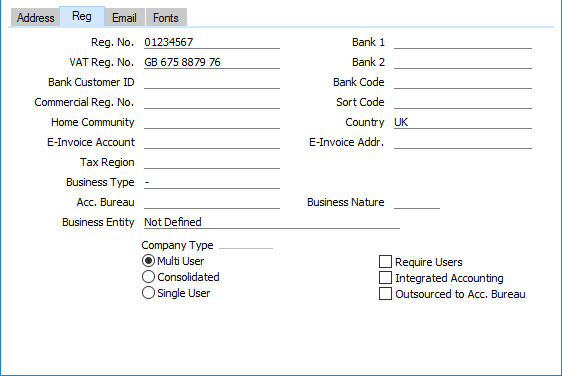

Company Info - Reg Card

This page describes the fields on the 'Reg' card of the Company Info setting. Please follow the links below for descriptions of the other cards:

---

- Reg. No.

- Field for Form Templates

Own Registration Number

- Enter your company registration number here. This information is required for you to be able to register your copy of Standard ERP and to receive Enabler Keys.

- VAT Reg. No.

- Field for Form Templates

Own VAT Reg. Number

- Enter your company's VAT registration number here. This information is required for you to be able to register your copy of Standard ERP and to receive Enabler Keys.

- Bank 1

- Field for Form Templates

Own Bank 1

- Bank 2

- Field for Form Templates

Own Bank 2

- You should enter your company's main bank account number(s) here. This information can then be printed on any appropriate documentation.

- In most countries, enter your bank account number in the Bank 1 field and the bank account number in IBAN format (including two-character country prefix) in the Bank 2 field. In Namibia enter your account number in Bank 1 and the sort code in Bank 2. In Finland, enter your bank account number in IBAN format in the Bank 1 field.

- Bank Customer ID

- Field for Form Templates

Own Bank Customer ID

- This is an ID number used for electronic communication with certain banks and other credit institutions in some countries.

- If you will be paying Purchase Invoices using 'Banking File' export files, enter the following in this field depending on the Payment File Format you have chosen in the Bank Transfer setting in the Purchase Ledger:

- Finland SEPA

- Enter your business ID or customer number at your bank. This Bank Customer ID will be included in export files in the <BkPtyId> tag if the Bank ID Code in the Bank record representing your bank is blank.

- All Norwegian banks except SEPA

- Enter here your company's VAT number with non-numeric characters removed. For example, if your company's VAT number is NO 987654321 MVA, enter 987654321.

- South Africa - First National Bank

- Enter your bank account number.

- Spain SEPA

- Enter your business ID or customer number at your bank. This Bank Customer ID will be included in export files in the <BkPtyId> tag if the Bank ID Code in the Bank record representing your bank is blank.

- Sweden - PlusGirot

- Enter your Customer Number at PlusGirot.

- Please contact your local HansaWorld representative for more details.

- Bank Code

- Paste Special

Banks setting, Purchase Ledger

- Field for Form Templates Own Bank Code

- The Banks setting in the Purchase Ledger should contain separate records for each of the bank branches that you deal with. These records should contain name, address and contact details for each bank branch. Usually, you will need to add a record to this setting for your own bank. If you will be using 'Banking File' export files to pay your Suppliers, you should add records for your Suppliers' banks as well.

- After adding a record in the Banks setting for your own bank, enter the Code of this record in this field. It is usually recommended that you enter your account details (account number, sort code, etc) both in the Bank record for your own bank and here in the Company Info setting. Please refer to Standard Fields page for a list of the fields that you can add to Form Templates if you need information from the Bank record for your own bank to printed on documentation.

- Commercial Reg. No.

Field for Form Templates Own Commercial Registration Number

- In Europe, the Intrastat system is used to collect statistics on the physical trade in goods (i.e. the actual movement of goods) between the various member countries of the European Union (EU). If your business is situated in an EU country and its trade with companies in other EU countries is greater than the threshold value, it will be necessary to send an Intrastat report periodically to the relevant authorities. You can do this by printing a document or exporting a text file. In both cases, the report should include your company name and address (from the 'Address' card), your VAT Number (above) and a three-digit company or branch identifier (entered in this field). You will need to enter a separate identifier (i.e. a separate Commercial Reg. No.) in the Company Info setting in each branch (i.e. in each Company) if you will be submitting Intrastat returns from different branches using the same VAT Number.

- In Argentina, if your fiscal printer is an Epson LX-300 or TM-U220, use 'Paste Special' from this field to connect to a row in the Registration Defaults setting in the Sales Ledger. This will assign an Official Tax Code and Customer VAT Responsibility to your company, which will ensure that a code representing your Customer VAT Responsibility will be printed on every Invoice by the fiscal printer. If your fiscal printer is a Hasar 330F, you will need to register the relevant code in the printer's memory using its own software. Please refer to step 10 on the Fiscal Printers page for more details.

- In Brazil, enter the Inscrição Municipal do Contribuinte of your company in this field.

- In Latvia, Norway and Sweden, you should ensure that the Reg. No., VAT Reg. No. and Commercial Reg. No. fields are not all empty. At least one of these fields must contain a value if you will be using e-invoicing.

- This field is also used in Portugal. Enter the commercial registration number of your company in this field. This information is required for SAFT reporting.

- Sort Code

- Field for Form Templates

Own Sort Code

- Enter the sort code or branch code of the bank where your bank account is held.

- Home Community

- Field for Form Templates

Own Home Community

- This field is used in Lithuania, Norway and Portugal. Enter the region or district in which your company is located. This information will be included in 'SAFT' export files.

- Country

- Paste Special

Countries setting, System module

- Field for Form Templates Own Country Code

- Enter the Country where your company is located. It is recommended that you use the two-character ISO 3166 format, as this is required for some features (for example, paying Purchase Invoices using 'Banking File' export files when the Payment File Format you have chosen in the Bank Transfer setting in the Purchase Ledger is one of the SEPA formats).

- If you have included the "Own Country Code" field in your Form Templates, the ISO Code from the record in the Countries setting for the Country will be printed on the corresponding documentation. If the ISO Code is blank or there is no connected record in the Countries setting, the Country from this field will be printed.

- E-Invoice Account

- In Italy, the E-Invoice Account will be exported in the <CodiceDestinatario> tag in files created by the 'Public Administration E-Invoicing' Export function in the Sales Ledger.

- In Mexico, enter the GLN (Global Location Number) of your company here. This is needed for e-invoicing.

- E-Invoice Addr.

- Field for Form Templates

Own ANA Code

- Record the unique ANA Code assigned to your company by the Article Numbering Association here. This is required if you will be using the EDI (Electronic Data Interchange) module. Please refer to your local representative for details.

- In Finland, this field must be filled in with the OVT-tunnus (EDI Identifier) of your company if you will be using e-invoicing.

- In Lithuania, the ANA code will be exported in box E10 in the VAT Periodic Declaration (form FR600).

- Business Type

- Paste Special

Choices of possible entries

- In Portugal, the maximum value of a POS Invoice and of a sales Invoice that has a "Cash" Payment Term is €100.00 Euros. If the Company issuing the Invoice is in the retail sector or is a market trader and if every Item on the Invoice is a Stocked Item, the maximum value is increased to €1000.00 Euros. If your company is able to issue cash Invoices up to a value of €1000.00 Euros, set this field to "Retail".

- Acc. Bureau

- Paste Special

Customers in Contact register

- If your company has outsourced its accounts to an accounting bureau, first enter a record in the Contact register representing the accounting bureau. Tick the Customer box in the header of that Contact record, and enter at least the Name, Invoice Address, VAT Reg. No. and Bank Account (bank account number). Then, enter the Contact Number of that Contact record in this field (using 'Paste Special' if necessary) and tick the Outsourced to Acc. Bureau box below. In Lithuania, Norway and Portugal this information is required for SAFT reporting.

- Business Nature

- Paste Special

Nature of Business setting, System module

- Use this field to note the nature of your business. This is for information only.

- Business Entity

- Paste Special

Choices of possible entries

- In Italy, the Business Entity will be exported in the <RegimeFiscale> tag in files created by the 'Public Administration E-Invoicing' Export function in the Sales Ledger.

- Company Type

- The word "Company" here refers to the Company partition of your Standard ERP database in which you are currently working. You should assign a Type to each Company to be able to register your copy of Standard ERP and to receive Enabler Keys.

- The following options are available:

- Multi User

- Choose this option if more than one person will have access to the Company (i.e. the Company will be stored in the database on a server machine).

- The number of Multi User Companies in your database should match the number of Multi-User Non-Consolidated Companies registered in the Configuration setting.

- Consolidated

- Choose this option if more than one person will have access to the Company and if the information in the Company will be included in consolidated reports. Please refer here for more information.

- The number of Consolidated Companies in your database should match the number of Multi-User Consolidated Companies registered in the Configuration setting.

- Single User

- This option means that only one user will be able to log in to the Company at any one time (i.e. the Company will be stored in a database on your local machine).

- The number of Single User Companies in your database should match the number of Single User Companies registered in the Configuration setting.

- Outsourced to Acc. Bureau

- Tick this box if your company has outsourced its accounts to an accounting bureau.

- In Italy, you should also fill in the Chief Accountant field on the 'Email' card of this setting. If the Outsourced to Acc. Bureau box is ticked, the contents of this field will be exported in the <CodiceFiscale> tag inside <Dichiarante> in files created by the 'Periodic VAT Declaration' Export function in the Nominal Ledger.

- In Lithuania, Norway and Portugal, enter a record in the Contact register representing the accounting bureau. Tick the Customer box in the header of that Contact record, and enter at least the Name, Invoice Address, VAT Reg. No. and Bank Account (bank account number). Then, enter the Contact Number of that Contact record in the Acc. Bureau field above.

The Company Info setting:

---

Go back to:

|