VAT Report - Example VAT Report Definitions - Standard VAT

This page describes an example VAT Report definition that is suitable for use in the UK. Please refer to the following pages for more details about the VAT Report in Standard ERP:

---

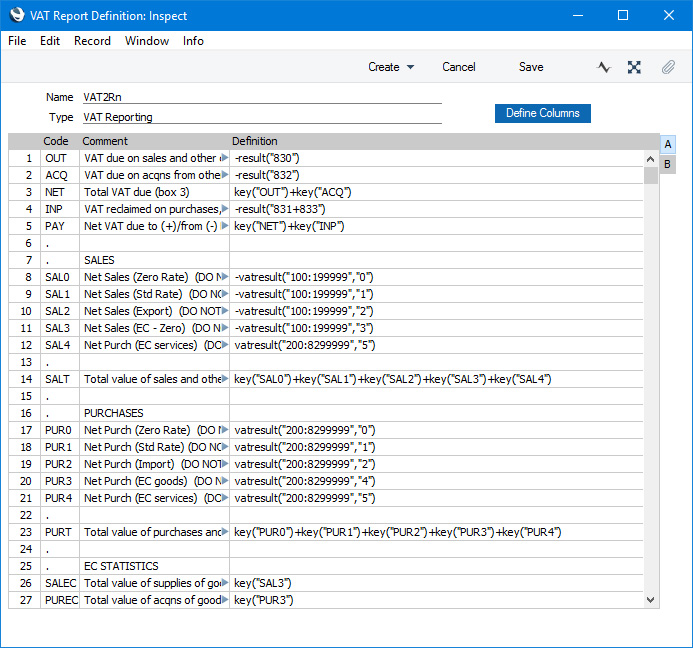

A VAT Report definition suitable for use in the UK is illustrated below:

In essence, we are using the RESULT command to calculate the VAT to be paid or reclaimed and the VATRESULT command to calculate turnover figures. The RESULT command will print the net change in a specified Account over the report period i.e. the net amount posted to the Account. The VATRESULT command will print the net amount posted with a specified VAT Code to the Account.

In more detail the calculations in this report definition are as follows:

| Row 1 OUT | -RESULT("830") | 830 is the Output VAT Account, so this row prints the total output VAT on domestic sales made during the report period. Sales figures are stored as negative figures in Standard ERP, so the negative sign will convert them to positive. This figure should be placed in Box 1 on the UK VAT Return. If you have more than one Output VAT Account, you can include them all in the formula (e.g. -RESULT("830+8300")), or you can print the net change in each Account on separate lines and then add them together using the KEY command. |

| | |

| Row 2 ACQ | -RESULT("832") | 832 is the Account for output VAT on EU acquisitions of goods, so this row will print the VAT due on acquisitions of goods from other EU member states. This figure should be placed in Box 2 on the UK VAT Return. Please refer to the Reverse Charge VAT example towards the end of this page for more details about EU acquisitions. |

| | |

| Row 3 NET | KEY("OUT")+KEY("ACQ") | Prints the total Output VAT due, calculated by adding the previous two figures together. This figure should be placed in Box 3 on the UK VAT Return. |

| | |

| Row 4 INP | -RESULT("831+833") | 831 is the Input VAT Account and 833 is the Account for input VAT on EU acquisitions of goods. This row will therefore print the VAT reclaimable on purchases and other inputs (including acquisitions from the EU). The result will be printed as a negative figure. This figure should be placed in Box 4 on the UK VAT Return. |

| | |

| Row 5 PAY | KEY("NET")+KEY("INP") | Prints the net VAT to be paid or reclaimed, calculated by adding the figure in row 3 to the (negative) figure in row 4. A positive figure indicates that you are liable for VAT, a negative one signifies that you are owed money by the VAT authority. This figure should be placed in Box 5 on the UK VAT Return. |

| | |

| Rows 8-12 SAL0-SAL4 | -VATRESULT("100:1999999","0") -VATRESULT("100:1999999","1") -VATRESULT("100:1999999","2") -VATRESULT("100:1999999","3") -VATRESULT("200:8299999","5") | Accounts 100:199 are the Sales Accounts. These rows print the total values of sales made with each VAT Code. If you sell non-digital services to customers in the EU who are not registered for VAT, you will need to charge VAT at the relevant domestic rate for the type of Item. Place these Customers in the Inside EU (Post VAT) Zone and use the standard VAT Code. This will ensure these sales will be included in the Box 1 figure (row 1) and in the relevant sales turnover figure here. Row 12 will print the value of purchases of services from Suppliers in the Inside EU Zone. This will ensure this figure is included in Box 6 (row 14 below). |

| | |

| Row 14 SALT | KEY("SAL0") + KEY("SAL1") + KEY("SAL2") + KEY("SAL3") + KEY("SAL4") | Prints the sum of rows 8-12 i.e. the total value of sales and all other outputs excluding VAT. This figure should be placed in Box 6 on the UK VAT Return. |

| | |

| Rows 17-21 PUR0-PUR4 | -VATRESULT("200:8299999","0") -VATRESULT("200:8299999","1") -VATRESULT("200:8299999","2") -VATRESULT("200:8299999","4") -VATRESULT("200:8299999","5") | Accounts 200:829 all represent items that can be purchased by the business. These rows print the total values of purchases made with each VAT Code. The range does not include the VAT Accounts (830:835). If you are using the Add VAT Code to VAT A/C rows option in the Transaction Settings setting, the appropriate VAT Code will be copied to the V-Cd field in each Transaction row posting to a VAT Account, as well as to the V-Cd field in the rows posting to a Sales or Cost Account. If the range included the VAT Accounts, the resulting figures would include VAT when they should exclude it. |

| | |

| Row 23 PURT | KEY("PUR0") + KEY("PUR1") + KEY("PUR2") + KEY("PUR3") + KEY("PUR4") | Prints the sum of rows 17-21 i.e. the total value of purchases and all other inputs excluding VAT. This figure should be placed in Box 7 on the UK VAT Return. |

| | |

| Row 26 SALEC | KEY("SAL3") | Prints the total value of sales made with VAT Code 3 i.e. the total value of sales to other EU member states. This assumes that sales made to other EU member states will always carry VAT Code 3, and that VAT Code 3 is not used for any other sales. This figure should be placed in Box 8 on the UK VAT Return. (Box 8 should not include sales of services, so a different VAT Code would need to be used for such sales.) |

| | |

| Row 27 PUREC | KEY("PUR3") | Prints the total value of purchases made with VAT Code 4 i.e. the total value of purchases of goods from other EU member states. This assumes that purchases of goods made from other EU member states will always carry VAT Code 4, and that VAT Code 4 is not used for any other purchases. This figure should be placed in Box 9 on the UK VAT Return. (Box 9 should not include purchases of services. In the example, VAT Code 5 would be used for such purchases.) |

As previously mentioned, the VAT Report definition illustrated and described above uses the

Chart of Accounts and

VAT Codes that are supplied with Standard ERP. You will need to amend the VAT Report definition (or start one from scratch) if you have modified the standard Chart of Accounts and/or VAT Codes, or created your own. For example, in the sample Chart of Accounts, the Output VAT Account is 830 and the standard VAT Code is 1. If your Output VAT Account is not 830 (e.g. it is 83010), you must replace every instance of "830" in the report definition with "83010". If your standard VAT Code is not 1 (e.g. it is S), you must replace every instance of "1" in the report definition with "S". It may be for example that you use different VAT Codes for sales and purchases.

Please follow the links below for more details about the VAT Report:

---

Reports in the Nominal Ledger:

---

Go back to: