Create Depreciation Simulations

This page describes the 'Create Depreciation Simulations' Maintenance function in the Assets module.

---

The 'Create Depreciation Simulations' function in the Asset module will create a record in the Simulation register in the Nominal Ledger representing the depreciation of the selected Assets over the selected period. Using these Simulations, you can test different outcomes on the Balance Sheet and the Profit & Loss report before you confirm the depreciation of each Asset for the month or year.

Once you have checked and finalised a Simulation created by this function, you can create a Transaction from it by highlighting the Simulation in the 'Simulations: Browse' window and then selecting 'N/L Transactions' from the Create menu (Windows/macOS) or + menu (iOS/Android). This Transaction will ensure the depreciation is correctly recorded in the Nominal Ledger.

The value of the depreciation of an Asset will be calculated using one of the two Depreciation Models specified on the 'Models' card of the Asset record and, depending on which Model you use, the Purchase Value on the 'Purchase' card or the Purchase Value 2 on the 'Models' card. As an option you can use an Asset's Fiscal Value instead of its Purchase Value. The Initial Depreciation, if any, will be included in the calculation, as will the Residual Value, if any and if the previous depreciation of the Asset is such that the Residual Value has been reached. Full details of this process, together with an example, can be found on the page describing the 'Models' card of the Asset record.

Note that, because the function creates records in the Simulation register, not in the Transaction register, there is no control to prevent you running it repeatedly for the same Asset for the same period. You can easily delete superfluous records from the Simulation register. However, if you have created more than one Simulation, take care to ensure that you only create a Transaction from one of them.

You can produce a Simulation Preview - Depreciations report before using this function to preview the Simulation that will be created.

If the function does not calculate depreciation for an Asset, the probable causes are:

- In the Asset record, the Purchase Value or Fiscal Value (as appropriate), Asset Category, Depreciation Model and/or Start Date are blank, or the Quantity is zero.

- The Asset and the Asset Category to which it belongs both do not have an Asset Class, or the Asset Class does not have a Depreciation or a Cost Account.

- The Asset belongs to an Asset Category in which you have selected the Exclude from Reports option.

- The Asset has already been fully depreciated.

- There is no valid record in the Number Series - Simulations setting (in the Nominal Ledger). This problem will usually occur at the beginning of a new year.

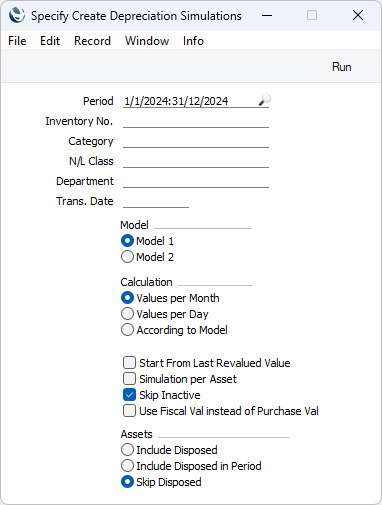

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the time period for which depreciation is to be calculated. Usually the period should consist of a selected number of whole months or years: it will be rounded up if this is not the case. However, if you are using a Straight Line Depreciation Model in which you have selected Day as the Period, you can specify a daily or other period here, and if you are using a Declining Balance Depreciation Model in which you have selected Quarter as the Period you must specify a calendar quarter (or a number of calendar quarters).

- Inventory No.

- Paste Special

Asset register, Assets module

- Range Reporting Alpha

- If you need depreciation to be calculated for a particular Asset, enter its Inventory Number here. You can also enter a range of Inventory Numbers separated by a colon (:).

- Depreciation will not be calculated for Assets that have already been fully depreciated or that belong to Asset Categories in which you have selected the Exclude from Reports option.

- Category

- Paste Special

Asset Category register, Assets module

- Range Reporting Alpha

- Specify an Asset Category here if you want depreciation to be calculated for Assets belonging to a particular Category. You can also enter a range of Asset Categories separated by a colon (:).

- N/L Class

- Paste Special

Asset N/L Classes setting, Assets module

- Specify an Asset Class here if you want depreciation to be calculated for Assets belonging to a particular Class.

- You can assign an individual Asset to an Asset Class using the N/L Class field in the header of the Asset record, or you can leave that field empty and assign the Asset to an Asset Category that belongs to the Asset Class. In both cases, the Asset will be found when you specify the Class here.

- Department

- Paste Special

Departments setting, Assets/Human Resources Management/System module

- If you need to calculate depreciation for the Assets that belong to a particular Department, specify that Department here. The Department to which an Asset belongs will be taken from the latest Asset Status record of Type "Movement" with a date in the depreciation period that you have marked as OK or, if there are no "Movement" Asset Status records for the Asset, from the 'Owner' card of the Asset record.

- Trans. Date

- Paste Special

Choose date

- Enter the date that is to be used as the Transaction Date in the Simulation created by the function. If you do not enter a date, the current date will be used.

- Model

- Select one of these options to specify which of the two Depreciation Models specified on the 'Models' card of each Asset record is to be used to calculate its depreciation.

- Calculation

- These options are only relevant to Straight Line Depreciation Models. Declining Balance Models will usually use the Values per Month option, even if you have selected Values per Day. If you have any Depreciation Models of either type in which the Period is "Quarter", you must select the According to Model option for depreciation to be calculated correctly.

- Values per Month

- This option will divide the yearly depreciation percentage by 12 to obtain a monthly percentage. For example, an Asset worth 50,000 being depreciated by 5% p.a. will be depreciated by 208.33 per month (50,000 x 0.05 / 12). This figure will always be the same, irrespective of the number of days in the month. Selecting this option will override the Period that you have selected in the Depreciation Models specified in each Asset.

- Values per Day

- This option will divide the yearly depreciation percentage by 365 and multiply it by the number of days in the month to obtain a monthly percentage. For example, an Asset worth 50,000 being depreciated by 5% p.a. will be depreciated by 212.33 per 31 day month (50,000 x 0.05 / 365 x 31). This figure will change, depending on the number of days in the month. The number of days is calculated from the report period. Again, selecting this option will override the Period that you have selected in the Depreciation Models specified in each Asset.

- According to Model

- Select this option if you need the Period that you have selected in the Depreciation Models specified in each Asset to be used by the depreciation calculation.

- Start from Last Revalued Value

- Use this option to control how depreciation is calculated if an Asset has at least one Revaluation record. Such Revaluation records will take effect from their Starting Dates (if you do not select this option) or from the beginning of the life of the Asset.

- If there are no Revaluation records for a particular Asset, this check box will have no effect and depreciation will be calculated as normal.

- Selecting this option may be useful if you are using a Straight Line Depreciation Model, if you did not change the Model in the Revaluation record and if you want to ensure the life of an Asset remains the same. By treating the value in the latest Revaluation as the original Purchase Value of an Asset, it effectively recalculates the depreciation from previous years retrospectively. Depending on advice from your auditor, you may need to enter a Nominal Ledger Transaction to record the change in depreciation that results from this recalculation in the Nominal Ledger. This retrospective calculation will take place even when the Starting Date of the Revaluation is later than the report period. So, you might need to make certain that depreciation from past years is calculated and posted to the Nominal Ledger before entering subsequent Revaluations.

- Simulation per Asset

- In the Simulation created by this function, depreciation of an Asset will be debited to the Cost Account of the Asset Class to which the Asset belongs and credited to the Depreciation Account of the Asset Class.

- By default, a single Simulation will be created. If you are not using Tags/Objects, this Simulation will contain a single debit posting to each Cost Account (to the value of the accumulated depreciation of all Assets using that Account) and a single credit posting to each Depreciation Account. If you are using Tags/Objects, the Simulation will contain single postings for each Tag/Object - Account combination.

- If you do not want a single Simulation to be created but instead would like separate Simulations to be created for each Asset, check this box.

- Skip Inactive

- Select this option if you do not want depreciation to be calculated for Assets that have been marked as Inactive.

- Use Fiscal Val instead of Purchase Val

- Select this option if you want the Fiscal Value of each Asset to be used as the basis for the depreciation calculations, instead of the Purchase Value.

- If you use this option, make sure you have specified Fiscal Values for all your Assets. Depreciation will not be calculated for an Asset with no Fiscal Value.

- Assets

- Select one of these options to specify whether depreciation should be calculated for Assets that you have disposed of (i.e. that you have written off or sold using Disposal records that you have marked as OK) during the specified period.

- These options will not affect how depreciation will be calculated for Assets that were disposed of after the specified period (depreciation will be calculated) or before the specified period (depreciation will not be calculated).

- If an Asset has been partially disposed of (e.g. the Qty in the Asset is 3 of which one has been disposed of), these options will only affect the calculation of depreciation for the disposed quantity.

- Include Disposed

- Depreciation will be calculated for Assets that were disposed of during the specified period.

- Include Disposed in Period

- Depreciation will be calculated for Assets that were disposed of during the specified period.

- Skip Disposed

- Depreciation will not be calculated for Assets that were disposed of during the specified period.

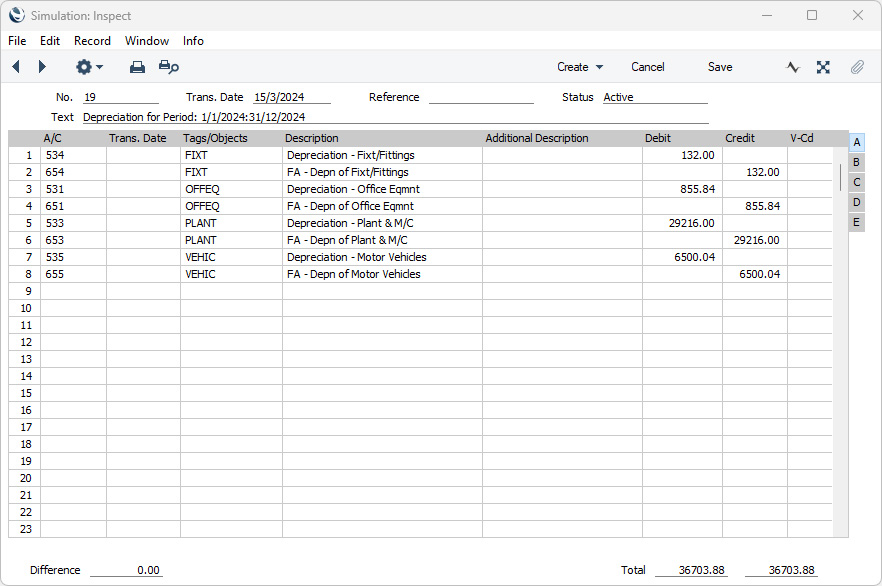

A sample Simulation created by this function is shown below. The depreciation figure is debited to the Cost Account from the Asset Class and credited to the Depreciation Account. If you specified that Model 1 should be used to calculate depreciation, these will be the Depr. Cost and Acc. Depreciation Accounts in the Asset Class, but if you specified that Model 2 should be used, they will be the Depr. Cost 2 and Acc. Depr 2 Accounts. The Tags/Objects in the Asset record will be assigned to both sides of the Simulation, as will the Tags/Objects specified in the Asset Class. The Depr. Cost Tags/Objects or Depr. Cost 2 Tags/Objects (depending on the Depreciation Model) from the Asset Class will also be assigned to the debit posting, while the Acc. Depr Tags/Objects or Acc. Depr 2 Tags/Objects (depending on the Depreciation Model) will also be assigned to the credit posting.

By default, single debit and credit postings will be made for each Asset Class, irrespective of the number of Assets. Separate postings will be made for each Tag/Object combination. If you would like separate postings to be made for each Asset, use the

Simulation per Asset option (this will create separate Simulations for each Asset).

Please refer here for some examples illustrating the calculation of depreciation.

---

Go back to: