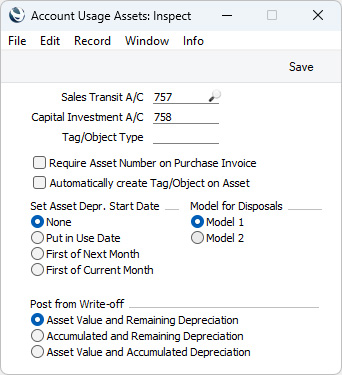

Account Usage Assets

This page describes the Account Usage Assets setting in the Assets module.

---

The Account Usage Assets setting allows you to choose the Accounts that will be used as defaults in your Asset Simulations and Transactions. Take care to ensure that the Accounts specified here exist in the Account register, otherwise there is a risk that Simulations and Transactions will not be created.

To open the Account Usage Assets setting, first ensure you are in the Assets module. Then, if you are using Windows or macOS, click the [Settings] button in the Navigation Centre and then double-click 'Account Usage Assets' in the 'Settings' list. If you are using iOS or Android, select 'Settings' from the Tools menu (with 'wrench' icon) and tap 'Account Usage Assets' in the 'Settings' list. Fill in the fields as described below. Then, to save changes and close the window, click the [Save] button (Windows/macOS) or tap √ (iOS/Android). To close the window without saving changes, click the close box (Windows/macOS) or tap < (iOS/Android).

- Sales Transit A/C

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the Account that is to be debited with the Sales Price of an Asset when you sell it, which you can do using a Disposal record of Type "Sale".

- Capital Investment A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you will be creating "Put In Use" Transactions to record the implementation of your Assets in the Nominal Ledger, the Purchase Value of each Asset will be credited to the Account that you specify here.

- If you revalue an Asset and create a Simulation from the Revaluation using the 'NL Simulation' function on the Create menu (Windows/macOS) or + menu (iOS/Android), an increase in value will be credited to this Account, while a decrease will be debited to this Account.

- Tag/Object Type

- Paste Special

Tag/Object Types setting, Nominal Ledger

- If you need to create Tags/Objects that are specific to each Asset, there are two methods that you can use:

- You can have a Tag/Object created automatically whenever you save an Asset record for the first time. To use this method, select the Automatically create Tag/Object on Asset option below.

- After saving an Asset record, you can create a Tag/Object by selecting 'Object' from the Create menu (Windows/macOS) or + menu (iOS/Android).

- In both cases, the new Tag/Object will be assigned to the Asset automatically, being added to any Tags/Objects that are already there. The existing Tags/Objects will not be overwritten.

- The Inventory Number of the Asset will be used as the Code of the new Tag/Object. For example, Tag/Object 001 will be created from Asset 001.

- If you need the new Tag/Object to be assigned to a Tag/Object Type, specify that Tag/Object Type in this field. If you have specified a Start String in the Tag/Object Type, it will be included in the Codes of the new Tags/Objects. If you have specified a Length (maximum numbers of characters) in the Tag/Object Type, take care that it is sufficient for Tag/Object Codes to be constructed from the Start String and Inventory Numbers.

- Require Asset Number on Purchase Invoice

- This option controls behaviour when you enter a Purchase Invoice with at least one row in which the Cost Account is also an Asset or Asset 2 Account that you have specified in any row in the Asset N/L Classes setting. If you are using this option, it will be mandatory to specify the Inventory Number of an Asset on flip E of the Purchase Invoice row. This in turn will mean you also have to specify an Asset Trans. Type, signifying that the Purchase Invoice row is to cause a new Asset record to be created or an existing one to be updated. Please refer to the description of the fields on flip E of the 'Costs' card of the Purchase Invoice window at the bottom of this page for more details.

- Automatically create Tag/Object on Asset

- Select this option if you would like Tags/Objects to be created automatically from and assigned to Asset records when you save them for the first time. Please refer to the description of the Tag/Object Type field above for more details.

- Set Asset Depr. Start Date

- When you specify a Used From date in an Asset record, you can have it copied to the Start Date 1 field automatically and immediately. Choose an option as follows:

- None

- The Used From date will not be copied to the Start Date 1 field.

- Put in Use Date

- The Used From date will be copied to the Start Date 1 field.

- First of Next Month

- The Start Date 1 field will be set to the first day of the month after the Used From date.

- First of Current Month

- The Start Date 1 field will be set to the first day of the month in which the Used From date falls.

- Model for Disposals

- When you save a Disposal record that you have marked as OK, a Nominal Ledger Transaction will be created if you have so determined using the Sub Systems setting in the Nominal Ledger and in the Number Series - Disposals setting. This Transaction will include postings to an Asset Account and an Acc. Depr Account. Please refer to the description of the Post from Write-off options below for more details about these postings. The choice of Asset and Acc. Depr Accounts (and associated Tags/Objects) will depend on the option that you choose here as follows:

- Model 1

- The Asset Account and the Acc. Depr Account in the Asset Class to which the Asset belongs will be used. The Asset Tags/Objects will be assigned to the posting to the Asset Account, and the Acc. Depr Tags/Objects will be assigned to the posting to the Acc. Depr Account.

- Model 2

- The Asset 2 Account and the Acc. Depr 2 Account in the Asset Class to which the Asset belongs will be used. The Asset 2 Tags/Objects will be assigned to the posting to the Asset 2 Account, and the Acc. Depr 2 Tags/Objects will be assigned to the posting to the Acc. Depr 2 Account.

- Post from Write-off

- Select one of these options to specify the postings that will be included in the Nominal Ledger Transaction that will be created when you write off an Asset by marking a Disposal record as OK and saving. The option that you select will depend on how the writing off of Assets should be accounted for in your country. The options are:

- Asset Value and Remaining Depreciation

- The value of the Asset (from the most recent Revaluation or, if there are no Revaluations, the Purchase Value) will be debited to the Account specified in the Disposal record.

- The value of the Asset (from the most recent Revaluation or, if there are no Revaluations, the Purchase Value) will be credited to the Asset or Asset 2 Account specified in the Asset Class to which the Asset belongs. The Asset or Asset 2 Tags/Objects specified in the Asset Class will be assigned to this posting. As in all postings described here, the choice of Asset or Asset 2 Account and Asset or Asset 2 Tags/Objects will depend on the Model for Disposals that you have selected above.

- The value of the Asset (from the most recent Revaluation or, if there are no Revaluations, the Purchase Value) will be debited to the Acc. Depr or Acc. Depr 2 Account specified in the Asset Class, and the depreciation to date will be credited to the same Account. The Acc. Depr or Acc. Depr 2 Tags/Objects specified in the Asset Class will be assigned to both postings. The net effect of these two postings will be that the future depreciation will be debited to the Acc. Depr or Acc. Depr 2 Account.

- The depreciation to date will be credited to the Account specified in the Disposal record.

- The Tags/Objects specified in the (which by default will have been copied from the Asset record) and in the Tags/Objects field in the Asset Class will be assigned to all postings.

- Accumulated and Remaining Depreciation

- The depreciation to date will be debited to the Acc. Depr or Acc. Depr 2 Account specified in the Asset Class. The Acc. Depr or Acc. Depr 2 Tags/Objects specified in the Asset Class will be assigned to this posting.

- The depreciation to date will be credited to the Asset or Asset 2 Account specified in the Asset Class. The Asset or Asset 2 Tags/Objects specified in the Asset Class will be assigned to this posting.

- Future depreciation will be debited to the Account specified in the Disposal record.

- Future depreciation will be credited to the Asset or Asset 2 Account specified in the Asset Class. The Asset or Asset 2 Tags/Objects specified in the Asset Class will be assigned to this posting.

- The Tags/Objects specified in the (which by default will have been copied from the Asset record) and in the Tags/Objects field in the Asset Class will be assigned to all postings.

- Asset Value and Accumulated Depreciation

- The value of the Asset (from the most recent Revaluation or, if there are no Revaluations, the Purchase Value) will be debited to the Account specified in the Disposal record.

- The value of the Asset (from the most recent Revaluation or, if there are no Revaluations, the Purchase Value) will be credited to the Asset or Asset 2 Account specified in the Asset Class. The Asset or Asset 2 Tags/Objects specified in the Asset Class will be assigned to this posting.

- The depreciation to date will be debited to the Acc. Depr or Acc. Depr 2 Account specified in the Asset Class. The Acc. Depr or Acc. Depr 2 Tags/Objects specified in the Asset Class will be assigned to this posting.

- The depreciation to date will be credited to the Account specified in the Disposal record.

- The Tags/Objects specified in the (which by default will have been copied from the Asset record) and in the Tags/Objects field in the Asset Class will be assigned to all postings.

- If you sell an Asset, the Nominal Ledger Transaction created from the Disposal record will include the postings listed above, and there will be two further postings in which the Sales Price will be debited to the Sales Transit Account specified above and credited to the Account specified in the Disposal record. No Tags/Objects will be assigned to the debit posting, while the Tags/Objects specified in the Disposal row and in the Tags/Objects field in the Asset Class will be assigned to the credit posting.

---

Go back to: