VAT Listing

This page describes the VAT Listing report in the Nominal Ledger.

---

The VAT Listing report lists the transactions that will be used to calculate the figures shown in the VAT Report. For each transaction, the total including and excluding VAT, the VAT total, the overall VAT percentage and the Currency will be shown.

This report is compiled from the Sub System records (e.g. Invoices, Purchase Invoices) that are liable for VAT. The VAT Report is compiled from the Nominal Ledger postings to the VAT Accounts. If there is a difference between the two reports, one possible reason is that the connection between a Sub System record and its related Nominal Ledger Transaction is not correct. Perhaps the Nominal Ledger Transaction does not exist at all, or perhaps the VAT Code in a Transaction row posting to a Sales or Purchase/Cost Account is incorrect or missing, in which case that row will not be included in the figure calculated by the VATRESULT or VATBALANCE commands in the VAT Report.

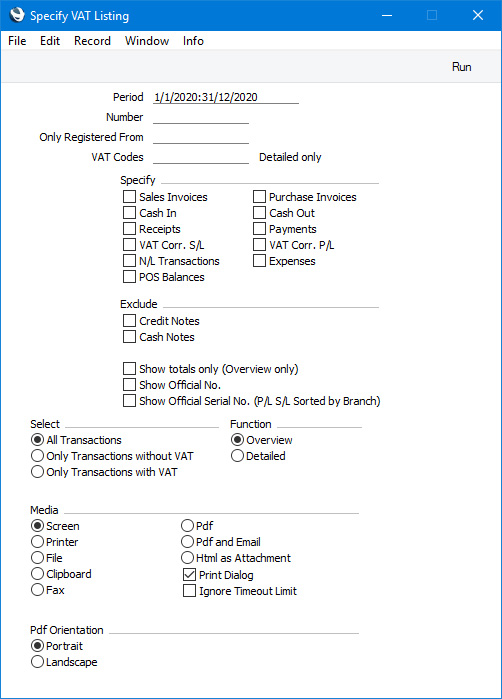

- Period

- Paste Special

Reporting Periods setting, System module

- Enter the period to be covered in the report. The report will list records in the register(s) specified below with Transaction Dates that fall within this period. The first period in the Reporting Periods setting will be offered as the default value.

- Number

- Range Reporting

Numeric

- If you want the report to list records in the register(s) specified below whose serial numbers fall within a particular range, enter that range here.

- Only Registered From

- If you want to list records that you entered on or after a particular date, enter that date here. In the case of a Sub System record, this refers to the date when the resulting Nominal Ledger Transaction was created (i.e. the date when you marked the Sub System record as OK).

- VAT Codes (Detailed only)

- Paste Special

VAT Codes setting, Nominal Ledger

- The Detailed version of the report will list the rows in each Transaction and Sub System record individually. If you only need to list the rows with a particular VAT Code, specify that VAT Code here. You can also enter more than one VAT Code, separated by commas.

- Specify

- You can choose to have Sales Invoices, Purchase Invoices, Expenses, Receipts, Payments, inward and outgoing cash transactions, POS Balances and/or Nominal Ledger Transactions listed in separate sections in the report. You must choose at least one option otherwise the report will be blank.

- The Invoices option depends on whether you are using the Post Receipt VAT option in the Account Usage S/L setting in the Sales Ledger. If you are not using this option, the report will list the Invoices issued during the report period, together with Invoice Dates. If you are using this option (i.e. your VAT calculation is based on Receipts rather than Invoices), the report will list the Invoices paid during the report period, together with the dates they were paid. The Purchase Invoices option will similarly depend on the Post Payment VAT option in the Account Usage P/L setting in the Purchase Ledger.

- The Receipts option will only list Prepayments and On Account Receipts (i.e. Receipts that do not have Invoice Numbers). Similarly, the Payments option will only list Prepayments and On Account Payments.

- Exclude

- If you have specified that the report will list Sales Invoices and/or Purchase Invoices, use these options if you need to exclude Credit Notes and/or Cash Notes from the report.

- Show totals only (Overview only)

- The Overview version of the report will list each Transaction and Sub System record individually, in separate sections for each register. If you don't need to see each record listed and instead only need totals for each register, select this option.

- Show Official Serial No. (P/L S/L Sorted by Branch)

- If you choose to have Sales Invoices listed in the report, select this option if you need the Official Serial Number of each Invoice to be included in the report (in addition to the Invoice Number).

- Select

- The report can show all Transactions and Sub System records or just those with or without VAT.

- Function

- Use these options to determine the level of detail to be included in the report.

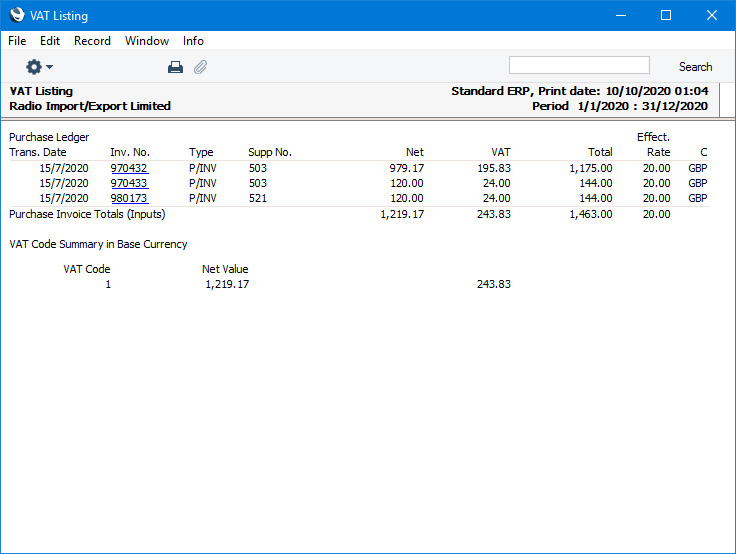

- Overview

- This option lists each transaction, showing for each one the date, number, amount excluding VAT, VAT amount, total amount, effective VAT rate and Currency. This is followed by summary totals for each VAT Code.

- If you don't need the transactions to be listed and just want a single line summary of each section, use the Show Totals Only option.

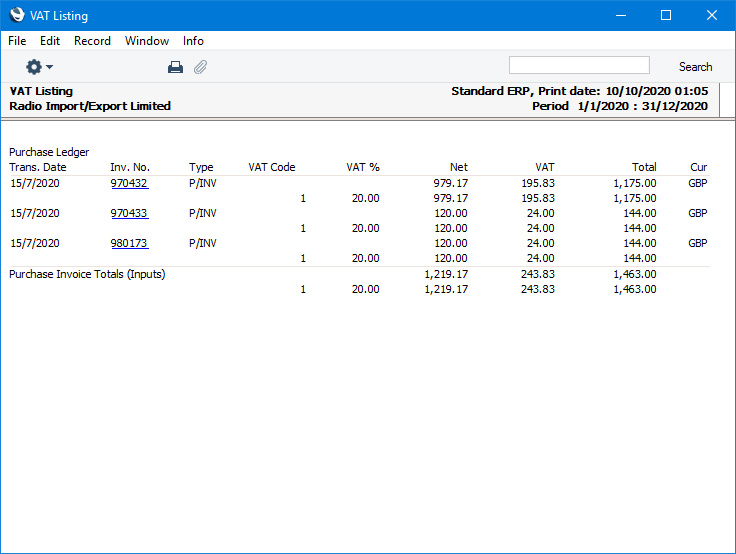

- Detailed

- This is similar to the Overview, with the addition of VAT Code analysis for each transaction.

---

Reports in the Nominal Ledger:

---

Go back to: