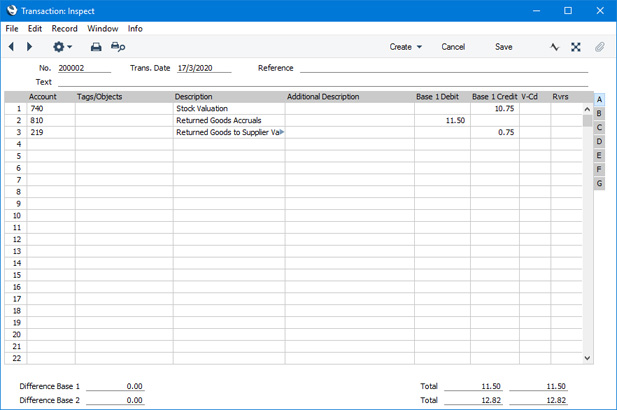

In the resulting Nominal Ledger Transaction, the original purchase cost will be debited to the Returned Goods to Supplier (in this case) or Purchase Accruals Account, and the value to be removed from stock will be credited to the Stock Account. The difference will be posted to the Returned Goods to Supplier Variance Account:

The value removed from stock and credited to the Stock Account is the Weighted Average value, 10.75, leaving 10.75 as the value on the Stock Account. If the value removed from stock was the actual value of the unit, 11.50, that would leave 10.00 as the value on the Stock Account. There would then be an imbalance when the other unit is removed from stock at its Weighted Average value of 10.75.

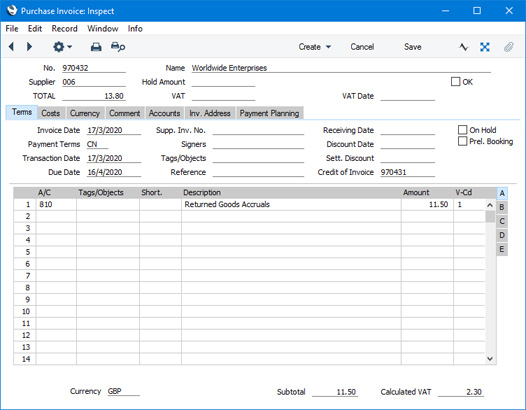

In a Credit Note created from the Returned Goods to Supplier record, the value will be the original purchase cost:

---

The Returned Goods to Supplier register in Standard ERP:

Go back to: