Entering a Payment

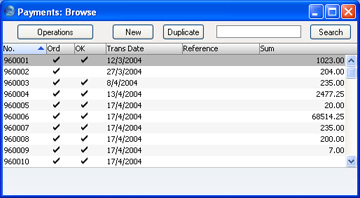

In the Purchase Ledger module, click the [Payments] button in the Master Control panel. The 'Payments: Browse' window is opened, showing Payments already entered.

Payments are numbered consecutively. In the list, the Payment Number is followed by check marks if the Payment has been Ordered or approved, by the Transaction Date, any reference and the total amount of the Payment.

To enter a new Payment, click [New] in the Button Bar or use the Ctrl-N (Windows and Linux) or ⌘-N (Macintosh) keyboard shortcut. Alternatively, highlight a Payment similar to the one you want to enter and click [Duplicate] on the Button Bar.

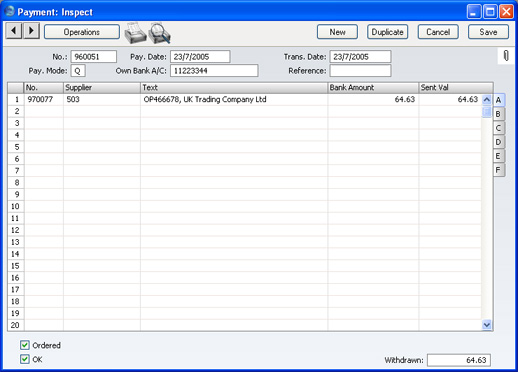

The 'Payment: New' window is opened, empty if you clicked [New] or containing a duplicate of the highlighted Payment.

The principle for entering a Payment is that you know the following:

- How much has actually been withdrawn; and

- any extra fees charged by the bank.

FirstOffice provides several shortcuts to simplify your work entering Payments. You can for example bring a date into a date field using the

'Paste Special' function (Windows and Linux users should press Ctrl-Enter, Macintosh users ⌘-Enter). You can also use this function to simplify the entering of Account Numbers, Supplier Numbers, Payment Modes etc. When a transaction window is open for data entry, you also have the Operations menu available. This menu is explained in the following sections.

First, a run-through of the fields.

- No.

- Paste Special

Select from another Number Series

- The serial number of the Payment: FirstOffice will enter the next unused number from the number sequence specified in the Number Series Defaults setting or from the first record in the Number Series - Payments setting. You may change this number, but not to one that has already been used.

- Pay. Date

- Paste Special

Choose date

- The date when you want the Payment to be executed.

- Once you have Ordered a Payment, you can still change the Payment Date. After approval, however, no further changes are possible.

- Trans. Date

- The date of the Nominal Ledger Transaction resulting from this Payment. This date is always the same as the Payment Date and cannot be changed independently.

- Pay. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- The Payment Mode is the method of payment (e.g. cheque, credit card or cash). It determines the Nominal Ledger Account that will be credited by the Payment.

- On a single Payment record it is possible to enter payments to different Suppliers against different Invoices. It is also possible to enter payments across Payment Modes: specifying a Payment Mode for any of the individual payments in the grid will override that entered here.

- Own Bank A/C

- The number for the bank account you want to use for the Payment. This information will be brought in from the Payment Mode record.

- Reference

- You can use this field if you need to identify the Payment by any means other than the Payment Number (e.g. a bank reference in the case of credit transfers or BACS payments).

- The Reference is shown in the 'Payments: Browse' window, allowing you to search for a Payment with a particular Reference. This Reference will be copied to the Reference field of any Nominal Ledger Transaction generated from this Payment.

Use the grid area that takes up most of the screen to list the Purchase Invoices being paid by this Payment. A single Payment can be allocated to several Invoices, and/or feature payments in different Payment Modes. The Payment Mode reflects not only the payment method (i.e. cheque, cash or credit card) but also the Bank Account credited. So, all payments issued in a single day can be entered using a single Payment record, irrespective of Payment Mode.

If you need FirstOffice to print a remittance advice and/or a cheque, separate such forms will be printed for each Supplier included in the Payment record.

Each record in the Payment register results in one Nominal Ledger Transaction, with bank or other institution as credit Account (taken from the Payment Mode).

You can also bring Purchase Invoices into a Payment by opening the 'Purchase Invoices: Browse' window, selecting a range of Invoices by clicking while holding down the Shift key, and then dragging them to the Invoice No field in the first empty Payment row. You can also copy a list of Invoice Numbers from a spreadsheet or word processor and paste them in the Invoice No field in the first empty row.

Flip A

- No.

- Paste Special

Open, approved Purchase Invoices, Purchase Invoice register

- The number of the Purchase Invoice being paid. When you enter an Invoice Number, if the Invoice qualifies for an early settlement discount, a discount row will be inserted automatically, together with a suggested discount amount. This is calculated using the formula specified for the appropriate Payment Terms record.

- Note that when you use 'Paste Special', only unpaid Purchase Invoices will appear in the selection list. However, Purchase Invoices against which an unapproved Payment has been entered are treated as unpaid (unless the Payment's Ordered box is checked) and thus will be listed. Sorting the 'Paste Special' selection by Supplier will allow you to find the Invoice that is being paid quickly and easily.

- If the Payment is a Prepayment or On Account Payment to a Supplier with whom you have an account (marked using the On Account box on the 'Company' card of the Customer record for the Supplier) for which an Invoice has not yet been received, leave this field blank and enter a Prepayment Number field on flip D instead. This is fully described on the On Account Payments and Prepayments page.

- Supplier

- Paste Special

Suppliers in Customer register

- Default taken from Purchase Invoice

- Entered by FirstOffice when you enter an Invoice Number.

- Text

- The Supplier's Name is entered by FirstOffice, from the Customer register. You may change this if you wish. It will appear in the Text field of the Nominal Ledger Transaction.

- Bank Amount

- Default taken from

Sent Value

- The amount paid out of your bank account. Usually, this will be the same as the Sent Value (below): do not use this field to subtract bank fees from the amount paid: the Bank Fee field on flip F is provided for this purpose.

- Sent Val

- Default taken from

Outstanding amount on Invoice

- The amount paid against the Purchase Invoice. You can change the default figure in the event of partial payments or overpayments.

Flip B

- Open Inv. Value

- The outstanding amount of the Invoice being paid. This field cannot be changed.

- PInv Val

- The amount being paid against the Purchase Invoice.

Flip C

- Bank Reference

- This field is used in Estonia. Please refer to your local FirstOffice representative for details.

- To Bank A/C

- The number of the Supplier's bank account receiving the Payment is brought in from the 'Identifiers' card of the Purchase Invoice or from the 'Company' card of the Customer record for the Supplier.

Flip D

- P. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- Enter a Payment Mode, if different from the Payment Mode entered in the header. This allows different payments on the same Payment to be credited to different Bank Accounts.

- Cheque No.

- Record the number of the cheque used for the Payment here.

- If you print a cheque using the Payment Forms document, the cheque number will be recorded here automatically.

- Prepay. No

- If the payment is a Prepayment (i.e. one where it is not possible to specify an Invoice Number on flip A), you should enter a Prepayment Number here. This can be a number of your own generation or, preferably, a reference given to the prepayment by the Supplier.

- When you receive an Invoice to be set against the Prepayment, you can connect the two using the 'Connect to Prepayment' function on the Operations menu of the Purchase Invoice screen. This is fully described on the On Account Payments and Prepayments page. If a deposit or prepayment exists without a Prepayment Number, it will not be made available to that function and connecting it to an Invoice will be more difficult. Prepayments that do not have a Prepayment Number will not be shown in the Prepayment History report.

Flip E

- VAT Val, V-Cd

- These fields are provided to satisfy a requirement of users in Latvia, where it can be necessary to post VAT on Payment. This is also the case for users of the Cash VAT scheme in the UK and for some users in Poland. If you are using the Post Payment VAT option in the Account Usage P/L setting, the VAT Code and VAT Amount will be brought in to these fields automatically when you enter a Purchase Invoice Number on flip A (the VAT Code comes from the first row of the Invoice). When you approve and save the Payment, the VAT amount will be moved from the temporary VAT Input Account to the final one (the I/P Account), as specified in the VAT Codes setting in the Nominal Ledger.

- The Post Payment VAT option also adds a VAT element to On Account Payments. Once again, the I/P Account for the VAT Code is debited and the Input Account for the VAT Code is credited with the VAT amount.

- Take care with these fields when entering On Account Payments. As On Account Payments do not have an Invoice Number or a Prepayment Number, you must enter a VAT Code manually if you are using the Cash VAT scheme (i.e. if you are using the Post Payment VAT option). The VAT Value will then be calculated from the Sent Value. The Nominal Ledger Transaction resulting from the Receipt will not have a VAT element if the VAT Code or VAT Value is blank.

- If you would like VAT to be posted from Prepayments, you should check the Post Prepayment VAT box on the 'Creditors' card of the Account Usage P/L setting. When you enter a Prepayment Number (on flip D), the Domestic VAT Code from the Supplier or from the 'VAT' card of the Account Usage P/L setting will be placed here as a default when you enter the Prepayment Number. The VAT Value will then be calculated from the Sent Value. The VAT Value will be credited to the On Account VAT Account and debited to the I/P Account for the VAT Code.

- In all cases, if a particular VAT Code does not have an I/P Account, the Prepayment VAT Account from the 'Creditors' card of the Account Usage P/L setting will be used instead.

Flip F

- Bank Fee

- Enter any fee charged by the bank for this payment. Bank fees will be debited to the Bank Fee Account specified on the 'Exchange Rate' card of the Account Usage P/L setting. The Sent Value plus the Bank Fee will be credited to the Bank Account specified in the Payment Mode.

- Note that this field allows you to specify a Bank Fee for each row (or for a single particular row) on the Payment, remembering that each row can have a different Payment Mode and therefore a different credit (Bank) account. If you want to record a single Bank Fee for the entire Payment, use the 'New Fee' function on the Operations menu.

Footer

- Ordered

- The Ordered and OK check boxes are provided to allow for the delay between the issuing of a Payment and the clearing of the funds from your company's bank account. Checking the Ordered box indicates that you have issued a Payment, while checking the OK box indicates that the funds have been cleared. You must therefore check the Ordered box before the OK box.

- When you save a Payment with its Ordered box checked, the Invoice being paid is no longer treated as open, even if the OK box is not checked.

- If, once a Payment has been issued, it transpires that the funds are not cleared from your company's bank account (perhaps because the cheque bounced or was lost), highlight each row in the Payment in turn by clicking the row number. Then, press the Backspace key. A red line will be drawn through the row, re-opening the Purchase Invoice.

- OK

- Approve a Payment by clicking this check box. On clicking [Save] to save the Payment, if so determined in the Sub Systems setting in the Nominal Ledger, a Transaction will be generated crediting the Bank Account specified for the Payment Mode and debiting the Creditor Control Account of the Invoice being paid.

- You can use Access Groups to control who can approve Payments. To do this, deny access to the 'OKing Payments' Action.

- References in these web pages to approved Payments are to Payments whose OK check box has been switched on.

- Withdrawn

- The sum of the Bank Amounts: the total for this Payment.