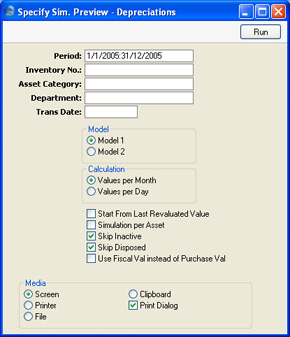

Simulation Preview - Depreciations

Use this report to preview the Simulation that will be created when you run the 'Create Depreciation Simulations' Maintenance function. It shows the Accounts that will be included in such Simulations and the value of the depreciation that will be posted to those Accounts: if you so choose, you could therefore also use the report as a basis for entering depreciation directly to the Transaction register manually.

Please refer to the page describing the 'Create Depreciation Simulations' Maintenance function for examples showing how depreciation is calculated, and for possible reasons why certain Assets have been omitted from the report unexpectedly.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the time period for which depreciation will be calculated. Unless you are using a Straight Line Depreciation Model and the Values per Day option, the period should consist of a selected number of whole months: it will be rounded up if this is not the case.

- Inventory No.

- Paste Special

Asset, Assets module

- Range Reporting Alpha

- Enter one or more Assets for which depreciation will be calculated.

- Asset Category

- Paste Special

Asset Categories setting, Assets module

- Range Reporting Alpha

- Limit the selection to Assets belonging to a single Asset Category.

- Department

- Paste Special

Departments setting, Assets module

- Limit the selection to Assets belonging to a particular Department. This information will be taken from the latest Asset Status record of Type "Movement", or, if there aren't any, from the 'Owner' card of the Asset record.

- Trans. Date

- Paste Special

Choose date

- Enter the date that you think you will use when you create the depreciation Simulation. This will be shown at the beginning of the report together with the probable Simulation Number (i.e. the next unused number from the first Number Series in the Number Series - Simulations setting).

- Model

- Use one of these alternatives to determine which of the two Depreciation Models specified on the 'Models' card of each Asset record is to be used to calculate its depreciation.

- Calculation

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details of these options.

- Simulation per Asset

- When you create a Simulation using the 'Create Depreciation Simulations' Maintenance function, depreciation of an Asset will be debited to the Cost Account of the Asset Class to which the Asset belongs and credited to the Depreciation Account of the Asset Class.

- By default, the function will create a single Simulation. If you are not using Objects, this Simulation will contain a single debit posting to each Cost Account (to the value of the accumulated depreciation of all Assets using that Account) and a single credit posting to each Depreciation Account. If you are using Objects, the Simulation will contain single postings for each Object/Account combination. This structure will also be used in this report.

- If you will not be creating a single Simulation when you run the Maintenance function, but instead will be creating one Simulation per Asset, check this box. The report will list the Simulations that will be created by the Maintenance function.

- Skip Inactive

- Check this box if you do not want to include in the report Assets that have been marked as Inactive.

- Skip Disposed

- Check this box if you do not want to include in the report Assets that have been disposed of (i.e. written off or sold using an approved Disposal record).

- Use Fiscal Val instead of Purchase Val

- Check this box if you want to use the Fiscal Value as the basis for the depreciation calculations in the report, instead of the Purchase Value.

- If you use this option, make sure you have specified Fiscal Values for all your Assets. Depreciation will not be calculated for an Asset with no Fiscal Value.