Credit Limit

You can set credit terms for a Customer in two ways:

- You can enter a record for the Customer in the Contact Credit Limits setting.

- You can use the Sales Credit Limit and/or Sales Credit Limit Days fields on the 'Terms' card of the Contact record for the Customer.

If you have used both, a Customer's credit terms will be taken from the Contact Credit Limits setting.

Having set credit terms for each Customer, you should use this Credit Limit setting for the following purposes:

- You can use it to control behaviour in sales transactions when the credit terms of a Customer have been (or are about to be) exceeded.

- You can use it to specify how it should be determined whether a Customer has exceeded their credit terms.

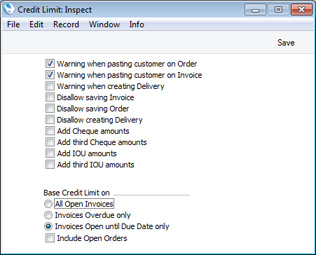

To open the Credit Limit setting, ensure you are in the Sales Ledger and then click the [Settings] button in the Navigation Centre. Double-click 'Credit Limit' in the 'Settings' list. Select options as described below. Then, to save changes and close the window, click the [Save] button. To close the window without saving changes, click the close box.

Use the first six check boxes in the setting to control behaviour in sales transactions when the credit terms of a Customer have been (or are about to be) exceeded, as follows:

- Warnings

- Select any of the first three options as appropriate if you would like a warning to be shown when you enter a Customer that has already exceeded their credit terms in an Order or Invoice or when you create a Delivery. You will be able to override the warnings and continue.

- Disallow

- Select any of the next three options if you would like it not to be possible to save an Order or Invoice or to create a Delivery for a Customer that has exceeded their credit terms. If you are using the All Open Invoices or Invoices Open until Due Date only options below, you will not be able to save an Invoice if it will take the Customer over their Credit Limit.

Use the remaining options in this setting to specify how it should be determined whether a Customer has exceeded their credit terms.

If you have specified a Sales Credit Limit Days for a Customer (either in the Contact Credit Limits setting or in the Contact record for the Customer), that Customer will immediately be said to have exceeded their credit terms as soon as an Invoice of any value becomes outstanding for more than that number of days (measured from its Due Date). If you have not specified a Sales Credit Limit Days for a Customer, or the Customer does not have an Invoice that has been outstanding for that length of time, then the Customer's credit status will depend on the Base Credit Limit on options in this setting, as follows :

- All Open Invoices

- The Customer will be said to have exceeded their credit terms if the total outstanding value of unpaid Invoices is greater than their Sales Credit Limit.

- Invoices Overdue only

- The Customer will be said to have exceeded their credit terms if the total outstanding value of unpaid Invoices that have exceeded their Payment Terms ("Overdue" Invoices) is greater than their Sales Credit Limit. An Invoice is Overdue if it has not been paid in full and its Due Date is in the past.

- Invoices Open until Due Date only

- If there are any Overdue Invoices, the Customer will immediately be said to have exceeded their credit terms, irrespective of the value of those Invoices. If there are no Overdue Invoices, the total outstanding value of unpaid Invoices that have not exceeded their Payment Terms ("Open" Invoices) will be compared with the Customer's Sales Credit Limit.

- Include Open Orders

- If you are using the All Open Invoices option above, select this option if you would like the value of open (i.e. uninvoiced Sales Orders) to be taken into account when assessing whether a Customer has exceeded their Sales Credit Limit. The Customer will be said to have exceeded their Sales Credit Limit if the outstanding value of all unpaid Invoices plus the value of uninvoiced Orders is greater than their Sales Credit Limit.

- Add Cheque amounts, Add third Cheque amounts, Add IOU amounts, Add third IOU amounts

- If you have the Cheques module, you can select these options if you would like the value of Accepted Cheques of various Types to be taken into account when assessing whether a Customer has exceeded their Sales Credit Limit. The Customer will be said to have exceeded their Sales Credit Limit if the outstanding value of all unpaid Invoices (depending on the options described above) plus the value of Accepted Cheques with the selected Type(s) is greater than their Sales Credit Limit.

Credit checking will not take place if you have not given a Credit Limit to a Customer (i.e. if the Sales Credit Limit and Sales Credit Limit Days fields are both empty). If you want to allow a Customer no credit at all, set their Credit Limit to 0.01.

---

Settings in the Sales Ledger:

Go back to: