Create Menu - Invoice - Instalment Receipts

This page describes the 'Instalment Receipts' function on the

Create menu in the Invoice record window. If you are using iOS or Android, the 'Instalment Receipts' function is on the + menu.

---

If you agree with a Customer that an Invoice is to be paid in instalments, you can use the 'Instalment Receipts' function to create Receipts for those instalments in advance. For example, if you agree that an Invoice will be paid in four instalments, this function will create four Receipts, each for a quarter of the value of the Invoice and with dates as agreed with the Customer.

To use this function, it is not necessary for the Payment Term in the Invoice to be one that refers to a record in the Instalments setting. This function will therefore be useful in the situation where you have already entered an Invoice and marked it as OK before agreeing with the Customer that it will be paid in instalments.

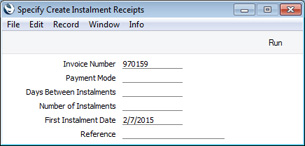

To create instalment Receipts from an Invoice, first open the Invoice in a record window and then select 'Instalment Receipts' from the Create menu (Windows/Mac OS X) or + menu (iOS/Android). The following dialogue box will appear:

- Invoice Number

- Specify the Invoice for which instalment Receipts are to be created.

- Payment Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- Specify the Payment Mode that you want to be used in the instalment Receipts created by the function. If you leave this field empty, the first Payment Mode in the Payment Modes setting will be used.

- Days Between Instalments

- The function will create a number of instalment Receipts, each with the correct date. The date in each Receipt will be calculated by adding the number of days that you specify here to the date in the previous Receipt.

- Number of Instalments

- Specify here how many instalment Receipts are to be created. The Received Value in each instalment Receipt will be the Invoice TOTAL divided by the number of instalments.

- You must enter a number between 1 and 99, otherwise the function will have no effect.

- First Instalment Date

- Paste Special

Choose date

- Specify the date to be used in the first instalment Receipt.

- Reference

- Any text that you enter here will be copied to the Reference field in the header of each instalment Receipt created by the function.

When you click (Windows/Mac OS X) or tap (iOS/Android) the [Run] button, the appropriate number of Receipts will be created. The Receipts will not be marked as OK: you should do this as you receive the instalment payments. The Invoice will be treated as open (unpaid) and will thus appear on

Open Invoice Customer Statements and in the

Sales Ledger report until you have marked the Receipts as OK.

If the function does not create instalment Receipts when expected, the probable reasons are:

- You did not specify a Number of Instalments when running the function.

- You have not marked the Invoice as OK, or you have not saved the Invoice (i.e. the window title is 'New' or 'Update').

- There is no valid record in the Number Series - Receipts setting. This might be a fault in the setting itself, or it might be because the default Receipt Number on the 'Number Series' card of the current user's Person record or in the Number Series Defaults setting (in the System module) is not in a valid Number Series. This problem will usually occur at the beginning of a new year. If you make a change to the 'Number Series' card of the Person record, you will need to quit Standard ERP and restart for it to take effect.

---

The Invoice register in Standard ERP:

Go back to: