Tax Reports - The Tax Calculations Report

You should use the Tax Calculations report to test your formulae and to check the results. As you add or change formulae in a record in the

Tax Report setting, you can recalculate this report to see the consequences of the changes immediately.

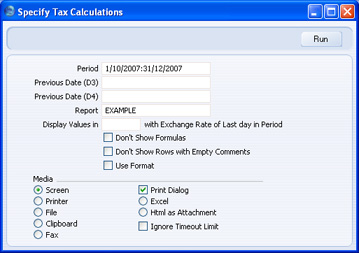

On double-clicking 'Tax Calculations' in the 'Reports' list in the Nominal Ledger, the 'Specify Tax Calculations' window opens:

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the period to be covered by the report.

- To refer to the first date of this period in your formulae, use the expression #D1.

- To refer to the last date of this period in your formulae, use the expression #D2.

- Previous Date (D3), Previous Date (D4)

- Paste Special

Choose date

- Enter any comparison dates, as required by the formulae in your record in the Tax Reports setting. To refer to these dates in your formulae, use the expressions #D3 and #D4.

- Report

- Paste Special

Tax Reports setting, Nominal Ledger

- Specify the record in the Tax Report setting that contains the formulae that you wish to test.

- Display Values in

- Paste Special

Currency register, System module

- Specify the Currency that is to be used in the report. Leave the field empty to use the home Currency (Base Currency 1).

- Don't Show Formulas

- By default, the Code and Formula of each row in the Tax Report record will be printed in the report. Use this option if you don't want this information to be printed.

- Don't Show Rows with Empty Comments

- Use this option if you want any rows in the Tax Report record that do not have Comments to be omitted from the report.

- Use Format

- Use this option if you have specified a Format on flip B of any row in the Tax Report record and if you want the figure resulting from that row to be printed using that Format.

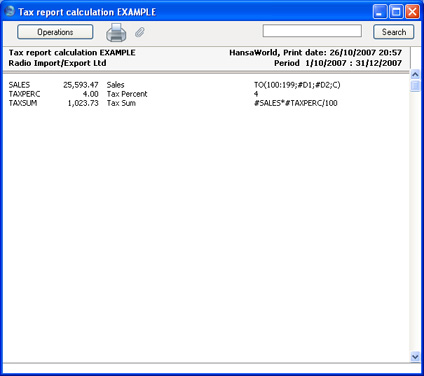

When the specification window is complete, click the [Save] button in the Button Bar. The resulting report contains a separate line for each row in the record in the

Tax Reports setting:

The calculated result of the formula is shown in the second column, while the formula itself is shown in the fourth column.