Profit & Loss - Printing

This page describes printing the Profit & Loss report.

---

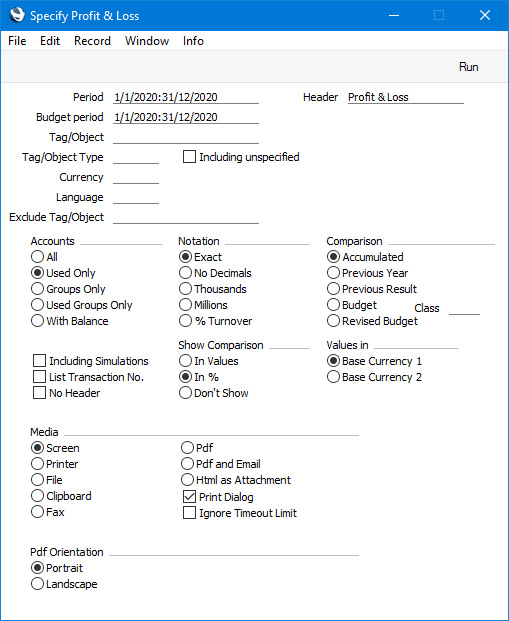

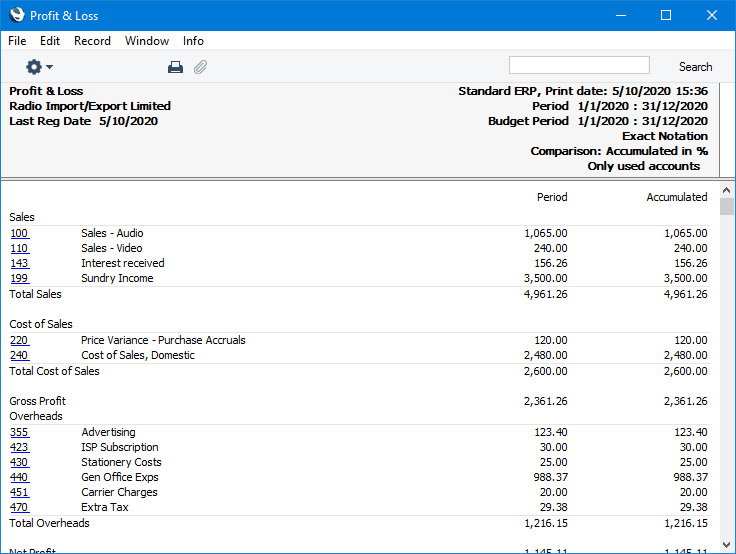

Having entered a definition for the Profit & Loss as described here, you will be ready to print the report. After ensuring you are in the Nominal Ledger, click (Windows/macOS) or tap (iOS/Android) the [Reports] button in the Navigation Centre and then double-click or tap 'Profit & Loss' in the 'Reports' list. The 'Specify Profit & Loss Report' window will be opened.

- Period

- Paste Special

Reporting Periods setting, System module

- The report period. Enter the start and end dates separated by a colon (:). The Account balances in the report will be calculated from postings (i.e. from Transaction rows) recorded during the period specified here. The first period in the Reporting Periods setting will be offered as the default.

- Budget period

- Paste Special

Reporting Periods setting, System module

- If you are using the "Budget" or "Revised Budget" Comparison options (below), specify the Budget period here. The first period in the Reporting Periods setting will be offered as the default. If you leave this field blank, the report period above will be used.

- Header

- Enter your own title for the report. This title will be printed in the report header, and will also appear in the title bar of the report window if you print the report to screen.

- Tag/Object

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Enter a Tag/Object Code here if you need the Account balances in the report to be calculated from postings with a particular Tag/Object. You can also enter a number of Tags/Objects separated by commas, in which case Account balances will be calculated from postings with all the Tags/Objects listed. If you leave this field empty, Account balances will be calculated from all postings, with and without Tags/Objects.

- Tag/Object Type

- Paste Special

Tag/Object Types setting, Nominal Ledger

- Enter a Tag/Object Type Code in this field if you want the report to show Account balances calculated from postings with Tags/Objects belonging to a particular Tag/Object Type.

- Including Unspecified

- Select this option if, for each Account, you want to show a balance figure calculated from postings (i.e. Transaction rows) with Tags/Objects belonging to the Tag/Object Type specified above and a second balance calculated from all other Transaction rows.

- Currency

- Paste Special

Currency register, System module

- If you specify a Currency here, the Account balances in the report will be calculated only from those Transaction rows with the specified Currency shown on flip C. The balances will be calculated using the figures on flip C of those Transaction rows (i.e. they will be in the chosen Currency). If you leave this field blank, all Transaction rows will be included in the calculations. In this case the calculation will use the figures in the Base 1 or Base 2 Debit or Credit fields on flip A (choose which Base Currency is to be used using the Values in options described below).

- Language

- Paste Special

Languages setting, System module

- You can produce the Profit & Loss report in different Languages: enter the required Language Code here. The appropriate translations of the Account Names will be taken from the 'Texts' card of each Account record, while the translations for each report heading or sub-heading will be taken from the report definition (please refer to the Balance Sheet Definition page for full details).

- If you do not enter a Language here, but you have entered a Language in the Company Info setting in the System module, the report will be produced in that Language if you are using the Account Description in Company Language option in the Transaction Settings setting in the Nominal Ledger.

- Exclude Tag/Object

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Enter a Tag/Object Code here if you need postings with a particular Tag/Object to be excluded from the balance calculations.

- Accounts

- Use these options to specify which Accounts are to be printed in the report and how their balances will be displayed.

- All

- This option will list all the Accounts that have been included in the Profit & Loss report definition.

- Used Only

- When you use this option together with the "Accumulated" Comparison option, the report will only list Accounts that have been used. This option is similar to With Balance below, with the exception that it also includes Accounts that have been used in the period in such a way that they have no closing balances.

- When you use this option together with the "Previous Year" or "Previous Result" Comparison options, the report will list Accounts that have a closing balance either in the report period or in the same period last year.

- When you use this option together with the "Budget" or "Revised Budget" Comparison options, the report will list Accounts that either have a Budget or Revised Budget for the report period or have been used during the report period.

- Groups Only

- This option does not print balances for individual Accounts. Instead, it simply prints an overall balance for each line in the Profit & Loss report definition.

- Used Groups Only

- This option only prints balances for lines in the Profit & Loss report definition that have been used.

- With Balance

- When you use this option together with the "Accumulated" Comparison option, the report will only show Accounts that have a balance for the report period. An Account that has been used in the period in such a way that it also has no closing balance will not be shown in the report. If you want such an Account to be included in the report, use the Used Only option above.

- When you use this option together with the "Previous Year" or "Previous Result" Comparison options, the report will only show Accounts that have a closing balance in both the report period and in the same period last year.

- When you use this option together with the "Budget" or "Revised Budget" Comparison options, the report will only show Accounts that have a Budget or Revised Budget for the report period. Providing this criterion is met, the Account does not need to have a closing balance to be shown in the report.

- Notation

- Use these options to control the presentation of amounts in the report.

- Exact

- Shows the balances as stored in the Transactions.

- No Decimals

- Rounds the balances up or down to the nearest whole number.

- Thousands, Millions

- Divide the balances by 1,000 or 1,000,000.

- % Turnover

- Shows each account balance as a percentage of overall turnover. This option requires you to have defined "turnover" in a Key Ratio that has the Code "TURNO". Please refer to the page describing the definition of the Key Financial Ratios report for an illustration.

- Comparison

- Select one option for the comparison column in the report.

- Accumulated

- This option compares the report period with the Year To Date.

- Previous Year

- This compares the report period with the same period last year.

- Previous Result

- This compares the report period with the previous period. For example, if the report period is a calendar month, the compared period will be the previous month.

- Budget, Revised Budget

- These options compare the report period with the Budget or Revised Budget figures for the Budget period. The Budget or Revised Budget figures will be calculated from the Budget or Revised Budget matrix rows with dates that fall within the report period. If the matrix in a Budget or Revised Budget record is empty or only contains rows whose dates are outside the report period, figures from that record will not be included in the report. You do not need to mark a Budget or Revised Budget record as OK for its figures to appear in the report.

- If you use Tags/Objects, you should create Budget (and, if you are using them, Revised Budget) records for each Tag/Object - Account combination and overall Budgets/Revised Budgets for each Account without Tags/Objects. This will allow you to use the Budget or Revised Budget options with a particular Tag/Object, and with no Tag/Object.

- If you select either of these options, you can also choose a Budget Class using 'Paste Special' from the Class field. The Budget or Revised Budget figures will then be taken from the Budget or Revised Budget records with the specified Class. If you do not specify a Class, figures will be taken from the Budget or Revised Budget records in which the Class is blank.

If you choose any option except "Accumulated", use the Show Comparison options below to choose whether the differences between the actual figures and the compared figures are to be shown as values or percentages.

- Including Simulations

- Select this option to you need simulated transactions from the Simulation register to be included in the report. Simulation rows in which the Status is "Invalid" and "Transferred" will not be included.

- List Transaction No.

- If you select this option, the Transaction Numbers of all Transactions that fall within the reporting period, together with debit and credit totals, will be listed at the end of the report.

- No Header

- Check this box if you want the report to be printed without a header.

- Show Comparison

- If you choose any of the Comparison options except "Accumulated", an extra column will be added to the report showing the differences between the actual figures for the period with the compared figures. Use these options to specify whether this added difference column should contain values or percentage. You can also choose not to have the difference column added to the report.

- Values in

- If you are using the Dual-Base system, use these options to specify whether the values in the report are to be shown in Base Currency 1 or 2.

- If you are not using the Dual-Base system, use the Base Currency 1 option to produce a report in your home Currency.

- If you have entered a Currency in the Currency field above, the figures in the report will be in that Currency.

---

Please follow the links below for more details about the Profit & Loss report:

- The Definition of the Profit & Loss report

- Printing the Profit & Loss report

---

Reports in the Nominal Ledger:

---

Go back to:

|