Transaction Journal

This page describes the Transaction Journal report in the Nominal Ledger.

---

The Transaction Journal report can be treated as a daily transaction ledger as it is a summary of the entries made in the Transaction Journal. You cannot change the definition of this report.

When printed to screen, the Transaction Journal has the Standard ERP Drill-down feature. Click (Windows/macOS) or tap (iOS/Android) on any Transaction Number in the report to open an individual Transaction record.

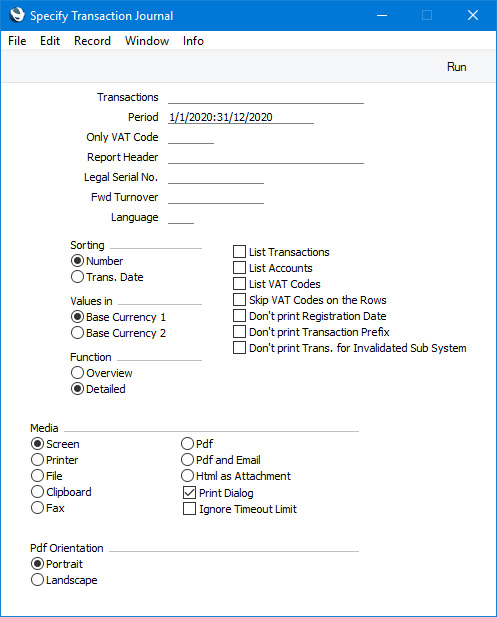

To produce this report, ensure you are in the Nominal Ledger and click or tap the [Reports] button in the Navigation Centre. Then double-click or tap 'Transaction Journal' in the 'Reports' list. The 'Specify Transaction Journal' window will be opened.

- Transactions

- Range Reporting

Numeric

- If you need the report to list the Transactions in a particular range, enter the first and the last Transaction Numbers in the range, separated by a colon (:). If you leave the field blank, every Transaction from the selected period will be included in the report.

- When entering a Transaction Number here, you must include the Fiscal Year or Sub System prefix (as shown in the 'Transactions: Browse' window). To include a Transaction that you entered directly to the Transaction register in the report, enter, for example, "2020.3" or, for a range, "2020.3:2020.10". To include a Transaction that was created from a Sub System in the report, enter, for example, "S/INV.200003" or "S/INV.200003:S/INV.200010" for a range.

- Period

- Paste Special

Reporting Periods setting, System module

- Enter the period to be covered by the report. The report will list Transactions with Transaction Dates that fall within the period specified here.

- Only VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- Use this field to limit the report to Transactions in which there is at least one row with a particular VAT Code.

- Report Header

- Specify the report title here. If you do not specify a title, "Transaction Journal" will be used. This title will be printed in the report header, and will also appear in the title bar of the report window if you print the report to screen.

- Legal Ser No.

- In some countries it is mandatory for all Transactions to follow a single number series, irrespective of their nature. Enter the first number in the series here and select the Don't Print Transaction Prefix option below. Each Transaction will be given a number in the specified series, in place of the usual Transaction Number.

- Fwd Turnover

- If you enter an amount in this field, this amount will be added to the total turnover at the bottom of the report.

- Language

- Paste Special

Languages setting, System module

- You can produce the Transaction Journal in different Languages: enter the required Language Code here. The appropriate translations of the Account Names will be taken from the 'Texts' card of each Account record.

- Sorting

- The Transactions listed in the report can be sorted by Transaction Number or Transaction Date.

- If you sort by Transaction Number, all Transactions of a similar type will be grouped together. For example, Transactions resulting from Sales Invoices will be grouped together, Transactions resulting from Purchase Invoices will be grouped together, and so on. This allows the report to provide debit and credit turnover figures for each type. If you have used different Number Series, then debit and credit turnover figures will be provided for each Number Series, identified by the Comment from the Number Series. For example, if you have created Invoices using three Number Series, the resulting Transactions in this report will be divided into three sections, with debit and credit turnover figures provided for each one.

- If you sort by Transaction Date, all Transactions of a similar type from a particular month will be grouped together. For example, Transactions resulting from Sales Invoices in January will be grouped together, Transactions resulting from Purchase Invoices from January will then be grouped together, to be followed by other Transactions from January, then the pattern will be repeated for February, and so on. This allows the report to provide monthly debit and credit turnover figures for each type. If you have used different Number Series, then monthly debit and credit turnover figures will be provided for each Number Series, identified by the Comment from the Number Series.

- Values in

- If you are using the Dual-Base system, use these options to specify whether the values in the report are to be shown in Base Currency 1 or 2.

- If you are not using the Dual-Base system, use the Base Currency 1 option to produce a report in your home Currency.

- Function

- Use these options to specify the level of detail required in the report.

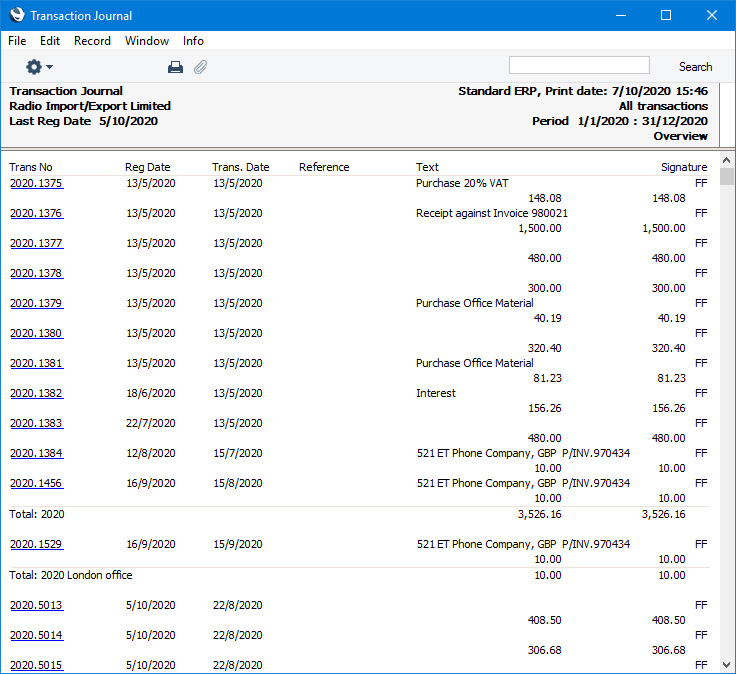

- Overview

- This choice produces a report with a single line for each Transaction, showing the Transaction Number, Registration and Transaction Dates, Reference, Text, Signature of the user who created the Transaction and debit and credit totals.

- The Registration Date will not be included if you select the Don't print Registration Date option below. The Signatures of the users who created each Transaction will not be included in Finland (i.e. when the VAT Law in the Company Info setting is "Finnish").

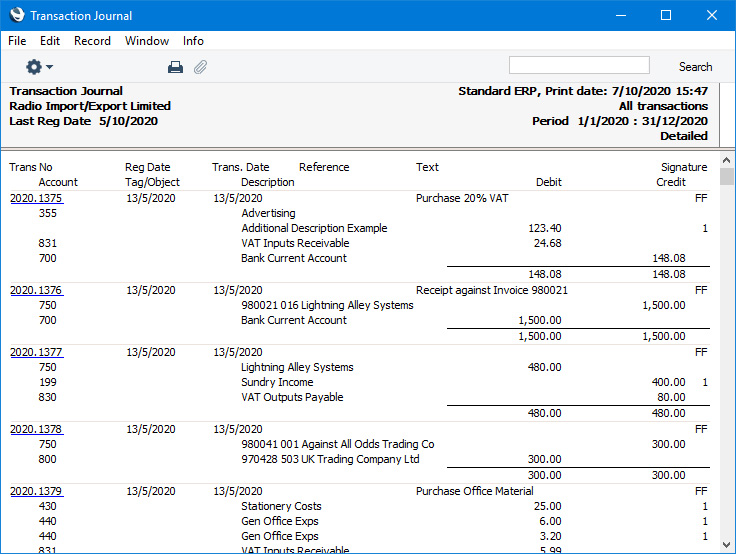

- Detailed

- In addition to the information shown in the Overview, this option lists the Transaction rows individually, showing the Account, Tags/Objects, Description, Additional Description, Debit or Credit Value and VAT Code.

- The VAT Code will not be included if you select the Skip VAT Codes on the Rows option below.

- List Transactions

- If you select this option, each Transaction used by the report, together with debit and credit totals, will be listed at the end of the report. If you have restricted the scope of the report using any of the fields above, only those Transactions included in the report will be listed.

- List Accounts

- If you select this option, each Account used by the Transactions in the report, together with debit and credit totals, will be listed at the end of the report. If you have restricted the scope of the report using any of the fields above, only those Accounts affected by the Transactions shown will be listed.

- List VAT Codes

- With this option selected, each VAT Code used by the Transactions in the report, together with debit and credit totals, will be listed at the bottom of the report. If you have restricted the scope of the report using any of the fields above, only those VAT Codes used in the Transactions in the report will be listed.

- Skip VAT Codes on the Rows

- If a Transaction row has a VAT Code, this will usually be shown in the report. Select this option if you do not need VAT Codes to be shown in the report.

- Don't print Registration Date

- The report usually shows both the Transaction Date (as shown in the Transaction header) and the Registration Date (the date when the Transaction record was created). Select this option if you do not need Registration Dates to be included in the report.

- Don't print Transaction Prefix

- Transaction Numbers will usually be printed in the report together with their fiscal year or Sub System prefixes (as shown in the 'Transactions: Browse' window). The Number of a Transaction that you entered directly to the Transaction register, for example, will be printed as "2020.3" while the Number of a Transaction created from a Sub System will be printed as, for example, "S/INV.200003". Select this option if you do not want these prefixes to be printed in the report (i.e. in the examples, to omit "2020." and "S/INV.").

- If you use the 'Lock N/L' Maintenance function to close an accounting period, a Document Number (also known as a Sequence Number) will be assigned permanently to every Transaction in the newly closed period. If you print the report using this option, these Document Numbers will be printed in place of the usual Transaction Numbers. The usual Transaction Number (without prefix) will be printed if there is no Document Number (i.e. when a Transaction belongs to a period that you have not yet closed).

- If you select this option and enter a Legal Ser. No. above, each Transaction will be printed with a number in the sequence beginning with the Legal Ser. No. in place of the usual Transaction Number or Document Number.

- Don't print Trans. for Invalidated Sub System

- By default, a Transaction created from a Sub System record (e.g. from an Invoice) that you then invalidate will be included in the report. Every piece of information will be printed drawn through with a red line, and the total value of the Transaction will be zero. Select this option if you want the Transaction to be excluded from the report altogether.

---

Reports in the Nominal Ledger:

---

Go back to:

|