Entering a Receipt

In the Sales Ledger or Cash Book module, select 'Receipts' from the Registers menu, or click the [Receipts] button in the Master Control panel.

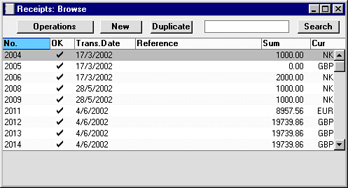

The 'Receipts: Browse' window is opened, showing Receipts already entered.

Receipts are numbered consecutively. In the list, the Receipt Number is followed by a check mark if the payment is approved, by the Date, any Reference, the total amount of the payment and finally the Currency. The last two columns do not contain values for Receipts that contain payments in different Currencies.

To enter a new Receipt, click [New] in the Button Bar or use the Ctrl-N (Windows and Linux) or ⌘-N (Macintosh) keyboard shortcut. Alternatively, highlight a Receipt similar to the one you want to enter and click [Duplicate] on the Button Bar.

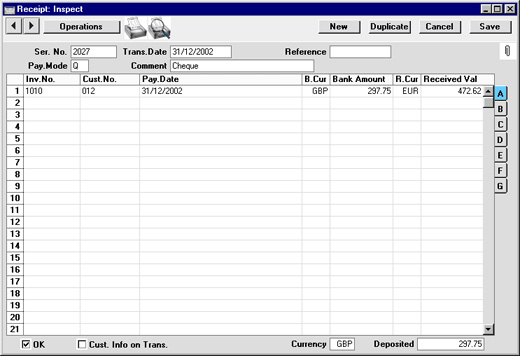

The 'Receipt: New' window is opened, empty if you clicked [New] or containing a duplicate of the highlighted Receipt.

The principle for entering a Receipt is that you know at least:

- How much has actually been received; and

- any extra fees charged by the bank.

In the case of payments in Currency, in order for the accounts receivable to balance, the possible rate loss or gain must be posted to a separate Account, not the basic Debtor Account. Exchange Rate Loss and Gain Accounts are specified on card 2 of the Account Usage S/L setting. The balancing must usually take place against the Exchange Rate:bank fees and the amount received cannot be changed.

First a run-through of the fields.

- Ser. No.

- Paste Special

Select from another Number Series

- The number of the Receipt: Hansa will enter the next unused number from the number sequence allocated on the 'Ser Nos' card of the user's Person record or from the Number Series - Receipts setting. You may change this number, but not to one that has already been used.

- If you have used the Payment Modes setting to define separate number sequences for each Payment Mode, the Receipt Number will be determined by the default Payment Mode and will change if the Payment Mode is changed. Number sequences defined in the Payment Modes setting are not shown in the 'Paste Special' list.

- Trans. Date

- Paste Special

Current Date

- The Transaction Date for the Receipt: the date when the Receipt is posted to your Nominal Ledger.

- Reference

- This field can be used if you need to identify the Receipt by any means other than the Receipt Number (e.g. a bank reference in the case of credit transfers or BACS payments).

- The Reference is shown in the 'Receipts: Browse' window, allowing you to search for a Receipt with a particular Reference. The Receipt Journal report can also be used to list Receipts with a particular Reference. This Reference will be copied to the Reference field of any Nominal Ledger Transaction generated from this Receipt.

- Pay. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- The Payment Mode determines the Nominal Ledger Account to be debited by the Receipt.

- On a single Receipt it is possible to enter payments from different Customers against different Invoices. It is also possible to enter payments across Payment Modes: specifying a Payment Mode for any of the individual payments in the grid will override that entered here.

- If you have used the Payment Modes setting to define separate number sequences for each Payment Mode, the Receipt Number will be determined by the default Payment Mode and will change if the Payment Mode is changed.

- Comment

- Default taken from

Payment Mode

- The text for the Payment Mode. This text may be changed.

Use the grid area that takes up most of the screen to list the Invoices being paid by this Receipt. A single Receipt can be allocated to several Invoices, and/or feature payments in different Currencies and Payment Modes. The Payment Mode reflects not only the payment method (i.e. cheque, cash or credit card) but also the Bank Account debited. So, all payments received in a single day can be entered using a single Receipt record, irrespective of Currency and of Payment Mode. It is recommended that, to facilitate reconciliation with the bank's statement of account, you should use one Receipt record to represent the monies paid into the bank on a single paying-in slip.

Each record in the Receipt register results in one Nominal Ledger Transaction, with bank or other institution as debit Account.

Flip A

- Inv. No.

- Paste Special

Open, approved Invoices, Invoice register

- The number of the Invoice being paid. On entering an Invoice Number, the Currency, if any, of the Invoice will be brought in and, if the Invoice qualifies for an early settlement discount, a discount row is inserted automatically, together with a suggested discount amount. This is calculated using the formula specified for the appropriate Payment Terms record.

- Note that when using 'Paste Special' only unpaid Invoices will appear in the selection list. However, Invoices against which an unapproved Receipt has been entered are treated as unpaid and thus will be listed. Sorting the 'Paste Special' selection by Customer will allow you quickly to find the Invoice that is being paid.

- If it is not known which Invoices are being paid by a particular Receipt, leave this field blank and enter the Customer Number in the next field instead. After an Amount has been entered, the 'Distribute Receipt' function on the Operations menu can then be used to allocate the Receipt to the Customer's oldest outstanding Invoices.

- If the Receipt is a Prepayment or On Account Receipt from a Customer with an account (marked using the On Account box on the 'Terms' card of the Customer screen) for which an Invoice has not yet been raised, this field should be left blank. An entry can be made to the Prepayment Number field on flip D instead. This is fully described on the On Account Receipts and Prepayments page.

- Cust. No.

- Paste Special

Customer register

- Default taken from Invoice or Sales Order

- Entered by Hansa when the Invoice Number is entered (or when a Prepayment Number that is also an Order Number is entered on flip D).

- In the case of account Customers, type in the Customer Number and use the 'Distribute Receipt' function on the Operations menu to select the Invoices being paid.

- Pay Date

- The date when the payment was made. This date is always the same as the Transaction Date (in the header) and cannot be changed independently.

- B. Cur

- Paste Special

Currency register, System module

- Default taken from Receipt Currency

- The Bank Currency: enter the Currency of the amount as paid into the bank.

- So far as the accounting of the Bank Amount is concerned, it does not matter whether the Receipt Currency, the home Currency or the Currency of the Bank Account (specified in the Account register in the System module) is entered here, since the resulting Nominal Ledger Transaction will contain values in all appropriate Currencies. However, it is recommended that all payments on the same Receipt use the same Bank Currency so that a total amount is shown in the Deposited field and in the 'Receipts: Browse' window. In smaller companies, this can help maintain a mental picture of the cash flow situation.

- If there are any bank charges attached to this particular payment, they should be entered using the 'New Fee' function on the Operations menu in the Currency specified here.

- Bank Amount

- Default taken from

Received Value

- The amount paid, expressed in the Bank Currency. If the Currency is changed, the Bank Amount is converted using the current conversion rates: these cannot be modified for an individual payment. Do not use this field to subtract bank fees from the amount paid: the 'New Fee' function on the Operations menu is provided for this purpose.

- In normal circumstances, you should not change the Bank Amount and Currency. In the case of partial payments or overpayments, change the Received Value (described below) and the Bank Amount will be altered automatically by Hansa, taking exchange rates into account if necessary. If you change the Bank Amount, the Received Value will not be updated automatically, so such an alteration should only be made in exceptional circumstances. Examples might be when you know that the exchange rate that will be levied by the bank is different to the latest rate in Hansa, or when you know the exact amount of the Receipt as added to your bank account. Changing the Bank Amount is therefore effectively the same as changing the exchange rate for a single Receipt row.

- R. Cur

- Paste Special

Currency register, System module

- Default taken from Invoice

- The Receipt Currency: enter the Currency used by the Customer on their payment (for example, the Currency used on the cheque). The default is to the Currency used on the Invoice, but any Currency can be used. If the Currency is changed, the Received Value is converted using the current conversion rates: these cannot be modified for an individual payment.

- Received Val

- Default taken from

Outstanding amount on Invoice or Sales Order total

- The amount paid, expressed in the Receipt Currency. The default can be changed, in the event of partial payments or overpayments. If the Currency is changed, the Received Value is converted using the current conversion rates: these cannot be modified for an individual payment. If the amount is altered before the Currency, the conversion will apply to the altered amount.

- When a Prepayment Number that is also an Order Number is entered on flip D, the Order total will appear here.

Flip B

- I. Cur

- The Invoice Currency is the Currency used on the Invoice being paid. This field cannot be changed.

- Open Inv. Value

- The outstanding amount of the Invoice being paid, in the Invoice Currency. This field cannot be changed.

- Invoice Val

- The amount being paid, in the Invoice Currency.

Flip C

- Text

- Hansa will enter the Customer's Name, as entered in the Customer register. You may change this if you wish.

- P. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- Enter a Payment Mode, if different from the Payment Mode entered in the header. This allows different payments on the same Receipt to be debited to different Bank Accounts.

- Cheque No.

- Record the number of the cheque used for the payment here.

- If the Type of the Payment Mode is "Received Cheques", this field cannot be left blank. It should contain the Serial Number of a record in the Deposited Cheques register: use 'Paste Special' to ensure the correct record is specified.

Flip D

- Order No.

- Paste Special

Sales Order register

- If the payment is a deposit against a Sales Order, you can enter the number of the Sales Order to this field or to the Prepayment Number field immediately to the right. If you enter it here, the Customer on flip A will be changed to that of the Order, the Bank Amount and Received Value will be changed to the Order total, and the Order Number will be copied to the Prepayment Number field. Please refer to the description of the Prepayment Number field below for full details.

- Prepay. No

- Paste Special

Sales Order register

- If the payment is a Prepayment (i.e. one where it is not possible to specify an Invoice Number on flip A), an entry should be made to this field. This can be a number of your own generation, the number allocated to the prepayment by the Customer or, preferably, the number of the Sales Order against which the deposit has been received. If you want to ensure that only Sales Order Numbers can be used, switch on the Use Sales Order No for Prepayments option in the Down Payments setting in the Sales Orders module. If a Sales Order number is used, the Customer on flip A will be changed to that of the Order, and the Bank Amount and Received Value will be changed to the Order total.

- When an Invoice is raised to be set against the Prepayment, the two can be connected using the 'Connect to Prepayment' function on the Operations menu of the Invoice screen. This is fully described on the On Account Receipts and Prepayments page. If a deposit or prepayment exists without a Prepayment Number, it will not be made available to that function and connecting it to an Invoice will be more difficult. Prepayments that do not have a Prepayment Number will not be shown in the Prepayment History report.

- It is not compulsory to make an entry to this field if the Invoice Number field on flip A is blank. If you would like to make it so, turn on the Use Prepayments, not On Account option on card 1 of the Account Usage S/L setting. This will also apply to the equivalent field on flip D of the Payment screen in the Purchase Ledger.

- It is not necessary to enter a unique number to this field. This allows you to receive more than one deposit against an individual Sales Order. However, using a Prepayment Number more than once may make the Prepayment History report difficult to understand, and may make it difficult to link a particular Prepayment to an Invoice using the 'Connect to Prepayment' function. Therefore you may wish to use the Force Unique Prepayment Numbers option, also on card 1 of the Account Usage S/L setting. This will mean that once a Prepayment Number has been used in an approved Prepayment, you will not be able to use it again.

- An Invoice can be raised immediately to be set against the Prepayment. Please refer to the page describing the 'Create Down Payment' Operations menu function for details.

Flip E

- V-Cd, VAT Val

- These fields are provided for users of the Cash VAT scheme in the UK. If the Book Receipt VAT option in the Account Usage S/L setting is being used, the VAT Code and VAT Value (in the Bank Currency) will be brought in automatically from the Invoice (the VAT Code comes from the first row of the Invoice). When the Receipt is approved, the VAT amount will be moved from the temporary VAT Output Account to the final one (the O/P Account), as specified in the VAT Codes setting in the Nominal Ledger.

- In the case of On Account Receipts and Prepayments that have a VAT element, the O/P Account for the VAT Code is credited and the On Account VAT Account specified on card 2 of the Account Usage S/L setting is debited.

- These fields are also used in Russia where output (sales) VAT is calculated from monies received (i.e. from Receipts). In the case of deposits that have been received for goods or services that are not going to be delivered until the next month, the supporting Invoice may not have been raised yet, so the 'Create Prepayment Invoice' function on the Operations menu can be used to create and print a Prepayment Invoice for filing.

- Take care with these fields when entering On Account Receipts and Prepayments. In the case of On Account Receipts, which do not have an Invoice Number or a Prepayment Number, you must enter a VAT Code manually if you are using the Cash VAT scheme (i.e. if the Book Receipt VAT option is being used). The VAT Value will then be calculated from the Received Value. The Nominal Ledger Transaction resulting from the Receipt will not have a VAT element if the VAT Code or VAT Value are blank. The same is true in the case of Prepayments whose Prepayment Number is not an Order Number. However, in the case of Prepayments whose Prepayment Number is an Order Number, the VAT Code and VAT Value will be brought in automatically from the Order (the VAT Code comes from the first row of the Order).

Flip F

- Round Off Acc, Round Off

- These fields will be filled automatically by Hansa when the Receipt is approved. This occurs in the situation where an Invoice is to be treated as fully paid if the amount received is slightly different to that outstanding, providing that difference is within an allowable margin. The difference is effectively written off. The margin can be specified separately for each Currency.

- The Round Off shows the amount that is written off (in the Invoice Currency), while the Round Off Account shows the Account used. This is taken from card 2 of the Account Usage S/L setting on the following basis:

- Write Offs

- if the Received Currency is the same as the Invoice Currency, and the Received Currency is not a member of the EMU;

- Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is not a member of the EMU;

- EMU Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is a member of the EMU;

- EMU Rate Write Off

- if the Received Currency is the same as the Invoice Currency, and the Received Currency is a member of the EMU.

- Although primarily intended for use by Hansa's Multi-Currency system, non-Multi-Currency users can use this feature as an easy way of automatically writing off small outstanding amounts, reducing the need to use the 'Write off Invoices' Maintenance function. To do this, set an allowable margin (on the 'Round Off' card) in the Currency record representing the home Currency.

- For more details about this feature, please refer to the pages describing the 'EMU' and 'Round Off' cards of the Currency screen.

- Instal.

- Paste Special

Open (unpaid) Instalments

- If the Invoice is payable in instalments, specify the instalment being paid here. An Invoice is payable in instalments if it has a Payment Term that refers to a record in the Instalments setting.

- Object

- Paste Special

Object register, System module

- Default taken from Invoice 'Terms' card or Customer

- Up to 20 Objects separated by commas can be allocated to each Receipt row. When a Nominal Ledger Transaction is generated, these Objects will be assigned to the credit posting to the Debtor Account. This will allow detailed analysis by department or cost centre. Objects assigned to the debit posting to the Bank or Cash Account will be taken from the Payment Mode.

- If an Invoice Number is specified on flip A, the Objects will be taken from the 'Terms' card of that Invoice. If no Invoice Number is specified (i.e. it is an On Account Receipt or a Prepayment), the Objects will be taken from the 'Contact' card of the Customer.

Flip G

- TAX

- This field is intended for use in Russia, where a Sales Tax is levied on cash Receipts.

- If a Payment Mode with a TAX %, Cash Account and TAX Account on flip D is used in a Receipt, the whole Received Value is paid into the cash or bank Account in the usual fashion. In addition, a percentage of the Received Value (determined by the Tax % on flip D of the Payment Mode) will be credited to the Tax Account with a balancing debit to the Cash Account. That figure is shown here.

- B. Cur. 1

- The amount received, expressed in Base Currency 1.

- In normal circumstances, the Bank Amount and Received Value fields on flip A are sufficient to express the value of the Receipt. If the Received Currency and Bank Currency are different, the Nominal Ledger Transaction resulting from the Receipt will contain values in all appropriate Currencies, converted using the latest Exchange and Base Rates.

- If you know the exact amount of the Receipt in Base Currency 1 as added to your bank account (i.e. you know the exchange rate that will be levied by the bank), you can either change the Bank Amount or you can enter the exact figure in Base Currency 1 here. The first of these choices will post to the Bank Rate Gain or Loss Account (specified on card 2 of the Account Usage S/L setting), while the second will post to the Rate Gain or Loss Account. Please click here for full details and an example.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

- B. Cur. 2

- The amount received, expressed in Base Currency 2.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

Footer

- OK

- Receipts of most Payment Modes can be approved by clicking this check box. On clicking [Save] to save the Receipt, the Bank Account specified for the Payment Mode will be debited and the Debtor Control Account of the Invoice being paid will be credited. Once this box has been checked, no modifications to the Receipt will be possible.

- References in these web pages to approved Receipts are to Receipts whose OK check box has been switched on.

- Cust. Info. on Trans.

- When a Nominal Ledger Transaction is generated automatically from this Receipt, use this option if you would like to have the Receipt Number, Payment Date and Customer shown on flip E of the Transaction. This applies to the posting to the Debtor Account only.

- The check box will be on by default if you are using the Invoice Info on N/L Transaction option on card 1 of the Account Usage S/L setting.

- Currency

- If the Bank Currency for all payments on the Receipt is the same, that Currency is additionally shown here so that it can be displayed in the 'Receipts: Browse' window.

- Deposited

- The sum of the Bank Amounts: the total for this Receipt. This field only contains a value if all payments on the Receipt feature the same Bank Currency.

|