Subsidy Assets

This page describes the Subsidy Assets report in the Assets module.

---

If you purchase an Asset with the help of a subsidy from the European Union, you should record the number of the EU contract authorising the subsidy in the Contract Number field on the 'Purchase' of the Asset record and the value of the subsidy in the Subsidy Value field on the 'Values' card. This is a requirement in some countries (e.g. Portugal).

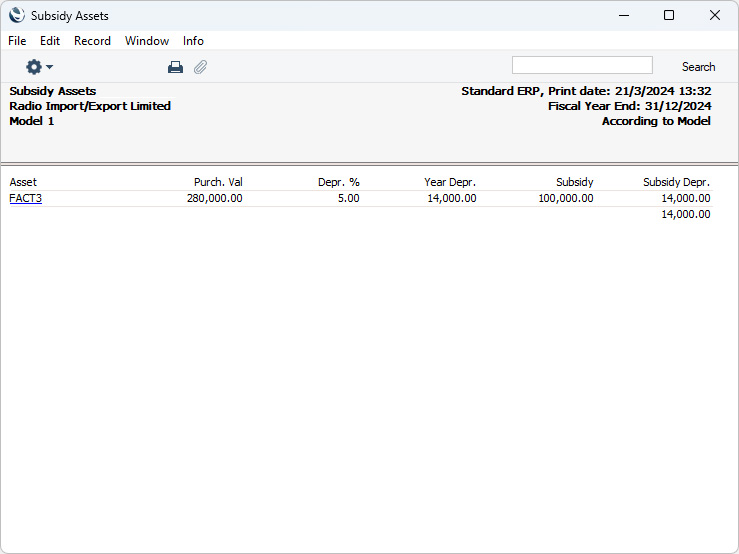

The Subsidy Assets report is a list of Assets that have a Subsidy Value, showing the depreciation of the Asset and of the subsidy. In some countries (e.g. Portugal), depreciation of a subsidy is treated as income. You should enter a Nominal Ledger Transaction manually to record this income, using the figures shown in the report.

When printed to screen, the Subsidy Assets report has the Standard ERP Drill-down feature. Click (Windows/macOS) or tap (iOS/Android) on an Inventory Number in the report to open the corresponding Asset record.

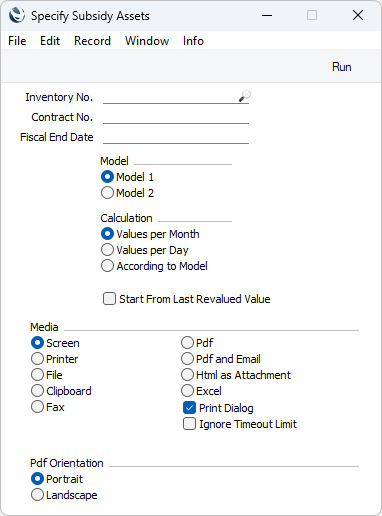

- Inventory No.

- Paste Special

Asset register, Assets module

- Range Reporting Alpha

- If you need a particular Asset to be listed in the report, enter its Inventory Number here. You can also enter a range of Inventory Numbers, separated by a colon (:).

- The report will only list the Assets in the range that have a Subsidy Value. Inactive and Disposed Assets with Subsidy Values will be included.

- Contract No.

- Enter a Contract Number here if you need the report to list Assets with a particular Contract Number (recorded on the 'Purchase' card of each Asset record).

- Fiscal End Date

- Paste Special

Choose date

- Depreciation for each Asset and its subsidy will be calculated for the Fiscal Year containing the date that you specify here. Depreciation will not be calculated if you do not specify a date.

- Model

- Select one of these options to determine which of the two Depreciation Models specified in each Asset record is to be used to calculate depreciation.

- Calculation

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details about the Values per Day and Values per Month options. Choose the According to Model option if you want to use the Period specified in the Depreciation Model of each Asset: you must select this option if you have any Depreciation Models in which the Period is "Quarter" for depreciation to be calculated correctly.

- Start From Last Revalued Value

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details of this option.

---

Go back to: