Hinnaerinevused

Kauba lattu võtmisel hinnangväärtustega võivad tekkida hinnavahed. Ostutellimuse koostamise hetkel ei pruugi olla selge, kui suured on transpordi, tolli, sadamamaksude, muude maksude jms kulud: seda eriti kauba impordil. Mõnel juhul pole teada ka kauba enda täpne maksumus, nii et Ostutellimusele tuleb see määrata hinnanguliselt. Kulud ei pruugi olla selged ka veel kauba lattu võtmisel, mis tähendab, et kaup võetakse lattu Ostutellimusel toodud hinnangväärtustega. Ostuarve saabumisel võivad tegelik hind (Arvel) ja Sinu hinnang (lattu võtmisel ja erinevatele kontrollkontodele kantud) erineda. Erinevused Ostuarve ja Laosissetuleku vahel kantakse Hinnaerinevuse kontodele kas Arvelt või Laosissetulekult, olenevalt, kumb koostatakse hiljem. Neid erinevusi näed koos kaubakuluga Kasumiaruandes. See funktsioon võimaldab registreerida hinnavahed, tagamaks korrektne saldo, erinevatel kontrollkontodel Ostuarvelt ja Laosissetulekult.

Hinnaerinevuse funktsioon seadista järgmiselt:

- Seadistuses Lausendamine Ladu märgi valik Konteeri hinnaerinevus.

- Samas seadistuses vali laosissetuleku, transpordi, tolli ja lisakulude erinevuste kontod:

- Artikliklassile võid anda oma Laosissetuleku hinnaerinevuse konto, kui antud Klass ei kasuta eelmises punktis määratud vaikimisi kontot. Kui tahad hinnaerinevused konteerida Artikliklassile määratud kontole, märgi Kuluarvestuse seadistuses valik Kasuta konteerimisel artikliklasse.

- Ostureskontros Ostuarve seadistustes märgi valik Iga rida eraldi. Samas seadistuses ära märgi valikut Kasuta alati ostutellimuselt täielikke koguseid.

- Kui tahad registreerida erinevused tolli-, transpordi- ja muudes lisakuludes, märgi Ostutellimuste seadistustes valik Lisakulude arved erinevatelt hankijatelt. Kui see valik ei ole märgitud, saad registreerida vaid erinevused Artiklihindades.

- Kui on tõenäoline, et pead Ostuarved koostama enne kauba kätte saamist, märgi Laoseadistustes valik Ostuarve enne laosissetulekut. Nüüd on uuel Ostutellimusel vaikimisi märgitud valik Arve enne laosissetulekut. Kui Laoseadistustes valikut Ostuarve enne laosissetulekut märgitud ei ole, saad vajadusel valiku Arve enne laosissetulekut märkida ka üksikul Ostutellimusel.

Kui oled ülaltoodud seadistused teinud, kasuta hinnaerinevuste funktsiooni järgmiselt:

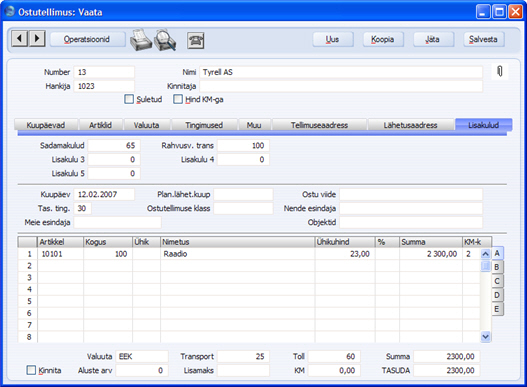

- Sisesta Ostutellimus nagu tavaliselt. Kui Artikli, transpordi-, tolli- ja/või muud lisakulud ei ole teada, sisesta hinnangulised summad, et saaksid Ostutellimuse välja trükkida. Pea meeles, et transpordi-, tolli- ega lisakulusid Tellimuse kogusummasse ei arvata, kuna need tuleb võib-olla tasuda mitte Hankijale, vaid hoopis transpordifirmale või riigile.

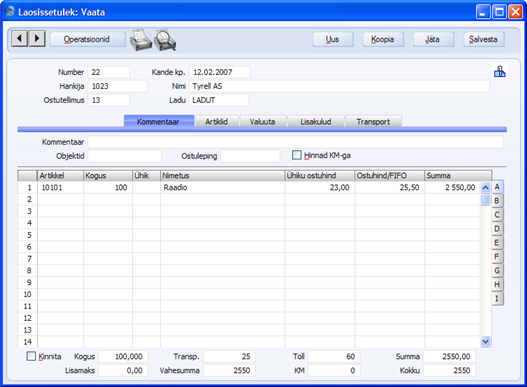

- Kui kaup saabub, ava Ostutellimus ja vali Operatsioonide menüüst käsklus Koosta laosissetulek. Ostutellimuselt sisestuvad kõik hinnad Laosissetulekule, kus need arvestatakse ka kogusumma sisse. Tavaliselt ei ole kauba saatelehel hinnainfot ning laotöötajad saavad sisestada vaid kogused. Kuid kui hinnad on siiski teada, saad summasid Laosissetulekul vajadusel muuta.

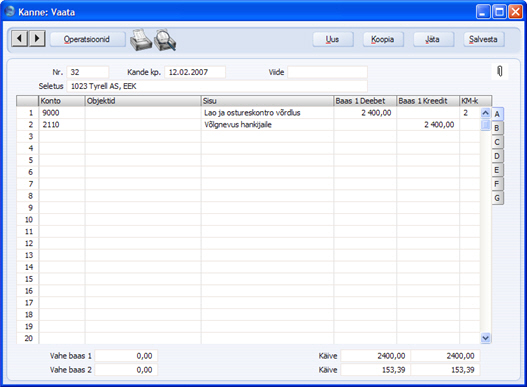

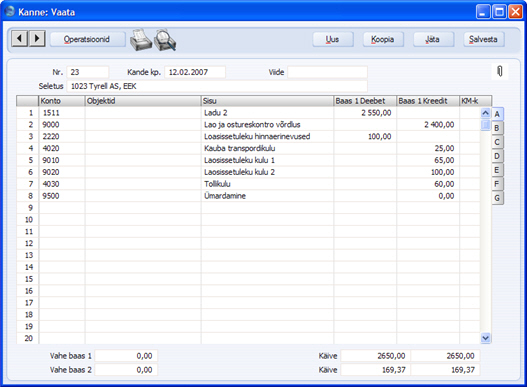

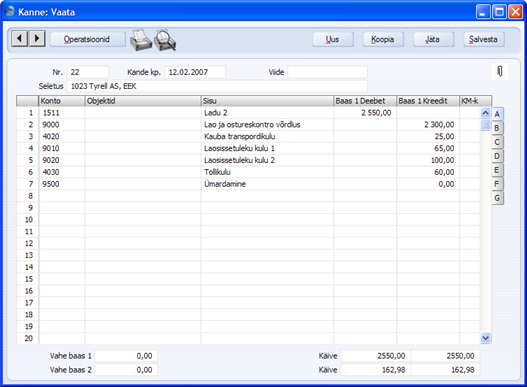

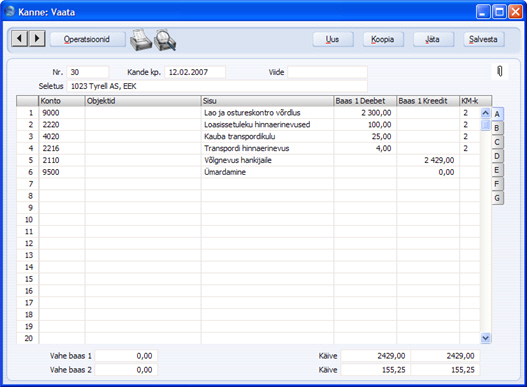

- Laosissetuleku kinnitamisel ja salvestamisel koostatakse Kanne, millega debiteeritakse Laokontot ja krediteeritakse vastavaid kontrollkontosid (näites Laosissetuleku, Tolli-, Transpordi- ja Lisakulude 1 ja 2 kontrollkontosid) nagu tavaliselt:

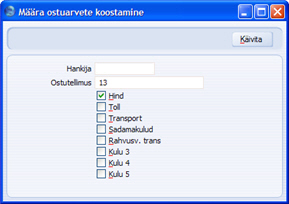

Konteering Laokontole sisaldab lisakulusid. Kui kaup müüakse, sisaldab kulukanne lisakulusid, eeldusel et kasutatakse Kaalutud keskmise, FIFO või LIFO kulumudelit (või Ostuhinna kulumudelit, kui Artikli Ostuhind muutub automaatselt Kaalutud keskmiseks või viimati kasutatud ostuhinnaks). - Kui saabub arve Hankijalt, ava Ostutellimus ja vali Operatsioonide menüüst käsklus Koosta ostuarve. Kuna Ostuarve seadistustes on märgitud valik Lisakulude arved erinevatelt hankijatelt, ei koostata kohe Arvet. Avaneb järgmine dialoogiaken:

Olenevalt sellest, millised andmed on paberarvele trükitud, toimi järgmiselt:

- Kui arvel on üks või mitu Artiklit Ostutellimuselt, jäta Hankija väli tühjaks (Hankija sisestub Tellimuselt). Kui Arvel on registreeritud ka lisakulud, jäta märgituks valik Hind ja märgi teised sobivad valikud. Klõpsa Käivita.

- Kui arvel ei ole ühtegi Artiklit Ostutellimuselt (st arve esitatakse vaid lisakulude kohta), vali Hankija, kasutades Ctrl-Enter klahvikombinatsiooni, märgi sobivad Lisakulude valikud, võta maha valik Hind ja klõpsa Käivita.

Kuna Artikli(te) ja Lisakulu kohta võidakse esitada eraldi arved, saad igal ajal Ostutellimuse uuesti avada ja koostada vajalikud Ostuarved. Artikli(te) kohta saad koostada vaid ühe Arve.

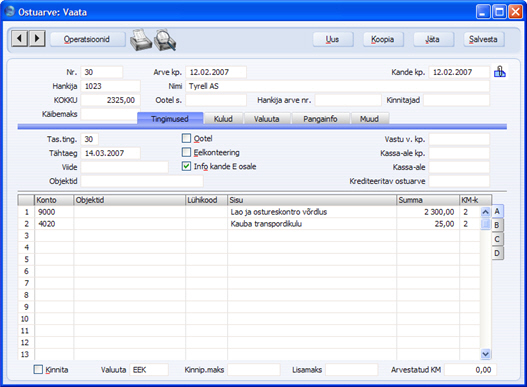

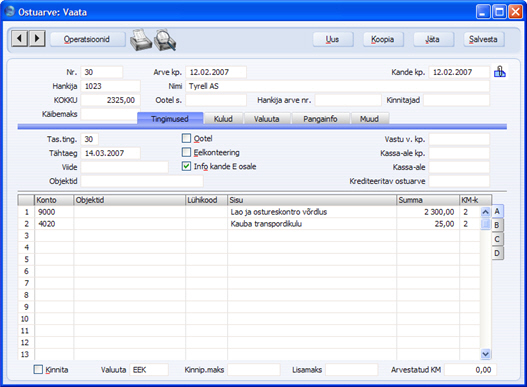

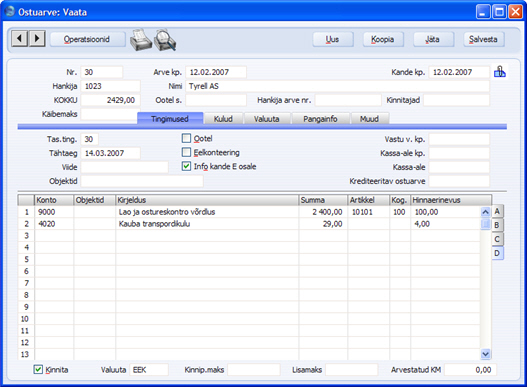

Alltoodud pildil näed Ostuarvet kauba ja transpordikulu kohta:

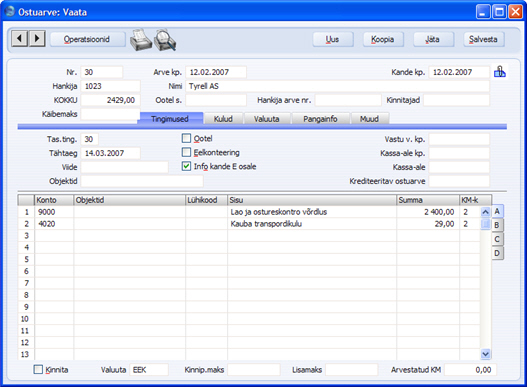

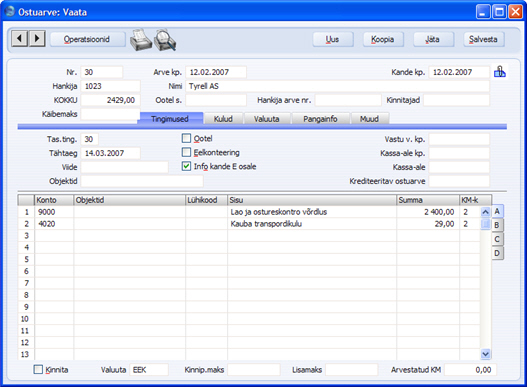

Artiklite hinnad ja transpordikulu summa sisestuvad Ostutellimuselt. Artikli Laosissetuleku kontrollkonto leitakse nagu tavaliselt vastavalt Arvele Tellimuse ridade eraldi ülekandmise reeglitele (lähemalt loe palun funktsiooni Koosta ostuarve kirjeldusest. Laosissetuleku transpordikulu kontrollkonto võetakse seadistusest Lausendamine Ladu. - Kui Hankija poolt esitatud arvel toodud summad erinevad vaikimisi sisestunud summadest, saad neid vajadusel muuta:

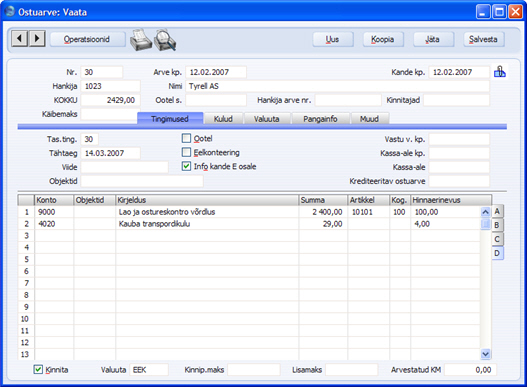

- Kui oled veendunud, et Ostuarve on õige, kinnita kaart nagu tavaliselt. Erinevusi summade vahel Laosissetulekul ja Ostuarvel näed Ostuarve D osal Hinnaerinevuse väljal (kui tegid Laosissetulekul muudatusi, nagu kirjeldatud punktis 2, kajastuvad need muudatused Hinnaerinevuse summades):

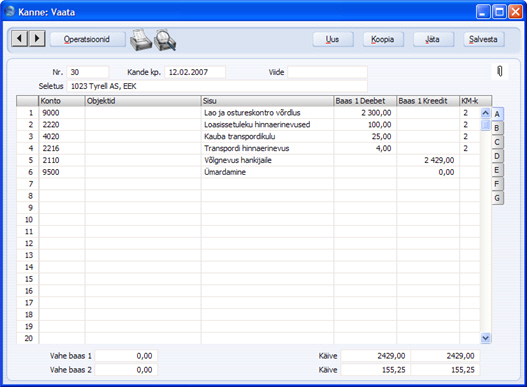

Koostataval Kandel kantakse Artikli Hinnaerinevuse summa vastavale Artikliklassile antud Ostu hinnaerinevuse kontole, kui Kuluarvestuse seadistuses on märgitud valik Kasuta konteerimisel artikliklasse. Kui seda valikut märgitud ei ole, Artikkel ei kuulu ühtegi Klassi ja/või pole Artikliklassile oma Hinnaerinevuse kontot antud, konteeritakse Laosissetuleku hinnaerinevuste kontot seadistusest Lausendamine, Ladu. Lisakulude erinevused kantakse vastavatele Hinnaerinevuse kontodele seadistusest Lausendamine, Ladu:

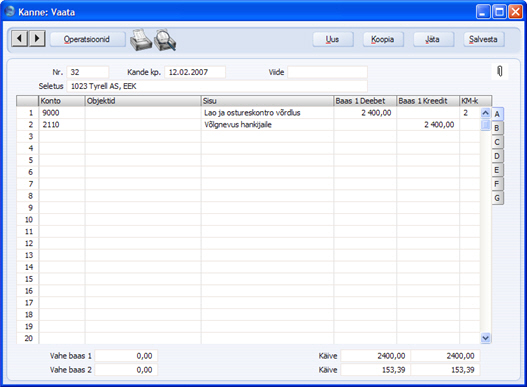

Näites krediteeriti Laosissetulekuga Laosissetuleku kontrollkontot väärtuses 1000. Ostuarvest koostati tasakaalustav konteering samas summas. Kui Hinnaerinevuste funktsiooni ei kasutataks, debiteeritaks Ostuarvega Laosissetuleku kontrollkontot summas 1100, mis muudaks saldo 100 võrra valeks. Korrektse saldo saavutamiseks tuleks teha parandus käsitsi. - Kui Ostuarve esitatakse enne, kui oled tellitud kauba kätte saanud, märgi Ostutellimuse Tingimuste kaardil valik Arve enne laosissetulekut. Kui Laoseadistustes on märgitud valik Ostuarve enne laosissetulekut, on see valik vaikimisi märgitud. Nii saad koostada Tellimusest Arve nagu tavaliselt, kuid võid teha seda enne kauba kätte saamist. Summad Arvele sisestuvad Tellimuselt ning neid saad vajadusel muuta. Koostataval Kandel ei kasutata Hinnaerinevuste kontosid:

Kui kaup saabub, ava Ostutellimus ja vali Operatsioonide menüüst käsklus Koosta laosissetulek. Hinnad sisestuvad Laosissetulekule Ostutellimuselt. Tavaliselt ei ole saatedokumentidel hinnainfot ning laotöötajad saavad sisestada vaid kogused. Vajadusel saad hindu Laosissetulekul muuta.

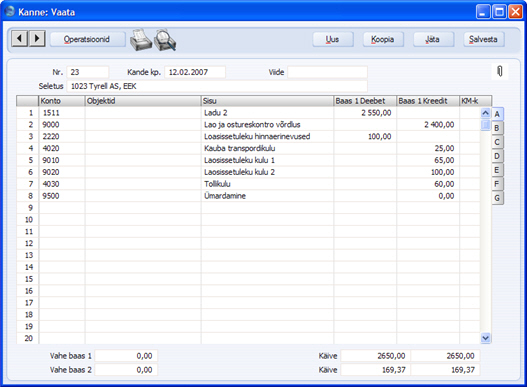

Kui hinnad Ostuarvel ja Laosissetulekul erinevad, konteeritakse Laosissetuleku kinnitamisel koostataval Kandel hinnaerinevused vastavatele kontodele. Teine Kanne (antud näites Laosissetulekust või esimese näite puhul Ostuarvest) sisaldab alati konteeringuid Hinnaerinevuste kontodele:

- Kui kaup on vaja Hankijale tagastada, koosta registrisse Tagastatud kaubad hankijale kaart nagu tavaliselt. Hiljem saad Tagastamise kaardilt koostada Kreeditarve (vali Operatsioonide menüüst käsklus Koosta kreeditarve. Kui tagastatud kauba hinnad Tagastamise kaardil ja Kreeditarvel erinevad, registreeritakse vahe Hinnaerinevuse kontol.

|